Since over 70% of Americans ages 45 and older own their home outright, selling could be a good idea prior to retirement. Whether you want to travel, transition to a retirement community or buy a new home in an exciting location, your home’s value can help you achieve your goals.

If you’re looking to sell, seller financing can helpp you find buyers and close your sale quickly in a tight credit market. It also allows you to handle the mortgage process yourself, instead of relying on a third-party financial institution.

Before you commit to the process, however, it’s important to understand its pros and cons. Learn everything you need to know about seller financing with our guide below.

What Is Seller Financing and How Does It Work?

Seller financing is a nontraditional mortgage agreement whereby the seller acts as the mortgage lender for the buyer. Since no third-party financial institutions are involved in the transaction, the process allows for buyers to widen their pool of prospective buyers.

Both parties sign a promissory note outlining the details of their agreement, and installments are paid directly to the seller.

Normally, these loans are shorter in duration compared to traditional loans since sellers generally aren’t around as long as the average mortgage lending institution.

Seller financing is also known as owner financing or a purchase-money mortgage.

Read More: Promissory Note vs. Mortgage Note

One advantage of seller financing is that sellers who aren’t comfortable with being too hands-on also have the option to hire a loan servicing company. This company can assist in managing the mortgage paperwork, sending billing statements to the buyers and collecting payments.

The Benefits of Seller Financing Homes

Owner financing can be a great deal for both parties involved in the sale of a home. It tends to result in less red tape associated with mortgage lenders and more flexible interest rates for the buyer.

