Key Takeaways

- Recovering financial independence after struggling with substance abuse is a crucial step to recovery.

- Individuals in recovery often face financial fallout, which can be compounded and threaten a relapse.

- Financial stress can cause individuals to become overwhelmed and discouraged, leading to relapse and making the problem worse.

- Building a strong financial foundation involves creating a budget, paying down debt and having a plan to manage finances.

- Creating a budget is perhaps the most important step to getting your financial life on track.

Nearly one in 10 Americans — 22.35 million adults — were in recovery from some form of addiction in 2021, according to a study in the journal Drug and Alcohol Dependence. But they have very little support from banks or financial service providers.

Lack of support for financial recovery, while recovering from substance use disorder — or SUD — puts these people at greater risk of relapse.

A person’s quality of mental health can further complicate their financial stress if they abuse drugs or alcohol. A 2019 study found that drug use among people with depression resulted in distinct types of stress — including financial stress.

What’s more, financial literacy and counseling programs through rehab and recovery programs are a mixed bag. Some make financial health a focus of recovery, while others provide little to no focus on returning to financial independence while recovering from SUD.

This guide explores financial stress for people in recovery and where to turn for help in achieving financial independence.

Understanding Financial Stress During Addiction Recovery

Financial stress is the physical or emotional reaction people have from concerns or worry about their personal finances. It can lead to mental health problems and sometimes substance abuse. For people recovering from substance abuse, this stress can be compounded and threaten a relapse, according to the experts who commented for this guide.

“Individuals in recovery often have to face the financial fallout they experienced when they were actively struggling with addiction. This financial fallout is not pretty,” Dr. Lea McMahon Ed.D, LPC, chief clinical officer at Symetria Recovery told Annuity.org. “Achieving financial independence after you spend all of your savings and income on substances is no easy task, especially for someone who is fighting a recovery battle.”

The vicious cycle of finances and mental health issues can also fuel addiction or other self-destructive behavior as people look for escape. But it only keeps the vicious cycle spinning.

“Substance abuse, for instance, may result in money being spent on items that are not necessary, which can lead to further financial instability,” Candace Kotkin-De Carvalho, a licensed social worker with recovery center Absolute Awakenings in New Jersey told Annuity.org.

Financial insecurity and mental health issues are two of the leading factors connected to substance abuse in the United States and United Kingdom, according to a 2023 study by Rehabs.uk.

Substance abuse can damage people’s finances to the point where they end up homeless. But substance abuse is often the result of homelessness rather than the cause, according to the National Coalition for the Homeless.

This creates a new vicious cycle. Substance abuse can exacerbate depression or anxiety over your finances. The cost of alcohol or drugs can leave you with less money to meet your expenses. It can also lead to health problems requiring more money for care. And substance abuse can hinder your judgment.

“This could result in decisions that further aggravate their mental health, such as taking out loans they cannot pay back, turning to alcohol or drugs for comfort, or going into debt — all of which only add onto the existing burden of achieving financial independence,” Dr. Harold Hong, a board-certified psychiatrist at New Waters Recovery in North Carolina told Annuity.org.

Ultimately, it can lead to more costs through recovery from addiction.

Common Financial Concerns for Recovering Addicts

Anxiety and stress, especially around money, can become serious roadblocks and trigger the fight, flight or freeze response, among anyone facing financial stress, according to Dale Shafer II, a Certified Financial Planner® and founder of Life Moves Wealth Management in Scottsdale, AZ.

“Any of these responses can lead to additional financial difficulty if you are taken off course from what may have otherwise been a path of progress,” Shafer told Annuity.org.

For someone in recovery, simply getting back on their feet financially can pose a risk to their sobriety. Among friends and family members of people in recovery for SUD, 77% felt that their loved one having access to cash could result in relapse, according to a True Link survey.

“If an individual has what is considered ‘disposable money’ they may feel prompted to use that money to purchase substances and/or alcohol,” McMahon told Annuity.org. “The temptation to become an active user again is greater for a former active user as it’s easy to fall back into old habits.”

In many cases, those who are actively using substances and/or alcohol to cope or “feel good” tend to chase that feeling when they can, McMahon said.

