What Is Workers’ Comp?

Workers’ compensation, also known as workers’ comp, provides benefits to employees who were wrongfully injured on the job. Workers’ comp covers medical bills, lost wages and the cost of retraining and rehabilitation.

The injured employee can receive a lump sum as compensation, or a structured settlement, which is a series of payments over time. But most workers’ compensation cases result in structured settlements, according to Missouri’s Department of Labor. According to the most recent data from the National Academy of Social Insurance, almost 136 million individuals had workers’ comp coverage in 2020.

Key Facts About Workers Comp and Structured Settlements:

- Workers’ compensation settlements can cover medical bills, lost wages and costs of future treatments or long-term care.

- The main advantage offered by a workers’ compensation settlement is the assurance of a steady, tax-free income that is safeguarded against inflation.

- Your structured settlement can also be used to fund a Workers’ Compensation Medicare Set-Aside (WCMSA) account.

This special type of insurance is state-mandated in all U.S. states except Texas. Each state has different regulations for which employers must have coverage and which types of workers are excluded from the requirement.

To receive workers’ compensation benefits, the injured employee must waive the right to sue their employer.

Family members of workers who pass away on the job may be eligible for benefits as well.

For some people, receiving a lump sum workers’ compensation settlement is preferable to receiving a series of payments, which is known as a structured settlement. However, a structured settlement is wise for people that struggle to manage their finances and need some help safeguarding their money.

Who Qualifies for a Workers’ Comp Structured Settlement Case?

The location, cause, fault and injury type all play a role in qualifying the injured employee for a workers’ comp settlement case. For example, you don’t even need to be at your workplace to qualify. You can be eligible even when traveling for your job.

- Location

- The illness or injury may arise while at the workplace, traveling for business, running a work-related errand, or even attending a mandatory social event with co-workers or clients.

- Cause

- A job-related injury might be from a single accident, such as slipping and falling down a flight of stairs, or it might be a repetitive stress injury that takes years to develop, as with carpal tunnel syndrome or chronic back problems. A job-related illness could be caused by exposure to toxic substances, or it could be a dangerous health condition caused by constant mental and emotional stress.

- Fault

- The harm may be accidental, or it may be the fault of the employee, the employer or some other third party like a co-worker or a customer.

Workers’ compensation structured settlement cases include a wide range of scenarios:

The type of qualifying injury can range from a burn to a lifelong disability.

Work injuries that can result in a structured settlement include:

- Brain injuries

- Amputations

- Severe burns

- Vision loss

- Spinal cord injuries

- Any other injury resulting in permanent disability or a disability affecting employment

However, if the harm was caused by the negligence of an employer or a third party, the employee does have the option to bypass the workers’ compensation system and file a personal injury lawsuit.

Coverage may be denied if an employee suffers an injury specifically because they were intoxicated, breaking the law or otherwise violating company policy at the time.

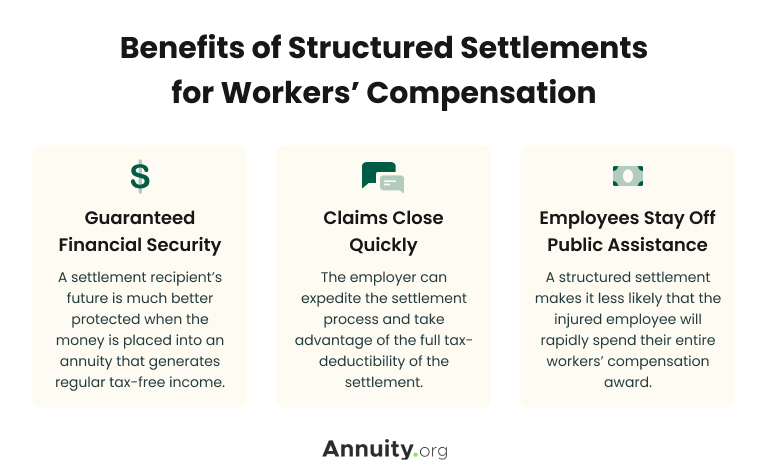

Benefits of Structured Settlements for Workers’ Compensation

The primary benefit of a structured settlement annuity is the guarantee of a lifelong stream of tax-free, inflation-protected income.

In some cases, the employee can be permanently disabled to the point that they can’t return to the workforce. So, the steady income that a structured settlement provides can be essential to the injured employee’s long-term financial security.

Guaranteed Financial Security

An injured employee may face hefty costs for ongoing medical treatment, future surgeries and the replacement of durable medical equipment for the rest of their life. On top of that, they may never be able to earn an income from working again.

Given these challenges, even a multimillion-dollar lump sum payout can run out quickly if it is not managed and invested with great care. A settlement recipient’s future is much better protected when the money is placed into an annuity that generates steady, tax-free income.

Claims Close Quickly

By paying the annuity provider up front to handle the long-term payments, the employer can expedite the settlement process and take advantage of the full tax deductibility of the settlement amount as if it were a lump sum.

Employees Stay Off Public Assistance

The state benefits because a structured settlement makes it less likely for the injured employee to quickly spend their entire workers’ compensation and run out of money.

Without the settlement funds, the injured employee would have to turn to Medicare, Medicaid or other public aid to cover health care and living expenses.

Need To Sell Your Structured Settlement for Cash Immediately?

Medicare and Workers’ Compensation Structured Settlements

If you are a Medicare beneficiary, you can use your structured settlement to also fund a Workers’ Compensation Medicare Set-Aside (WCMSA) account. This is where the employer is responsible for the cost of the primary medical treatment for the claimant, and Medicare is the secondary payer.

Your WCMSA funds must be depleted before Medicare covers treatment costs related to your workers’ comp injury. The amount of the WCMSA is determined on a case-by-case basis.

If you are amid your case, you should have the Centers for Medicare and Medicaid Services (CMS) review the settlement before your case is closed.

A CMS review will make sure your settlement is compliant with Medicare laws and ensure that Medicare will cover your expenses if your medical condition changes unexpectedly and you no longer have enough funds in your MSA.

Frequently Asked Questions

Yes — structured settlements can be arranged by a court from many different types of lawsuits, such as a wrongful death or medical malpractice case.

Disadvantages of a structured settlement are less access to your funds and being locked into your settlement terms. If your situation changes down the line, you could look into selling your structured settlement payments.

No, workers’ comp settlements are not taxed.