Seller Benefits

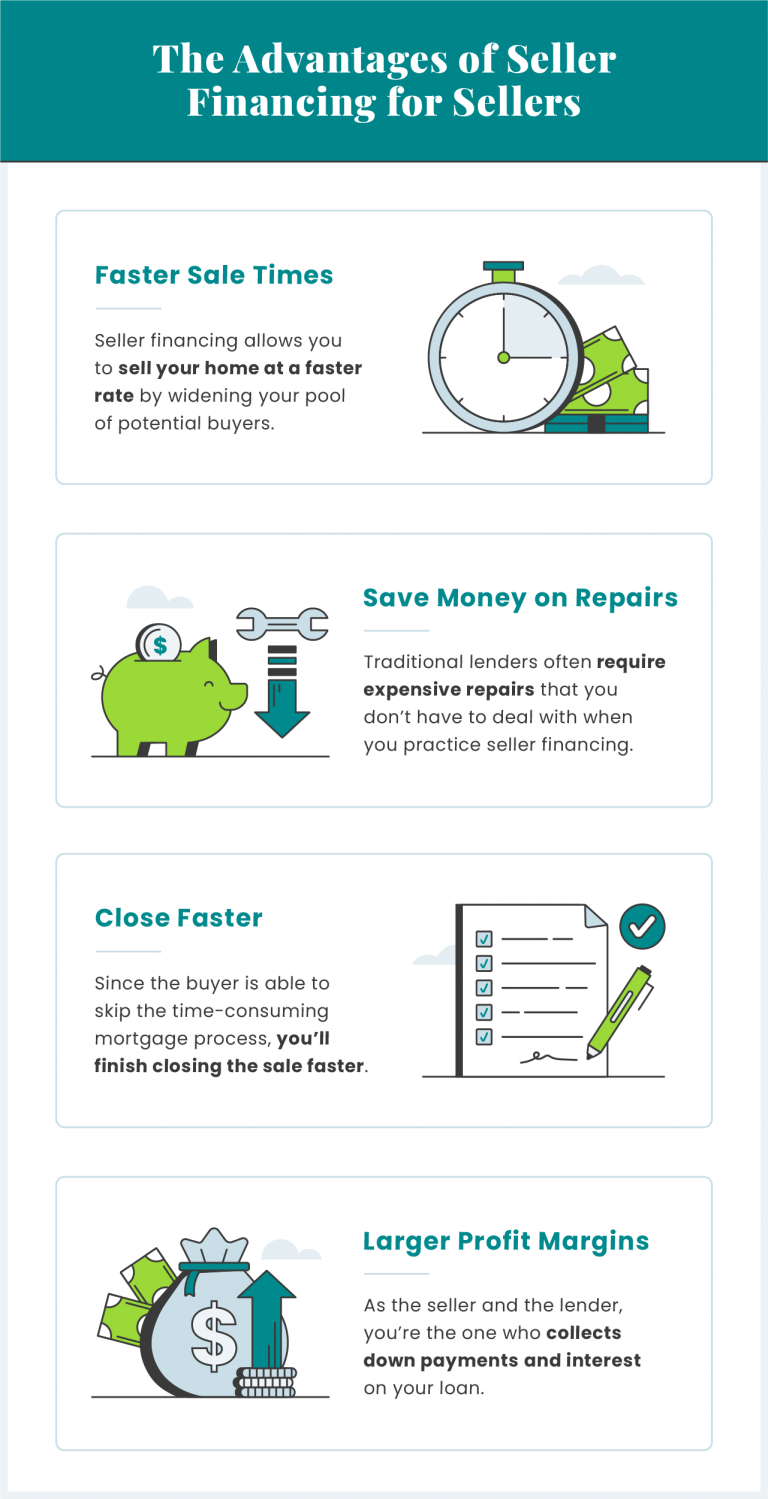

Some of the main benefits of seller financing for sellers include:

- Faster sale times: Sell your home at a faster rate by widening your pool of potential buyers.

- Saved money on repairs: Traditional lenders often require expensive repairs that you won’t have to deal with.

- Closing faster: Since the buyer is able to skip the time-consuming mortgage process, you’ll close the sale faster.

- Larger profit margins: As the seller and the lender, you’re the one who collects down payments and interest on your loan.

The biggest advantage of seller financing is that you increase the number of prospective buyers you have to choose from. Faster closing times and larger profit margins also makes seller financing an appealing option, particularly as you save for retirement.

Buyer Benefits

Details: Similar to the prior in-post image where we have one unifying visual for our headers. Of course, feel free to get creative with your structure if you have an idea

There are advantages of seller financing for buyers as well, such as:

- Alternative to traditional loans: For low-income or first-time buyers who might not qualify for traditional loans, seller financing is a more attainable option.

- Faster closing: By avoiding the traditional mortgage process, buyers are able to move into their new home faster.

- Affordable closing costs: Without appraisal costs and bank fees, seller financing is a more affordable option.

- Flexibility: Dealing directly with the seller of a home involves less red tape associated with traditional mortgage lenders, meaning it’s easier to negotiate a deal that works for both parties.

When asked about the advantages of seller financing, Erin McClafferty, a real estate agent based in San Diego, California, had this to say: “Sellers tend to be more flexible than traditional lenders. For lower income buyers, seller financing may be the only way they can get a mortgage.”

McClafferty continues, “There tends to be lower closing costs, no minimum down payment requirements, more flexible terms, potential for no PMI premiums and less strict credit standards. The seller financing process can also be much faster than traditional methods, closing in as little as a week compared to 17–30 days.”

Since owner financing involves quicker closing times and more flexibility, it can be the perfect option for both the buyer and seller.

