Key Takeaways

- A stock is a financial security that represents an ownership interest in a company.

- Stock shareholders have a proportional claim on a company’s net assets and future earnings.

- Publicly-traded stocks have a history of high returns, but they expose investors to a lot of near-term risks. As a result, they should always be viewed as long-term investments.

What Is a Stock?

A stock is a type of financial security that represents an ownership interest – equity – in a company. That equity is established on a per-share basis and owners are often referred to as shareholders or stockholders. Therefore, when you buy a share — or multiple shares — of stock, you are purchasing a proportionate claim on a company’s net assets and future earnings.

To illustrate, assume the following:

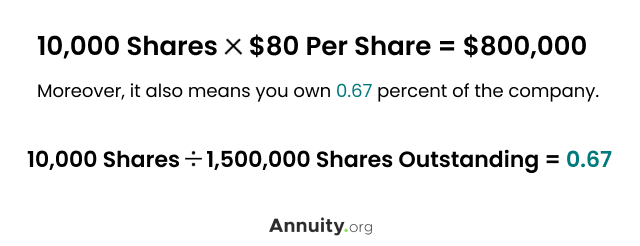

- You own 10,000 shares of Vision Global Corp stock, which are priced at $80 per share.

- There are a total of 1,500,000 Vision Global Corp shares outstanding.

This means your investment is worth $800,000.

Factors That Affect Stock Prices

Publicly traded stock prices continuously fluctuate based on changes in marketplace supply and demand. If there are more buyers for a certain stock than sellers, the price will go up. Conversely, if there are more sellers of the stock than buyers, the price will trend down.

Various factors cause these technical shifts. Generally, strong economic conditions and a stable outlook will broadly drive the demand for stocks up. Conversely, weak economic conditions and uncertainty usually cause demand to decrease.

However, not all sectors and individual stocks experience the same price movements. In any given environment, some fare better than others, primarily due to financial performance, technological innovations and regulatory developments.

Stocks represent ownership interests in the companies that issue them. This allows you to participate in the growth and earnings of the companies whose stocks you hold, but also means you are exposed to potential losses as well.

Benefits of Investing in Stocks

The primary reason most people buy stocks is to improve their finances. They seek to generate a long-term return on their investment (ROI) that exceeds that of other important asset classes, such as bonds, real estate and commodities. Generally, this is achieved in two ways.

- Dividends

- Dividends are payments made by a company to its shareholders. Normally, the payments represent a portion of the current year’s net earnings, but special dividends – funded with retained earnings or asset sales – are sometimes made.

- Price Appreciation

- This is when the price of a stock increases since purchase. Like a rise in the value of your home or any other asset you own, the increase represents a potential gain that can be obtained upon selling it.

Common Ways To Achieve ROI From Stocks

New to investing?: Read our Investing for Beginners guide.

While many investors benefit from both dividends and price appreciation, some do not. Not all stocks pay dividends, and many suffer from price depreciation rather than appreciation. As a result, careful investors avoid establishing highly concentrated positions in only a few stocks. Rather, they build diversified portfolios that include a variety of companies across different industries and geographic regions.

Beyond the potential financial benefits, most stocks also offer investors voting rights on key governance matters. Given their relatively small and uninfluential ownership positions, this is rarely a focal point for individual investors. However, institutional investors with significant ownership stakes tend to highly value voting rights.

Different Types of Stocks

Not all stocks are the same. Therefore it is important to understand their differences and some terminology distinctions before investing.

Public vs. Private Stocks

There are publicly traded stocks and privately held stocks. The former is what most people think of when they hear the phrase “stock market.” Publicly traded stocks consist of fairly well-known companies whose shares are traded on highly regulated exchanges, such as the New York Stock Exchange and the Nasdaq.

Private markets involve much less regulation than public markets, and they are comparatively illiquid and volatile. To protect unsophisticated U.S. investors from these pitfalls, the Securities and Exchange Commission (SEC) largely limits investment in this space, allowing only relatively wealthy and/or highly knowledgeable, accredited investors to buy privately placed securities.

The first time a privately held company issues stock to the general public is known as an initial public offering (IPO). These “going public” events tend to gather a lot of media attention, especially for large offerings like those conducted by Facebook in 2012 and Uber technologies in 2019.

Common vs. Preferred Stocks

Most equity investors own publicly traded common stocks. These offer voting rights and the possibility for dividends and price appreciation, but there is another type of stock favored by some investors — preferred stock.

Preferred shareholders rarely have the right to vote on company matters, but they are entitled to receive dividend payments before common shareholders. Oftentimes, they receive these payments at a higher dividend yield. Preferred shareholders also have a priority claim on assets in the event of a bankruptcy proceeding or liquidation.