Elijah Meason, who currently lives and is widely known as Elijah M’adiez, is a certified recovery peer worker and a SMART recovery facilitator in New Mexico.

“I’ve also been on the other side of addiction, so I know firsthand how addiction and finance tie together,” M’adiez told Annuity.org.

His addiction led him to years behind bars — an experience that he details about on his website StreetSober.com. He shared his firsthand experience of financial recovery with Annuity.org.

“The stress of trying to keep afloat while digging themselves out of a financial hole can often cause the person to become overwhelmed and discouraged, which can lead to relapse and inevitably makes the problem worse,” M’aidez said.

To an addict, the substance becomes their top priority, he said. Bills and other financial responsibilities take a “backseat to the habit.”

“People in recovery are often starting from scratch and have to get by on a minimum-wage job. On top of this, they may have a mountain of medical bills, probation costs and legal fees with bad credit to boot,” M’aidez said.

One of the keys to success is knowing how to get your financial life in order. Something people may not have even done before their addiction.

Financial Literacy Programs and People in Recovery

Financial literacy incorporates the basic skills necessary for anyone seeking financial independence. For people in recovery, financial independence and their recovery go together, according to McMahon.

On one hand, the patient desires to remain in recovery; on the other hand, if the patient were to fall back into substance use, their previously active purchasing behavior could create a vicious cycle.

“I believe the only way to address financial stress and or financial anxiety is through financial literacy and self-care,” Bill Ryze, a chartered financial consultant (ChFC) and board advisor at Fiona, told Annuity.org.

Financial literacy teaches you how to manage your finances and better saving habits, Ryze said. These are especially helpful for people dealing with financial stress due to debt or low savings — situations that are common to people in recovery.

Financial Literacy Programs in Recovery

The quality of financial literacy programs in recovery is a mixed bag, according to the experts Annuity.org reached out to.

“Money is definitely a topic that comes up while people are participating in therapy and in drug and alcohol treatment facilities,” Melissa Wesner, LCPC and owner and founder of Lifespring Counseling Services in Baltimore told Annuity.org. “These programs, however, may not necessarily teach people about money management strategies.”

Some recovery programs make financial literacy a high priority and see it as critical to preventing relapse. Other programs appear to give it little notice.

“I believe that many recovery programs address financial stress but should do so more effectively as this is a huge stressor in an individual’s life, especially a person in long-term recovery,” McMahon said.

McMahon said the program at her treatment center includes educating patients on financial literacy for their long-term financial independence. And though financial independence is a top priority for people in recovery, financial literacy training doesn’t appear to be the case for recovery programs across the board.

“I believe that if recovery centers made more of an effort to teach individuals about budgeting and how to manage money, many people would have a better chance of making long-term changes in their life. Elijah M’aidez said. “I know that it’s no silver bullet, but it was something I struggled with while getting sober. This is why I am making an effort to incorporate these concepts into the curriculum I use within my groups.”

People in recovery may need to take a proactive approach toward financial literacy and financial counseling beyond whatever recovery program they are a part of.

Let’s Talk About Your Financial Goals.