Disadvantages of Seller Financing

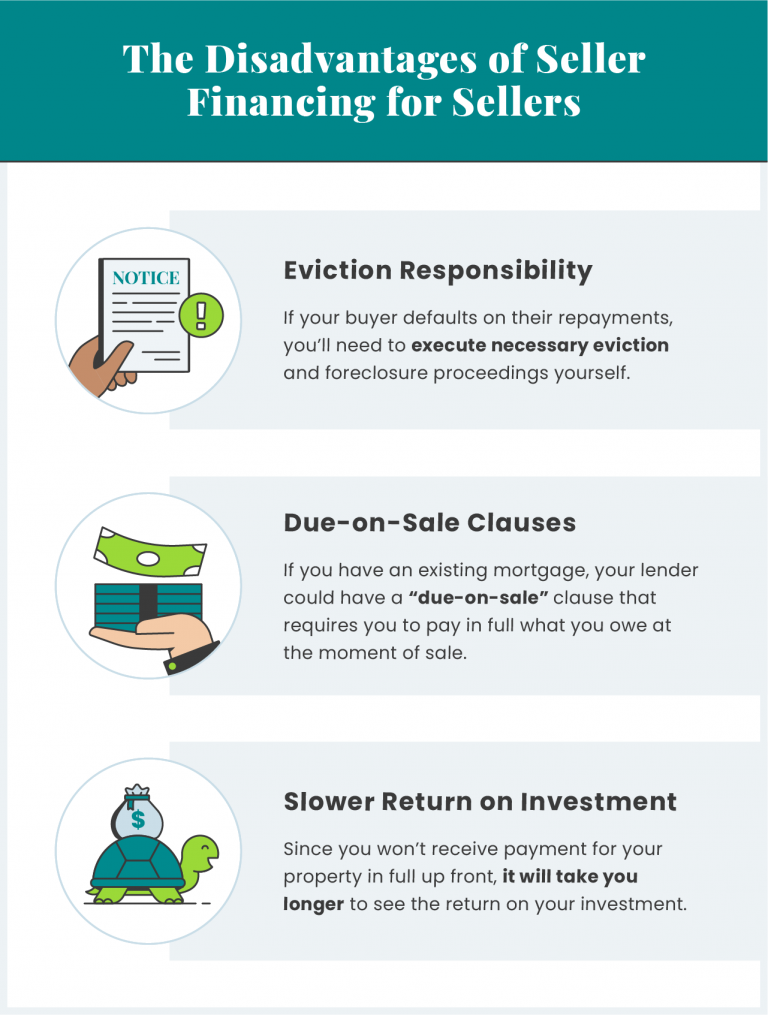

While seller financing can help you sell your home fast and possibly make more money, it also has its downsides, such as:

- Eviction Responsibility: If the buyer defaults on their repayments, you’ll need to execute the eviction proceedings yourself. This can be a hassle that you don’t have to worry about with traditional financing methods.

- Due-on-Sale Clauses: When you provide seller financing but have an existing mortgage, it’s possible your lender has a “due-on-sale” clause that requires you to pay what you owe in full at the moment of selling the property.

- Slower Return on Investment: Following the traditional mortgage process ensures you receive your money in full when you sell your home. While seller financing can help you sell faster and make more money, it takes longer for you to receive your full return on investment.

Assuming your buyer makes their repayments consistently and on time, seller financing could be a great option to help sell your home. If they default, however, you’ll be responsible for taking legal action.

Additionally, seller financing has some disadvantages for buyers.

“Sellers have less flexibility with loan and financing options, which often leads to a much higher interest rate than traditional lenders can offer,” says McClafferty. “Buyers might pay less upfront, but over time, they can end up overpaying with higher interest rates.”

Contract Types

As you prepare to sell your home through owner financing, it’s important to understand the different types of contracts you can use.

All-Inclusive Mortgage

In an all-inclusive trust deed (AITD), the seller makes payments on an existing mortgage using the money received from the buyer’s payments. Typically, the buyer will be paying more than the cost of the mortgage and the seller will pocket any surplus funds.

Assumable Mortgage

An assumable mortgage allows the buyer to take over (or assume) the seller’s existing mortgage loan with the same interest rate and payment terms. The buyer becomes responsible for repaying the remaining balance on the loan after it’s transferred from the current owner. Only specific types of mortgage loans are assumable, including government-backed loans, and the lender’s approval is necessary.

Junior Mortgage

If a lender isn’t willing to loan the buyer the full amount of money required to purchase the property, the seller can finance the difference with a junior mortgage. As the buyer makes their mortgage payments, the money goes from their primary lender to the seller until the difference is paid.

That said, junior mortgages aren’t accepted by most traditional lenders. If a junior mortgage is established, the mortgage lender will take priority over the seller if the buyer defaults on their loan.