This priority positioning manifests itself via the risk-return tradeoff: the investment principle that shows a higher level of return is only achievable by assuming a higher level of risk. While common shareholders may have greater return potential than preferred shareholders, they also face an increased risk of losing their money because they sit at the bottom of the capital stack.

The Legal Order of Claims on a Company’s Net Asset

- Secured Creditors

- Unsecured Creditors

- Preferred Shareholders

- Common Shareholders

Growth vs. Value Stocks

Growth stocks are associated with companies that are expected to grow their revenues and profits faster than their peers. Since growth is a priority, these companies typically reinvest their earnings to fund ongoing expansion. As a result, they pay little to no dividends to their shareholders.

Value stocks are different. They are associated with relatively mature, dividend-paying companies whose stock prices do not reflect their fundamental worth. They trade at a perceived bargain, offering investors the potential for some price appreciation. However, value stocks do not emphasize growth, which means the upside potential is limited.

Generally, growth stocks offer investors greater return potential than value stocks. However, they are also more volatile and expose investors to a higher probability of losing their capital.

Growth stocks are best for long-term, return-focused investors that can tolerate big price swings. Value stocks are best for more cautious equity investors that favor stability and dividend distributions.

Large-Cap vs. Mid-Cap vs. Small-Cap Stocks

Market capitalization is a term that describes the total market value of a publicly traded stock. The larger the market capitalization, the larger the economic footprint of the company in question.

At a high level, the universe of publicly traded stocks consists of small-cap, mid-cap and large-cap companies. The distinction is generally broken down as follows:

- Small-Cap Stocks have a market capitalization of $2 billion or less. Based on market capitalization, they are estimated to comprise about 10% of the total U.S. stock market.

- Mid-Cap Stocks reflect market capitalizations between $2 billion and $10 billion. They are estimated to comprise about 20% of the total U.S. stock market.

- Large-Cap Stocks have market capitalizations in excess of $10 billion. They are estimated to comprise about 70% of the total U.S. stock market.

Generally, the larger the market cap, the more mature the company and the lower its growth potential. With maturity comes stable cash flows, relatively high dividend payouts and reduced stock price uncertainty.

Conversely, the smaller the market cap, the less mature the company and the higher its growth potential. The lack of maturity means uncertain cash flows, relatively low dividend payouts and heightened stock price volatility.

Read More: Variable Annuities vs. Stocks

Let’s Talk About Your Financial Goals.

How To Invest in Stocks?

Companies sell stocks to raise funds, making investors part-owners. These funds are used to operate the company. The sales process is often called stock issuance, and gives investors the chance to earn their own profits. Those who own stock in a company also get voting rights in the issuing company.

The forum for direct exchanges between issuing companies and investors is known as the primary stock market. This differs from the secondary stock market, which is the forum where previously issued stocks are traded amongst investors.

Stocks To Buy

Experts do not advise retail investors to buy individual stocks. There is far too much risk in doing so. For most people, especially novice investors, buying a fund-style investment, such as an index fund or an exchange-traded funds (ETFs), is smarter.

These pooled investment vehicles offer passive, low-cost and diversified exposure to an array of markets and market sectors. For example, a single Vanguard ETF, which goes by the ticker symbol VOO, provides exposure to the 500 largest publicly-traded companies in the United States. Another, VT, provides exposure to companies of all sizes across the globe.

How To Sell Stocks

You can easily sell stocks via a stockbroker or an online brokerage firm, such as E*TRADE, Charles Schwab and TD Ameritrade. Traditionally, these middlemen have charged commissions for the service of matching buyers with sellers. However, the evolution of automated trading platforms — in addition to fierce competition throughout the brokerage industry — has led many brokers to drastically reduce or eliminate commissions for certain assets, including stocks.

This transition reflects a shift from a transaction-oriented business model to one focused on cultivating deeper client relationships. For the leading firms, this means providing a broader, highly integrated service offering that is inclusive of custodial banking, advisory support and customized research, data and tools.

Mitigating the Risks of Investing in Stocks

Stocks, particularly publicly-traded, common stocks, are a staple in nearly every investment portfolio. They have a history of high returns, but they expose investors to a lot of near-term risks, as we saw during the Great Financial Recession and the early days of the COVID-19 pandemic – when extreme uncertainty resulted in significant market volatility and widespread price collapse.

For this reason, stocks should be viewed as long-term investments. Moreover, prudent investors should strive to achieve a high degree of diversification across their stock holdings. Doing so provides for balanced economic exposure, which has been shown to strengthen long-term investment performance and minimize downside risk.

Years ago, achieving an appropriate level of diversification was a complex and costly endeavor. Today, it’s a simple and inexpensive process, thanks to the myriad of low-cost index funds and exchange-traded funds (ETFs) that provide exposure to different industries and geographic regions.

“This article was very useful and well explained. Most of the questions and assumptions I had on “stocks” were fully addressed. Thank you.”

Editor Malori Malone contributed to this article.