Ways to Spend Your Money

Most people begin the selling process with a specific need in mind. With money in your bank account, you finally have the resources to address a variety of financial dilemmas. When a pressing debt or emergency cost demands attention, people discover that funds locked in their structured settlement or annuity offer a solution, allowing them to move forward.

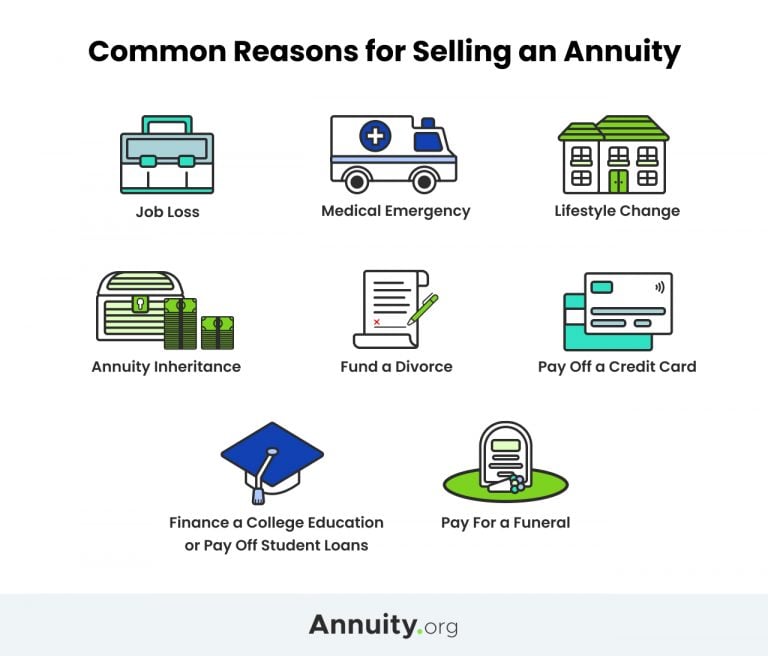

The majority of sellers use their cash to:

- Make a major life purchase (house, car or business)

- Fund a divorce

- Pay off credit-card debt and improve their credit score

- Pay off medical bills

- Finance a college education or pay student loans

- Pay for a funeral

Know that how you spend this money now has repercussions for your future financial well-being. The best decisions are ones that ensure that the sacrifice you decided to make – giving up long-term income for money now – pays off.

Need to Sell Your Annuity for Cash Immediately?

Making a Major Life Purchase

At several points during our lives, we have to make a significant purchase, like purchasing a car, home or business. The emotional part of the decision is one thing. Making sure the purchase is a wise one is another. Some fast facts:

- Buying a House

- The average first-time home buyer is 36 years old. The average price of a home sold in January 2025 was $510,000, according to the U.S. Census Bureau.

- Buying a Car

- The average number of cars bought in a lifetime is 9.4. The average price for a new vehicle in March 2025 is $48,641, according to CarEdge.

- Starting a Business

- The average start-up cost for a microbusiness is around $3,000 while start-up costs for home-based franchises range from $2,000 to $5,000, according to the U.S. Small Business Administration. Start-up costs for a traditional small business in 2024, without factoring in employees, was around $40,000 in the first year, according to Shopify.

Buying a House

Whether you’re single, married or starting a family, going from a rental apartment, condo or house to a home that you own is a big step. Culturally, it symbolizes a move to adulthood. Realistically, it means you’re putting down roots and making the call to build equity. After years of paying rent with no slice of ownership, home ownership means having something tangible to sell when your next move comes.

The greatest obstacle to buying a house is the down payment. The amount is a percentage of the price of the house, and the exact percent depends on the type of loan you secure. The lowest down payment is usually 5%, and most loans ask for 10% down.

The good news is you can use the money from the sale of your annuity or structured settlement for the down payment or perhaps to even pay for the home in full.