Land Contracts

Under a land contract, the seller lends enough money to the buyer in exchange for the home, under the agreement that the seller will pay back the funds in full according to a pre-established repayment schedule.

While this allows the buyer and seller to omit traditional mortgage lenders from the homebuying process, normally land contracts don’t give the seller the legal title to the property until repayments are complete.

Normally land contracts are paid with a lump sum at the conclusion of the repayment period pre-decided by buyer and seller.

Rent-to-Own Contract

A rent-to-own contract requires that a renter pays their seller an option fee which grants them the exclusive right to buy the property at a future date. This contract type is also known as a lease purchase agreement.

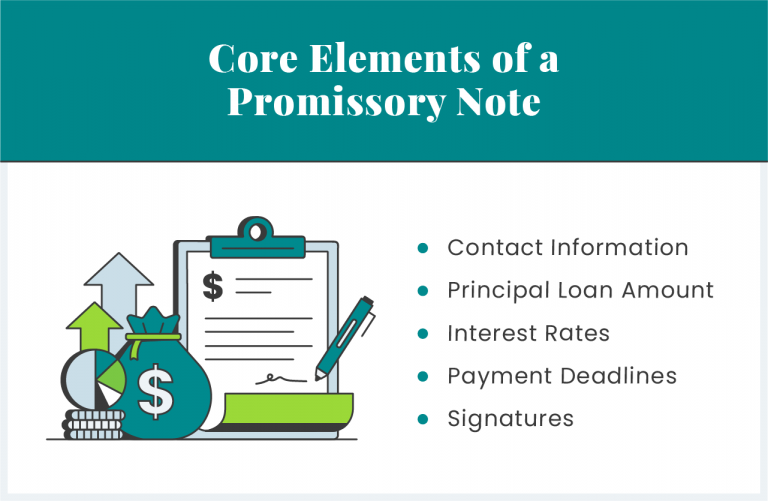

What’s Included in a Promissory Note?

When you engage in seller financing, a promissory note is a must to ensure you can take legal action if your buyer defaults on their payments. While they vary in structure, promissory notes usually include:

- Contact information: The names and addresses of each party involved in the transaction.

- Principal loan amount: The total amount of money owed by the borrower at the date of issuance.

- Interest rates: The percentage of interest the borrower will be expected to repay.

- Payment deadlines: The dates of the first deadline and how often payments will be expected to be paid.

- Signatures: The lender and borrower must sign the contract to make it legally binding.

Typically, it’s a good idea for sellers to ensure their promissory note is secured with the sold property as collateral. This helps ensure that in the event that your buyer defaults on their payments, you’ll maintain ownership of the property in question.

Tips for Sellers

The main drawback of seller financing is that it’s possible for the buyer to default on their loan payments.