Financial Literacy Tips for Managing Your Finances in Recovery

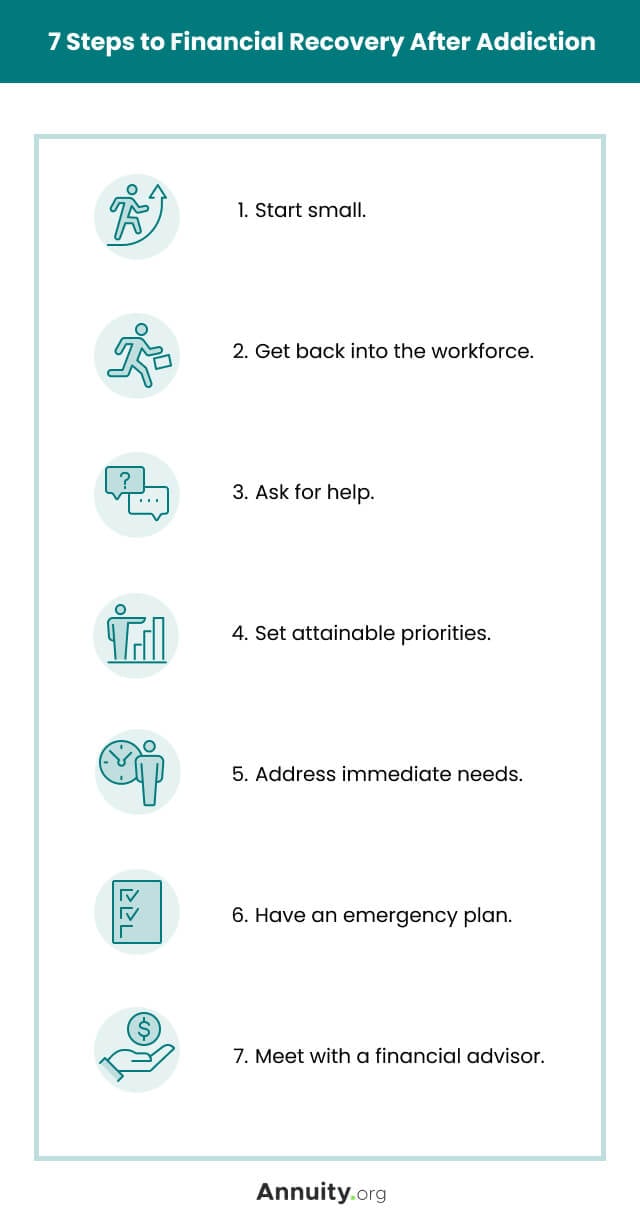

Recovering your financial independence after struggling with substance abuse can be a lengthy and difficult journey. But it is a crucial step toward restoring your life. Following a few, systematic steps can help you begin restoring your finances.

- Start small.

- Create a list of your financial priorities and work on funding them first.

- Get back into the workforce.

- Keep expectations reasonable — it may be difficult to find a job if you’ve had a long gap in work history due to addiction or rehab — but securing income is a vital step.

- Ask for help.

- Turn to family, friends, counselors — people close to you — for advice or help in managing your finances.

- Set attainable priorities.

- Create a budget designed to get you to your goals and find a job to provide a steady source of income.

- Address immediate needs.

- Address the big things first — housing and other necessities.

- Have an emergency plan.

- Create a detailed plan to manage your money in recovery — this will allow you to prevent a relapse into financial difficulties.

- Meet with a financial advisor.

- A financial advisor can help you design a budget and come up with a strategy for savings, investments and routine expenses.

How To Manage Your Finances in Recovery

The steps ahead may seem overwhelming at first. But they are part of a gradual process to rebuild your financial independence.

“After years of addiction, and years of digging myself out of the hole I dug for myself, being financially independent is one of the most rewarding accomplishments I have made other than getting sober,” M’aidez said.

These steps will help you build a financial strategy of living on a budget, managing your debt and ultimately laying the foundation of a long-term recovery. They can help you relieve the financial stress which can contribute to a relapse.

Creating a Budget

Creating a budget is perhaps the most important step in getting your financial life on track — or back on track. It gives you an overview of your income and expenses. In recovery, it can also help you set boundaries and prevent unsafe spending.

- Calculate Income

- Know how much money you’ll have each month

- Identify All Expenses

- Add up all monthly expenses — rent, utilities, food, transportation

- Retire Debt

- Calculate how much you can set aside money to pay down debt

- Pay Yourself

- Remember to put some aside for savings

How To Build a Budget

Source: True Link Financial

Budgets don’t do much for you unless you stick to them. You may want to consider sharing your budget with a friend, family member, counselor or someone else to support you and to help you stick to it.

Debt Management Strategies During Recovery

You should tackle your debt as soon as you have an income. This is critical to rebuilding your credit score and reducing your financial stress in the short term. It will also free up more of your income while opening you to better credit opportunities in the long run.

