Health care costs in retirement, including health insurance, are a significant concern for American workers. Losing your employer-sponsored health care coverage can leave you scrambling for a plan through the federal health insurance marketplace or a private insurer. Planning ahead and understanding your health care options can save you time and stress when you leave the workforce.

The cost of health care in retirement is a major worry across generations. A recent survey found that 61% of workers plan to work during retirement or postpone their retirement because of a lack of medical coverage.

A 2022 study from Nationwide found that 68% of millennials, 65% of Gen Xers and 37% of baby boomers are worried about finding affordable health insurance to supplement Medicare.

How Much Does Health Care Cost in Retirement?

According to a report by HealthView Services Financial, a healthy 65-year-old couple who retired in 2021 likely spent between $156,208 and $1 million on their lifetime retirement health care costs, depending on their lifespan and retirement location.

A mid-range projection from the same report based on the current value of the U.S. dollar and including Medicare premiums puts the costs of supplemental insurance and other out-of-pocket expenses for a man whose life expectancy is 87 and a woman whose life expectancy is 89 at more than $662,000 over the course of retirement.

Estimated annual health care costs, not including long-term care, for an average, healthy 65-year-old couple retiring in 2019

| Year | Ages | Cost |

|---|---|---|

| 2019 | 65 | $12,286 |

| 2024 | 70 | $16,155 |

| 2029 | 75 | $21,164 |

| 2034 | 80 | $27,060 |

| 2039 | 85 | $34,268 |

Rising prices driven by short-term inflation are impacting health care costs just as they are affecting gas, groceries and consumer goods.

Is An Annuity Right For You?

How Can I Lower Retirement Health Care Costs?

As daunting as these expenses seem, there are some things you can do to mitigate their effect and lessen financial risk during retirement.

For example, following doctor’s orders and making small changes can reduce your overall costs. According to a previous HealthView report, if a 45-year-old man with high blood pressure does as instructed by his doctor, he can lower his annual health care costs and extend his life.

“By taking medication as prescribed and maintaining a healthy level of physical activity, this individual could save an average of more than $3,600 in annual pre-retirement out-of-pocket healthcare costs,” the report states. “He can also expect to increase his actuarial longevity by more than two years.”

Retirement planning is important when it comes to health care costs. Make sure you include these costs in your budget and consider how you will cover them.

One option is to dedicate the income from an annuity solely to out-of-pocket health care expenses. If you have the option of using a health savings account (HSA), consider maximizing your contributions for use in retirement.

Health Savings Accounts (HSAs): Saving for Retirement Health Care

Health Savings Accounts (HSAs) can be a good way to save for health costs in retirement. But this option is not available to everyone, and it has limits.

HSAs are an option only for people with high-deductible health insurance plans and no other health insurance. To be considered a high-deductible plan, the insurance policy must have a deductible of at least $1,500 for self-only coverage and $3,000 for family coverage, as of 2023. These deductibles don’t apply to preventative care services.

HSA accounts are not available to people who qualify for Medicare or are claimed as dependents on someone else’s taxes.

The accounts take pre-tax deposits to cover health care costs that are not covered by insurance. The unspent money in an HSA rolls over from year to year. The accounts are also portable and stay with you when you change jobs or stop working.

According to the Society for Human Resource Management’s 2019 Employee Benefits Survey, HSAs were offered by 57% of employers. If your employer doesn’t offer an HSA, some banks and other financial institutions offer them for people with high-deductible health insurance.

As of 2023, if you have a high-deductible health plan, you can contribute up to $3,850 to an HSA for self-only coverage and up to $7,750 for family coverage, according to the Society for Human Resource Management. If you are age 55 by the end of the tax year, you can contribute an additional $1,000 to your HSA.

Learn About How Annuities Can Bolster Your Retirement Strategy

How Can I Use HSA Funds?

HSA withdrawals to cover qualified medical expenses are tax free. This gives them a major advantage over IRAs or 401(k)s, which require taxes to be paid on withdrawals.

If you are younger than 65 and you withdraw the money for other purposes, you will owe a 20% tax penalty. However, if you are older than 65, withdrawals for other purposes are taxed the same as withdrawals from other qualified retirement savings accounts, such as 401(k)s.

Qualified health expenses include things not covered by Original Medicare, such as dental care and hearing aids. Some Medicare Advantage Plans offer extra benefits that Original Medicare doesn’t offer, such as vision, hearing, and dental.