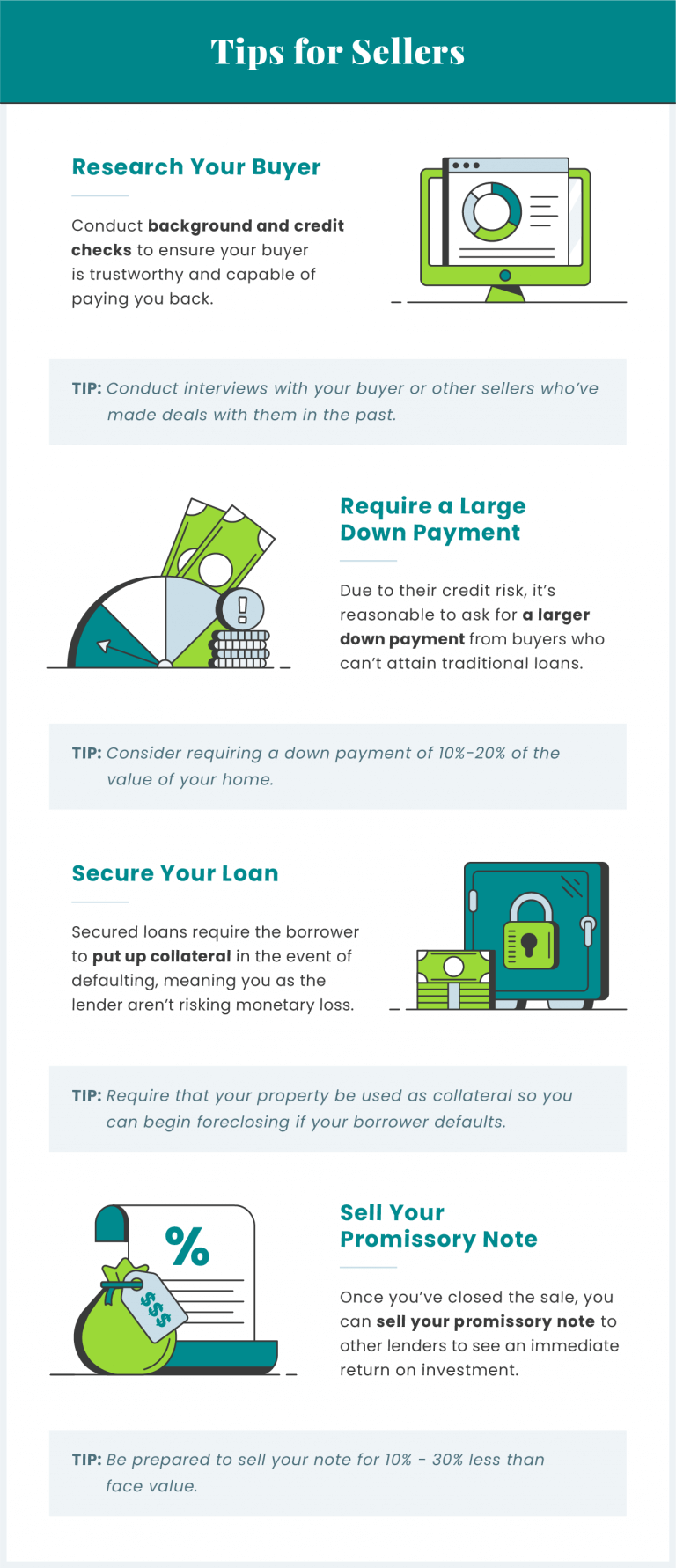

Luckily, there are ways to reduce your risk of your buyer defaulting:

1. Require a Larger Down Payment

As a seller, you ideally shouldn’t have to finance more than half of the purchase price of your home. Since seller financing is convenient for buyers who can’t attain a traditional loan, it’s reasonable for you to ask for a larger down payment up front.

This down payment will help motivate the buyer to repay what they borrowed for fear of losing a sizable sum of money.

2. Research Your Buyer

The best way to ensure you receive repayment for your loan is to research your buyer and confirm they’re trustworthy, responsible and financially sound. You may want to conduct background and credit checks to make sure they’re reliable and capable enough to pay you back.

You may even want to conduct an interview with your buyer or other sellers who have made deals with them. If you have any doubts, you shouldn’t be afraid to move on to another buyer.

3. Secure Your Loan

While unsecured loans allow the buyer to borrow money outright, secured loans require that the buyer offer something as collateral in case they can’t repay the loan. Typically, it’s a good idea to secure your loan with the property you’re selling as collateral. This grants you legal authority to begin the foreclosure process when your buyer defaults on their payments.

4. Sell Your Promissory Note

Once you’ve written up a promissory note and closed the sale with your buyer, you can then sell it to other lenders or investors. While you likely won’t be able to sell the note for its full value, selling your promissory note will put money in your pocket faster and release you from having to deal with the possibility of your buyer defaulting.

Closing Takeaways

While seller financing can help you sell your home faster and receive more money for the sale, it also comes with its downsides. For this reason it’s important to thoroughly research the process and run background checks on prospective buyers.

Selling your home is a great first step to transition to retirement, but you should also be well versed in money management to ensure you’re on track. Check out our guide on personal finance to help you navigate your golden years.

Check out our full infographic on the pros and cons of seller financing and tips to navigate the process below.