Retirement Overview

Retirement is the time in later life when people voluntarily or involuntarily leave the paid labor force. It starts at about age 64, on average, for American workers and lasts roughly 20 years. Average retirement age varies by state and ranges from age 61 to 67.

Key Facts About Retirement

- Retirement is the time in life when people leave the workforce. It can be voluntary or involuntary and lasts roughly 20 years for the average American.

- Full retirement age for Social Security is 67 years for people born in 1960 or later. Early benefits are available at age 62, but they are permanently reduced.

- The “three-legged stool” analogy for retirement income sources includes Social Security, personal savings and employer-sponsored pensions.

- Health care costs are a major concern in later life. Three other big risks for retirees are inflation, market volatility and longevity.

What It Means To Retire

For some people, retirement is a relaxing time of exploration, fulfillment and leisure. For others, it is stressful and marked by financial struggles, boredom and a lack of a sense of purpose. Even under the best of circumstances, retirement can be disorienting.

All retirees have one thing in common: suddenly, their time is their own. It is now time to live off the fruits of your labors. No more fighting commuter traffic, working overtime, attending interminable meetings and trying to please difficult bosses or coworkers.

In retirement, you can take up a hobby or volunteer for a worthy cause. You can even start a business or work part-time. It may take time to replace the structure and purpose of full-time work. If financial problems arise due to falling behind on planning or saving, or if life deals you a bad hand, things get tricky. Retirement can then become a time of major struggle.

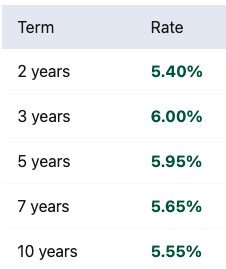

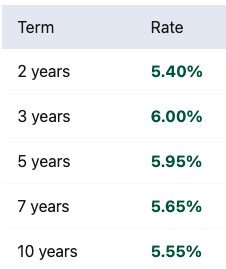

Calculate Your Returns Based on Today’s Best Rates

Retirement Misconceptions

Many people mistakenly believe that Social Security will be enough to pay their expenses in retirement and Medicare will be sufficient for their medical bills. Neither statement is true. Social Security replaces only about 37% of past earnings and Medicare has many coverage gaps.

In addition, many people don’t have the luxury of deciding when to retire. According to the 2023 Retirement Confidence Survey from the Employee Benefit Research Institute, 46% of U.S. retirees said they retired earlier than they’d planned because of layoffs or health issues.

Can you believe that in 1900, life expectancy was 32 years old, and in 1950, it went up to 46? The reality is that as a human race, we have not had much time to ‘plan for retirement,’ and generationally, we are not equipped to do so. For our great-grandparents, retirement was when they died; for us, retirement is an opportunity to redefine ourselves. Thanks to technology and nutrition, we can increase our quality of life, and some can easily aspire to live past 80 years old. This is why for Mariana, whose grandmother had just celebrated her 96th birthday, it was an eye-opening experience to start planning for those ‘golden years.’ Be better prepared by educating yourself and visualizing with numbers what it takes to get to your 2.0 version.

Planning for Retirement

The earlier you start planning and saving for retirement, the more prepared you will be when the time comes. Many workers start saving a small amount and gradually increase it as they are able.

When Can I Retire?

Many people use Social Security eligibility as a “trigger” to retire.

As of 2024, the full retirement age (FRA) is 66 years and six months for individuals born in 1957, and it increases in two-month increments for each subsequent birth year, reaching 66 years and 10 months for those born in 1959. For individuals born in 1960 or later, the FRA is set at 67.

Early benefits are available at age 62; however, they are permanently reduced from 70% to 80% of the full benefit amount. Additionally, retirees can access tax-deferred retirement accounts at age 59 ½ without penalties.

Retirement Planning Calculators

Another indicator of retirement readiness is results from a financial calculator that indicates when a savings goal will be reached. Experts recommend trying at least three different financial calculators because their assumptions and data inputs vary.

Look for similarities and differences in data output and the range of responses.

FIRE Number

FIRE is the acronym for Financial Independence, Retire Early. The goal of FIRE is for young or middle-aged adults to reach the point where they don’t have to work for a living.

Many FIRE proponents use the 25-4 Rule. To determine their “FIRE number” (savings goal), they multiply their desired annual income by 25. Then they withdraw 4% of savings annually, which is based on the often cited 4% Rule. Withdrawals are often supplemented with gig jobs.

Secure Retirement Without Hidden Fees

The Three-Legged Stool of Retirement

Financial planners and educators have long used the metaphor of a three-legged stool to describe the three primary sources of retirement income. Social Security was never meant to be the sole source of retirement income and must be supplemented.