HSA funds can also be used to cover specific health insurance premiums:

- Long-term care insurance (within specified limits)

- Health care continuation coverage (such as COBRA)

- Health coverage while receiving unemployment compensation

- Medicare and other health coverage if you are 65 or older (with the exception of Medicare supplementary policies, such as Medigap)

To get the most out of your HSA for retirement savings, you should contribute the maximum possible. If you can avoid it, don’t use your HSA funds for medical expenses before retirement. Consider this money earmarked for your retirement health care costs.

Also, shop around for HSA administrators that allow you to invest the money in high-quality, low cost options.

Health Care Options for Early Retirees

Although you can retire at age 62 and still receive social security benefits, if you retire before the age of 65, you will need to find health insurance to cover your medical costs until you’re eligible for Medicare. The price of health insurance can come as a shock to workers who are used to having their employers contribute to their plan premiums.

Postponing retirement or saving enough to cover health care costs until age 65 will allow you to defer your Social Security benefits. If you can wait until age 70 to begin collecting Social Security, you can, on average, collect more (assuming you live a long life).

If possible, it’s good to research these costs and options before you retire so you can plan according to the market and your needs.

Here are some options for coverage to bridge that gap between early retirement and when you are eligible to collect Medicare.

Employer-Provided Insurance

Ideally, your employer would offer retiree health coverage, which is a continuation of your pre-retirement coverage. Some employers offer this benefit for a set period of years or until you’re eligible for Medicare.

Affordable Care Act Marketplace

You may be able to buy insurance through a health insurance marketplace offered through the Affordable Care Act, also known as Obamacare. Policies offered through state and federal exchanges created by the law are generally more affordable than insurance purchased on the open market.

You may also be eligible for tax credits to help you pay for a plan through one of the exchanges if your income is below a certain threshold.

COBRA

Another option is COBRA coverage, available through your former employer under a law known as the Consolidated Omnibus Budget Reconciliation Act. This is the most expensive option because few employers subsidize these plans.

COBRA is generally available for up to 18 months after you leave your job. If you need coverage longer than that, you will have to seek other options.

Health Plan of Spouse

If your spouse or domestic partner has health coverage through their employer, coverage under their plan may be available to you during early retirement. This can be a very cost-effective option.

If your spouse or partner is already retired and has retiree medical coverage, see if you can be added to that coverage.

Get Your Free Guide to Annuities

What Does Medicare Cost and What Does it Cover?

Medicare is a government health insurance program available to Americans aged 65 and older. But even with Medicare, retirees face significant out-of-pocket costs because the program doesn’t cover all health care needs.

Medicare offers three parts — A, B and D — and private supplementary plans, including Medigap plans and Medicare Advantage plans available for purchase under Part C.

- Medicare Part A

- Medicare Part A generally covers inpatient hospital care, up to 100 days of skilled nursing facility care and home health care. It also pays for hospice care in the last six months of life. There is no premium for Part A unless the participant failed to pay Medicare taxes for a total of 10 years.

- Medicare Part B

- Medicare Part B covers more routine medical services and supplies, including preventative services, ambulance services and mental health treatment. In 2023, the standard monthly premium for Part B is $164.90. Part B participants must also pay deductibles and coinsurance.

- Medicare Advantage: Part C

- Medicare Advantage plans are sometimes referred to as Part C. They are private plans that take the place of Part A and B and often D and cover expenses that are not covered by Parts A and B. This coverage varies by plan.

- Medicare Part D

- Medicare Part D covers prescription drugs. Medicare Part D premiums vary by plan and income, as well as the type of medication purchased and whether it’s purchased at an in-network pharmacy or an out-of-network pharmacy. The estimated premiums range from $0.00 to more than $77.40 for people making $500,000 and above.

- Medigap

- Medigap plans are private plans that supplement Parts A and B. They generally cover coinsurance and hospital costs after Medicare Part A benefits have been used and all or a portion of Part B coinsurance or copayments. They also cover some Medicare-eligible services incurred while traveling across the United States and abroad.

Services such as long-term care, dentures and acupuncture are not covered by the program. In addition, several Medicare services have copays, premiums and other costs.

Long-Term Care

One of the most daunting expenses and experiences in retirement is long-term care. According to the U.S. Department of Health and Human Services (HHS), most Americans who reach age 65 will need long-term care at some point in their lives.

Long-term care services include anything from assistance with normal daily tasks, such as bathing and dressing, to specialized medical care. Assisted living facilities focus on daily tasks for people who are able to function on their own for the most part. They do not provide the same level of medical care, including medication management and mobility assistance, that nursing homes offer.