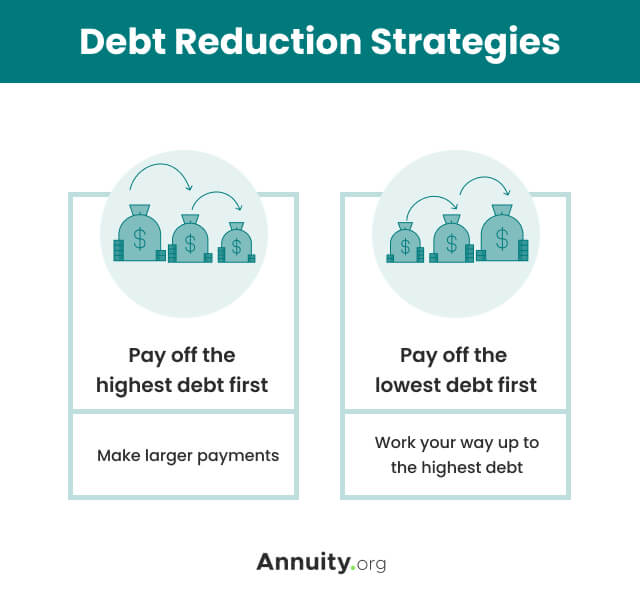

There are two main strategies for paying off debt, according to the Foundation for Financial Wellness.

Both strategies work, but each may be better for different people, according to the foundation.

Paying off the highest debt first will save you in the long run by reducing the interest you owe. But paying off the lowest debt first gives some people a sense of accomplishment. This can be a psychological edge to keep paying off debt until you’ve erased everything you owe.

It’s important to keep paying on all debts — don’t miss any bills. But by paying more to the debt you’re targeting, you’ll chip away at it.

Consider automating payments. Missed payments are the most likely thing to hurt your credit score. Autopay means you’ll never miss a payment. Plus, you won’t get hit with a late fee.

Build a Strong Financial Foundation for Long-Term Recovery

Creating a budget, paying down debt and having a plan to manage your finances can go a long way to building financial wellness during recovery. And building financial wellness can help you recognize spending triggers, according to Rutgers University’s Center of Alcohol & Substance Abuse Use Studies.

This may help you head off relapses associated with newfound “disposable income” in recovery that may trigger a relapse into substance use.

Once you’ve created this foundation, you can apply the four pillars of financial well-being — spending, saving, borrowing and planning.

- Spending

- Smart spending requires creating a budget and sticking to it. You can adjust it as needed if your income and expenses change over time.

- Saving

- Pay yourself first when you get your paycheck. Put aside savings first — into a retirement account and other savings. A good rule of thumb is 10% of your income. Using direct deposit may make it easier to save consistently.

- Borrowing

- Aside from your mortgage and car loans, your debt payments should never exceed 15% of your income. Keep your and other loans well under your income.

- Planning

- Set financial goals for both the short and long term. Consider major life changes in the years ahead and where you want to be financially. Set realistic and attainable goals along the way to get you there.

4 Pillars of Financial Well-Being

Financial Assistance and Other Resources for People in Recovery

Financial assistance can play a role in helping people in recovery get back on their feet financially. The average cost of drug rehabilitation per person is $13,475, according to the National Center for Drug Abuse Statistics. This can be a financial burden on top of other costs of SUD.

“Some people in recovery have lost their jobs, their homes, their cars, and it can take time to find new employment and rebuild one’s income to purchase the necessities that have been lost,” Melissa Wesner, a licensed clinical professional counselor, told Annuity.org.

It can be even harder for people who’ve run into legal problems or have a criminal record due to their addiction, she said.

The federal and state governments, nonprofit organizations, advocacy groups and even some addiction recovery programs or centers may offer grants or other types of financial assistance. Most of this is for treatment, but it can off-set your financial burdens after leaving rehab.

Grants and Government Assistance for People in Recovery

There are several types of state and federal financial assistance for people in recovery. The federal government offers treatment assistance through multiple agencies.

State & Federal Financial Assistance for People in Recovery

- Medicare & Medicaid coverage is available for enrolled individuals

- State-funded treatment programs — contact your state health department

- U.S. Department of Veterans Affairs helps with qualifying veterans

- Substance Abuse and Mental Health Services Administration (SAMHSA) grants

The Substance Abuse and Mental Health Services Administration — or SAMHSA — is a federal agency that offers block grants to state addiction treatment providers.

The block grants are meant to help providers assist those who need financial help. To be eligible for a SAMHSA grant, you must meet specific income criteria or enroll in a qualified treatment program. Your enrollment and treatment have to be under court supervision.