The Three-Legged Stool Analogy

The three legs of the “stool” are Social Security, personal savings and employer-sponsored defined benefit pensions. If people have an additional income source, such as rent or earnings from a job or business, they have a “four-legged table.”

- Social Security

- Around 97% of older Americans receive Social Security benefits. Benefit payments are determined by the highest 35 years of income that a retiree earns when working and the age at which they retire. Social Security’s trust fund is projected to run out of money in 2033. At that point, tax revenue will be enough to cover only about 77% of scheduled benefits.

- Personal Savings

- Americans are increasingly reliant on personal savings to fund retirement. However, most have not saved as much as they need, and that situation is expected to get worse. A recent study from Northwestern Mutual found that the average American has only $89,300 saved for retirement and expects to need $1.27 million to retire comfortably.

- Employer Pension

- Defined benefit pensions pay a monthly benefit-for-life based on workers’ earnings and years of service. Just 20% of all workers and 11% of private-sector workers participate in pension plans, according to the Pension Rights Center. For those who have pensions in the private sector, the median annual income from them is less than $11,000 a year.

The Three Legs

Why the Stool Is Wobbly

Social Security’s future is uncertain, personal savings are often inadequate, and pensions have largely disappeared for most workers. Public employees, including teachers and government employees, are a notable exception.

Most workers and retirees must turn to individual retirement accounts (IRAs) and workplace defined contribution plans, such as 401(k)s and 403(b)s, if their employer offers them. Firms with less than 100 employees often do not.

According to a report from the Center for Retirement Research, the typical household nearing retirement with a 401(k) has about $135,000 in retirement savings. Putting all that money into an annuity would only yield about $600 in monthly income. Even more worrying, the report says nearly a third of all households nearing retirement have no retirement savings at all.

Bottom line: the wobbly stool on which many Americans’ retirement rests has toppled over.

Health Care Costs in Retirement

Health care costs are a major concern in later life. Medicare does not cover everything, leaving many retirees facing substantial out-of-pocket expenses. This is even before accounting for the cost of long-term care, which many older adults will need at some point in their lives. Medicaid covers long-term care, but only if the person in need has an extremely low income, and only after their personal savings are depleted.

Out-of-Pocket Expenses

A 65-year-old retiree can expect to spend an average of $157,500 ($315,000 for a couple) on health care expenses throughout retirement. Health care expenses typically rise with age and are highest for retirees age 85 and older.

Researchers have also found that women, because of their longer life expectancy, have higher health care costs in retirement than men. Also, somewhat surprisingly, people in good health have higher retirement health care expenses because they tend to live longer, incur more out-of-pocket expenses and need nursing home care.

Retirement Risks

Three major risks for retirees are inflation, market volatility and longevity.

Inflation

Inflation, which causes higher prices and a reduction of purchasing power, can diminish the value of a retiree’s savings. If returns on investments can’t keep up with inflation, savings may run out sooner than expected.

Market Volatility

If retirement savings are invested in stocks and there is a market downturn, investors lose money. If interest rates rise, the value of existing bonds with lower coupon rates declines.

If you’re retired, your time horizon — the length of time you hold your investment — may not be long enough for you to get your money back.

Longevity

Everyone wants to live a long, healthy life; however, retirees have to make their money last a lifetime or risk running out of money. Guaranteed income sources, such as Social Security, pensions and annuities, provide a lifetime income stream no matter how long you live.

Calculate Your Returns Based on Today’s Best Rates

Retirement Planning Tips

It’s never too early or too late to plan for retirement. As the saying goes, “people who fail to plan, plan to fail.” When it comes to your finances, failure shouldn’t be an option.

- Take Advantage of Your Employer-Sponsored Retirement Plan

- This is especially important if the plan offers matching funds. If you don’t get those funds, you’re essentially leaving free money on the table.

- Set Aside Money From Your Paycheck

- If you incorporate this habit into your financial life, not only will you save more money, but the money you save will have time to grow into a healthy retirement nest egg.

- Don’t Touch Your Retirement Savings

- When you transition to a new job, don’t cash out your 401(k). Instead, move the money into an IRA or leave it in the plan to grow. Your “future self” will thank you.

- Set Up an Individual Retirement Account (IRA)

- If you don’t have access to an employer-sponsored savings plan, you can fund an IRA. You can even contribute to both an IRA and 401(k) up to annual limits specified by law.

- Consider a Deferred Annuity

- Annuities are purchased with after-tax dollars and can help insure against longevity risk. Annuity deposits grow tax-deferred and earnings are not taxed until you receive payments.

Consider Your Options When Planning for Your Future

Related Terms

Editor Bianca Dagostino contributed to this article.