Key Takeaways

- Structured settlements are financial arrangements providing a steady stream of income over a specified period. They are typically funded through an annuity.

- These arrangements usually result from legal settlements.

- Structured settlements offer numerous benefits like guaranteed future income, tax advantages and protection against impulsive spending, but lack the flexibility of lump-sum payments.

- Recipients can sell their future structured settlement payments for a lump sum, but the sale requires court approval.

Understanding Structured Settlements

Structured settlements are a series of negotiated financial or insurance arrangements. These are typically the result of a personal injury, wrongful death lawsuit or another legal claim. The plaintiff agrees to resolve a claim by receiving part or all of a settlement in the form of periodic payments on an agreed schedule, rather than as a single lump sum.

Typically, annuities fund all structured settlements. The defendant or their insurance company buys this annuity from a life insurance company. The annuity’s design ensures the plaintiff receives regular, scheduled payments over a set period or for their lifetime. Thus, the annuity serves as a secure and reliable source of funding for the structured settlement.

In some instances, U.S. Treasury securities fund structured settlements. Here, a trust holds the Treasury securities, generating regular interest payments. The plaintiff then receives these payments according to the structured settlement terms. This less common method usually applies when a government entity is the defendant.

Regardless of the funding source, the structured settlement’s objective remains to provide the plaintiff with a consistent income stream over a specified period.

Read More: Structured Settlement FAQs

Consider the options available with a structured settlement. If you need access to immediate funds, you can sell it; however, certain approvals will be needed. Contact a finance professional to guide you regarding the options available with a structured settlement.

The Structured Settlement Agreement Process

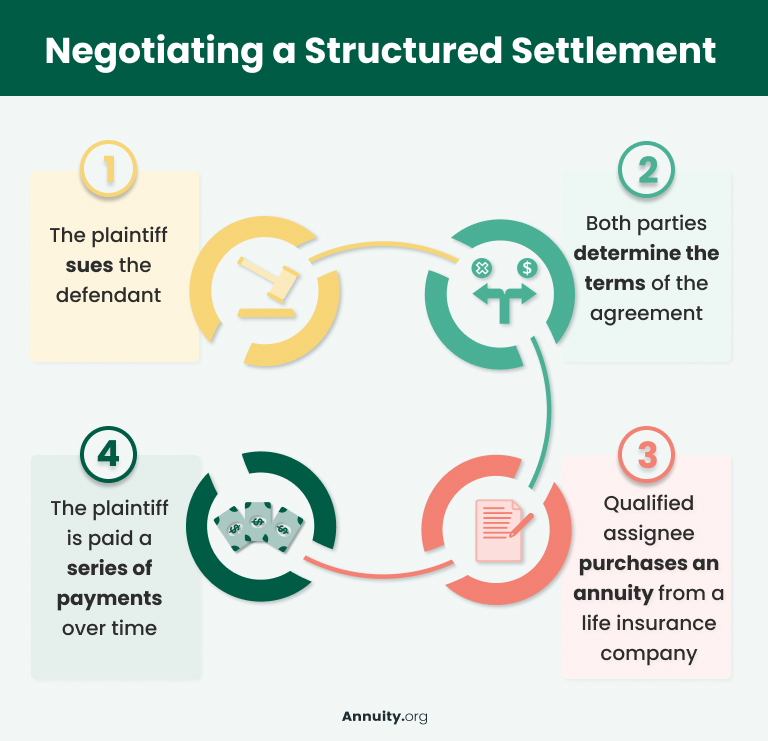

Negotiating a settlement happens at the resolution of civil cases when structured settlements are involved. This process requires the collaboration of several parties: the plaintiff, the defendant, a consultant with expertise in such cases and a life insurance company.

The plaintiff is the individual who has suffered harm, while the defendant is the person or entity responsible for the harm. The consultant, also known as a qualified assignee, facilitates the negotiation process and ensures that the terms of the structured settlement agreement are fair and beneficial to all parties.

The general process of negotiating a structured settlement agreement involves several steps. First, the plaintiff files a lawsuit seeking compensation against the defendant. Often, the defendant opts for a structured settlement to prevent the lawsuit from going to trial. If the case does proceed to trial and the judge rules in favor of the plaintiff, the defendant may then be compelled to establish a settlement.

The defendant and the plaintiff then collaborate with a qualified assignee to establish the terms of the structured settlement agreement. This includes determining the amount of regular payments, the duration of these payments and whether they should increase at certain times. The defendant provides the funds for the qualified assignee to purchase an annuity for the plaintiff.

Calculating the structured settlement amount can be complex. A financial advisor or lawyer will typically hire an economist to help calculate the value of the contract. This calculation takes into account various factors, including the plaintiff’s current and future needs, the severity of the harm caused and the terms of the annuity.

The qualified assignee next buys an annuity from a life insurance company, setting up the annuity contract to meet the settlement needs. Once the terms of the annuity are established, they cannot be altered. An immediate lump sum may also be set aside to cover attorney fees or to fund a specified trust.

Finally, the life insurance company disburses a series of payments to the plaintiff over time according to the terms of the annuity contract. The annuity earns interest to protect its value from inflation. The only way for the plaintiff to receive cash from the settlement ahead of schedule is to sell the right to future payments on the secondary market.

READ MORE: Lawsuit Payout Options

Structured Settlement Pros and Cons

Structured settlements offer a host of benefits, making them an attractive option for many. One of their primary benefits is guaranteed future income. This steady stream of payments can provide financial stability and predictability, which is particularly beneficial in cases involving long-term care needs.

Another significant advantage of structured settlements is the tax treatment. Thanks to the Periodic Payment Settlement Act of 1982, many annuities issued as part of a structured settlement agreement are exempt from income taxes. This is a financial incentive that lump-sum payments do not offer.

For minors who have received a legal settlement, structured settlements can be particularly beneficial. They provide a steady income stream that can be used for educational expenses or other needs as the minor reaches adulthood, ensuring their financial needs are met until they are capable of managing their own finances.

But they also have some drawbacks. They are not as flexible as lump-sum payments, and the terms cannot be changed once they are set. This can be a disadvantage if the recipient’s financial needs change over time. However, the security and stability they offer often outweigh these potential drawbacks.

Need To Sell Your Structured Settlement for Cash Immediately?

Frequently Asked Questions About How Structured Settlements Work

A structured settlement is paid out over time, according to the schedule agreed upon in the settlement. The payments are typically funded through an annuity purchased by the defendant from a life insurance company.

One potential downside of a structured settlement is its lack of flexibility. Once the terms are set, they cannot be changed, which can be a disadvantage if the recipient’s financial needs change over time.

The percentage taken by structured settlement companies can vary. It’s important to read the terms and conditions carefully and consider seeking professional advice before selling a structured settlement.

Yes, a structured settlement provides regular payments over a specified period. The frequency and amount of the payments are determined during the settlement negotiation.