The HHS Administration for Community Living noted that in 2016 the average cost of a semi-private room in a nursing home was $6,844 a month, while a private room cost $7,968 a month. An assisted living facility cost nearly $4,000 a month.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

How Do I Pay for Long-Term Care?

Medicare and other health insurance plans don’t generally cover long-term care. This means most retirees who don’t have long-term care insurance have few options.

According to a report by the Kaiser Family Foundation, Medicaid covers 62% of nursing home residents’ care. But Medicaid coverage for long-term care varies by state, and the program’s strict income limits leave retirees no choice but to deplete their savings before applying for assistance.

Married people who anticipate a spouse needing long-term care should investigate the benefits of a Medicaid-compliant annuity, which can preserve an income for the healthy spouse.

Alternatively, some people opt for private long-term care insurance, but the cost of these policies can be prohibitive. According to a 2016 study in the journal Inquiry, only 7.4 million people owned long-term care insurance policies in 2015, and, the authors claimed, ownership had “become dominated by the highest earners and the wealthy.”

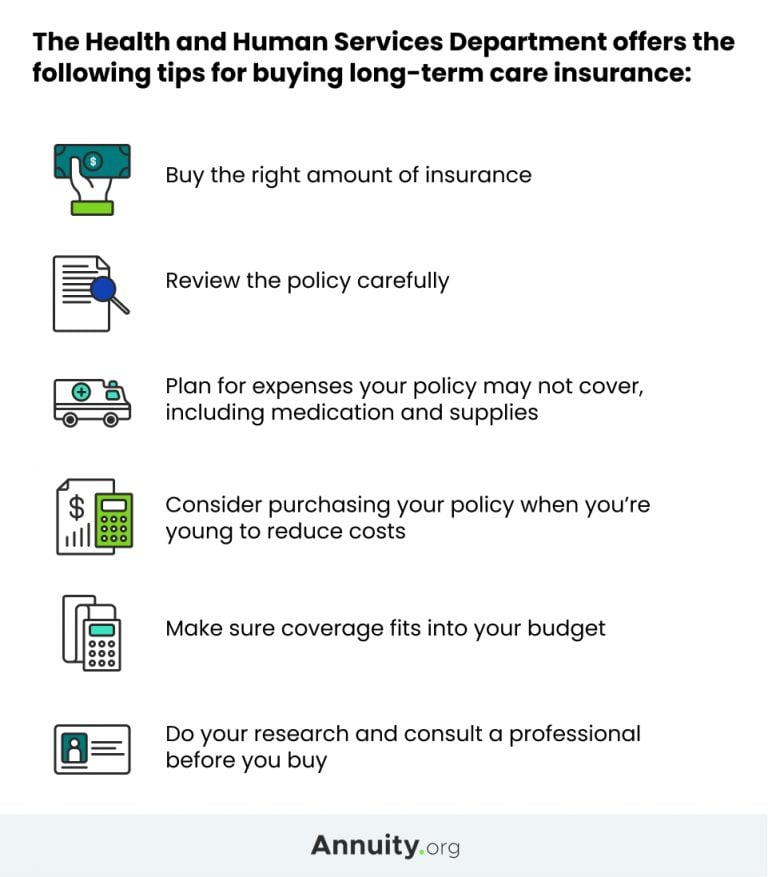

If private long-term care insurance is an option for you, start shopping for a policy early because the cost will be lower when you’re younger.

Annuities Offer Help for Long-Term Care

There are many types of annuities from which to choose. Your options can include fixed annuities, fixed-indexed annuities and variable annuities.

Variable annuities can be immediate or deferred. The immediate and deferred classifications indicate when you will begin receiving your annuity payments and each has tax implications.

Jamie Hopkins, a finance professor and contributor to Forbes, recommends using deferred annuities, a qualified longevity annuity contract (QLAC), 1035 exchanges and hybrid long-term care annuity products to finance expenses.

Depending on your specific situation and needs, however, you can probably find the right annuity for you and your retirement plans.

Alternatively, you may purchase a long-term care rider, which would increase the annuity payout for a specified period of time should long-term care be necessary.

Can You Retire Comfortably?

Hybrids and Other Options

Lawmakers in Washington, D.C., are looking for ways to ensure that seniors have access to the care they need, including allowing long-term care coverage in Medigap insurance policies.

In the meantime, some companies are offering hybrid policies that include long-term care and another form of insurance, such as life insurance. These policies may require large sums of money up front or paid in installments, which can be left to beneficiaries if long-term care is never needed.

It’s also possible to get short-term care insurance, which can cover up to 360 days in a care facility.