You can use the SAMHSA behavioral health treatment locator on FindTreatment.gov to find recovery centers that offer financial support through these federal block grants.

Nonprofit and Other Organizations That Offer Financial Counseling

There are several nonprofit groups and other organizations that can help people in recovery with financial counseling. But be aware that they often rely on member counseling or financial advisor firms to offer assistance — and those members may charge fees.

Ask about any fees before deciding to use their services.

- American Consumer Credit Counseling

- Offers free, over-the-phone credit counseling and budget consultations six days a week (Monday through Saturday). ACCC charges a one-time enrollment fee and monthly fee for debt management plans.

- Financial Counseling Association of America (FCAA)

- FCAA connects people throughout the United States with credit counseling services through a network of financial counseling agencies. These may include for-profit providers, but all member agencies are accredited by third-party financial associations.

- GreenPath Financial Wellness

- GreenPath provides free budgeting and debt counseling services, but charges for bankruptcy counseling, debt management plans and other services. It also provides free tools such as budget worksheets on its website.

- National Foundation for Credit Counseling (NFCC)

- The NFCC is the largest credit counseling organization in the United States and requires all member financial counseling agencies to meet its own accreditation standards. While credit counseling is free, NFCC member agencies may charge for mortgage, student loan and bankruptcy counseling or other services.

Financial Counseling Groups

The U.S. Justice Department also provides a searchable list by state of DOJ-approved credit counseling agencies throughout the United States.

Frequently Asked Questions: Financial Wellness in Recovery

There are several steps you should take to rebuild your financial health during recovery. These begin with seeking financial assistance, finding a job, expanding your financial inventory and creating a budget you can stick with.

Rebuilding your credit score requires you to reduce your debt, avoiding new debt through loans or credit cards, and making sure your income covers your spending. You should avoid common credit mistakes and pay down debt. Focus on cards with the highest debt levels — especially those that are nearly maxed out — because these can disproportionately affect your credit score.

Family members can play a role in helping a loved one in recovery find a new job. But some people may see the access to income triggering a relapse. Family members can help by offering to manage their finances as they work through recovery, relieving that trigger.

People in recovery may experience additional financial challenges that can serve as triggers, jeopardizing their sobriety. Financial wellness practices — such as creating a working budget, changing spending habits and creating a savings strategy — can ease financial stress and play a large role in helping people maintain sobriety.

Featured Experts

Dr. Harold Hong, MD

Medical Director, New Waters Recovery

Harold Hong, MD is a board-certified psychiatrist and Medical Director for New Waters Recovery in Raleigh, North Carolina. He is also the founder and president of Provia Healthcare, a multi-specialty mental health provider. Dr. Hong earned a BA in Philosophy from the University of Michigan before completing a dual MD and MA in bioethics with an emphasis on theology in medicine at Michigan. Hong completed his psychiatric residency at Duke University.

Candace Kotkin-De Carvalho, LSW, LCADC, CCS, CCTP

Clinical Director, Absolute Awakenings

Candace Kotkin-De Carvalho is a licensed social worker and the clinical director at Absolute Awakenings, a recovery center in Morris Plains, N.J. She received a MA in social work from Fordham University and has multiple professional certifications including certified clinical trauma professional, licensed clinical alcohol and drug counselor and certified clinical supervisor.

Lea McMahon LCP, Ed.D

Chief Clinical Officer at Symetria Recovery

Lea McMahon has more than 20 years of clinical experience — 10 years as a licensed professional counselor specializing in substance use disorders. She also serves as an adjunct professor of Psychology at Columbia College in Columbia, Missouri.

Melissa Wesner, LCPC

Founder, Owner of Life Spring Counseling Services

The founder and owner of Baltimore-area LifeSpring Counseling Services, Melissa Wesner is a Licensed Clinical Professional Counselor. She specializes in helping clients with trauma, depression, anxiety, and challenging life situations. Wesner also has specialized training in Brainspotting — therapy that teaches clients to reprocess traumatic memories and associate those spaces with more productive feelings.

Dale L. Shafer II, CFP®, APMA®, CDFA®

Founder | Financial Advisor | Chief Compliance Officer

More Featured Experts

- Bill Ryze, ChFC®, Board Advisor at Fiona Finance