Others use their lump sum to pay down a significant portion of their mortgage. This might be especially useful, for example, if you received a structured settlement following an accident you were in as a child. The annuity was set up to pay you a small amount each month for living expenses, but didn’t consider the large amount of money required for modern down payments on a home.

Buying a Car

Whether you’re buying your first car or your fifth, there are bound to be up-front costs. And as with home buying, the more expensive the car, the higher the initial costs. Cars deteriorate much faster than homes, though, meaning they will need to be replaced at some point.

Even if you’re buying an inexpensive new car, you can benefit from putting down more money up front because you’ll have lower payments or less payments later.

Settling for a used car can sometimes also be a wise choice but resist the urge to buy the cheapest vehicle out there — you could end up paying in repairs and consistent maintenance down the road. Leasing a car may also be a viable option. It’s like renting an apartment, during which period of time you pay a monthly fee for using the car. That fee can skyrocket, though, if you drive an excess of miles.

If your car suddenly breaks down and you have no funds to replace it, the best solution may be to use some of your annuity funds. Selling your payments to receive this money up front can solve your car financing dilemmas and alleviate long-term debt.

Starting a Business

Gathering capital to get a business off the ground is difficult. The amount of money you need to buy or rent a commercial property could be substantially higher than what it could cost you to buy a house. Plus, purchasing or leasing property isn’t the only startup expense you’ll face. You’ll also need capital to purchase equipment, start marketing campaigns, hire accountants or lawyers, recruit staff and pay overhead expenses.

It can be difficult to attract investors at this time, especially if you’ve never run a business before. Using some money from your structured settlement or annuity may be a way to finance your entrepreneurial goals.

Interested in Selling Annuity or Structured Settlement Payments?

Paying Bills

No one enjoys living with debt hanging over them. Regardless of where your debt comes from, owing hundreds or thousands of dollars brings stress and impedes the pursuit of happiness. In some of these situations, a lump sum of cash can knock out a large portion of your debt and allow you to better handle the crisis you are facing.

Paying Off Medical Bills

Medical bills are one of the most unpredictable and unavoidable expenses a person may face. In fact, medical debt is the single biggest cause of personal bankruptcies in America. This kind of debt can come following dental work, minor surgery, car accidents and major emergencies.

According to the Centers for Disease Control, one in five American adults struggles to pay medical bills, and 10 million adult Americans face medical bills they can’t pay each year despite having health insurance.

Paying Off Credit Card Debt

Credit-card debt is about as commonplace as owning a smartphone. Across the country, people struggle to pay monthly bills and juggle one to three credit balances while trying (often unsuccessfully) to pay off even one of the cards. Missed payments charges and late fees pile up. Credit card issuers increase interest rates and make the debt hole even bigger.

Shedding credit-card balances is one of the biggest reasons why people sell their structured settlement payments. It’s difficult to get out of a cycle of credit-card debt without some form of instant money, be it from winning the lottery or from inheriting from a deceased loved one or cashing an annuity in.

Paying Off Student Loans

The price of higher education increases every year, forcing thousands of Americans to rely on student loans to some degree to afford school. As of 2025, there are around 42.7 million Americans who have some amount of student loan debt, according to the Department of Education. This adds up to about $1.77 trillion in student loan debt.

Some children who receive structured settlements may have funds allocated toward college expenses, but if tuition prices rise dramatically from the time of the court case to the time of attendance, the student may need to sell part of their settlement to avoid debt. You may also choose to sell part of your structured settlement to finance a college education if you were in a workplace accident and need to learn a new trade after your injury prohibits you from working in your old one.

Affording Your Divorce

Divorce hurts; not only does it drain you emotionally, but it also deals both sides a financial blow. It’s common for both parties to feel like they got the short end of the financial stick. And then there are the added costs: legal fees, therapy and child counseling costs.

The reality is that annuity holders sometimes must sell all or part of their future payments because they’re a shared asset. Other times, one side has to sell just to avoid going broke during or after a divorce. In most cases, it beats bankruptcy.

Editor Sierra Campbell contributed to this article.