Key Takeaways

- Accrued interest is the interest that a bond, annuity or other investment vehicle has earned but has not yet paid out.

- You can estimate accrued interest for any bond or loan using this simple formula: accrued interest = face value x (coupon rate ÷ 365) x accrual period.

- The interest income earned from bonds gets taxed in the year that you earn it.

To understand the basics of accrued interest and how it works for bonds, stocks and annuities, we need to start with these two questions:

- How is accrued interest calculated?

- Is accrued interest taxable?

Calculating Accrued Interest for Bonds

Since the topic of accrued interest is most often associated with bonds, we’ll use examples specific to bonds to explain how to calculate accrued interest.

There are three numbers you need to know to calculate accrued interest for any bond:

- The face value of the bond, or the bond’s overall value. Also called the par value, this amount is printed on the face of the bond certificate.

- The coupon rate of the bond, or the annual rate of interest that’s paid by the bond issuer.

- The length of the accrual period, which is the number of days since the bond last paid interest to the bondholder.

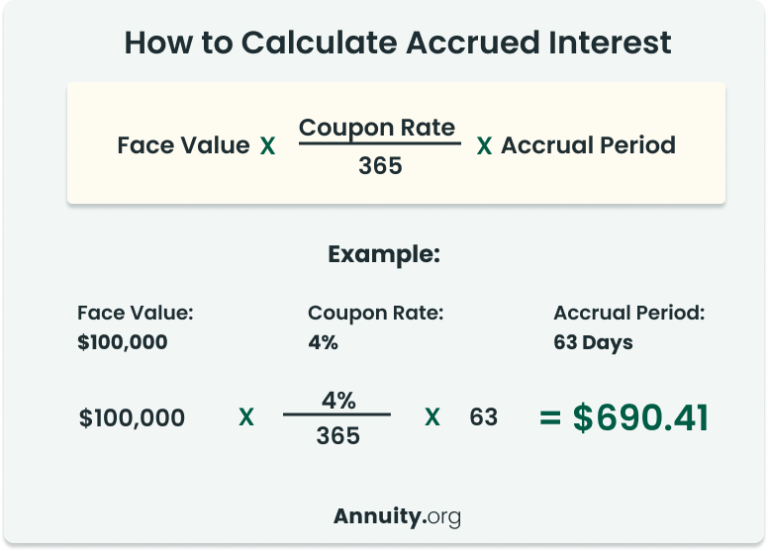

With these three numbers, you can calculate the interest that has accrued since the bond last paid interest using this formula:

Accrued Interest = Face Value x (Coupon Rate ÷ 365) x Accrual Period

To illustrate accrued interest with an example, let’s consider an investor who wants to sell a $100,000 bond. The bond has a 4% coupon rate, and the transaction will occur 63 days after they receive the bond’s last semiannual payment. Based on these numbers, the investor will have earned $690.41 in accrued interest over the 63-day period, an amount that will need to be paid by the bond buyer.

On the date of the next semi-annual coupon payment, the new bond owner will receive the full interest payment of $2,000 ($100,000 x 0.04 ÷ 2). But remember, the bond buyer will have already paid the $690.41 in accrued interest to the original bond owner at the time of the purchase.

When helping my mom with her retirement investments, which included bonds and annuities, she was unaware of which investments were taxable and the timing of the tax to be recognized. If I didn’t educate her about the tax implications and the timing, she would have been very surprised (and not in a good way) when she filed her taxes.

Taxation of Accrued Interest

In many cases, interest is taxed when it is received, not when it is accrued; however, some types of investments are subject to what’s known as accrual basis income tax.

Additionally, businesses that use accrual accounting (as opposed to cash basis accounting) must report their interest income on an accrual basis, regardless of the type of investment.

Other Investments That Accrue or Defer Interest Income

Many investors buy bonds to fund their retirement, but since the interest income earned from bonds gets taxed in the year that you earn it, you may want to consider alternative investments that may accrue or defer interest income until a later date. A few types of alternative investments include zero-coupon bonds, zero-coupon certificates of deposit (CDs) and deferred annuities.

Like regular bonds and CDs, zero-coupon bonds pay a stated rate of interest; however, they do not pay it in regular distributions. With zero-coupon bonds, you buy the bond at a discount upfront and only receive the full interest payment at maturity.

To understand how this works, let’s assume you pay $6,755 for a zero-coupon bond with a face value of $10,000. This bond will mature in 10 years and pay 4% interest. Over the 10-year period that you hold the bond, the $3,245 difference between the face value and the sale price will gradually accrue as income until the bond matures, at which time you will be paid the full $10,000.

Unfortunately, within a taxable custodial account, the $3,245 of interest income is taxable as it accrues, even though you don’t receive the interest payment until maturity.

However, the accrued interest on a non-qualified annuity is taxed differently, since the money you put into it has already been taxed. The accrued interest you earn with a non-qualified annuity is not taxed until you withdraw the money.

The tax-deferred nature of deferred annuities makes them popular with investors who are saving for retirement. The power of compound interest will help you accumulate wealth over a long period of time and retire comfortably.

Lastly, annuities may not make sense for every type of investor. To decide if investing in annuities is right for you, consult with a financial advisor, who can look at your unique circumstances and set up a formal retirement plan.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

Frequently Asked Questions About Bonds & Accrued Interest

Accrued interest is neither good nor bad — it’s just a part of all interest-bearing financial instruments like bonds and loans. Having interest accrue between payment periods ensures that buyers and sellers are treated fairly. As a buyer, you’ll owe accrued interest when you purchase a loan or a bond. As a seller, you’ll get paid for the interest that accrued prior to the sale.

Yes, accrued interest is considered a short-term receivable that should be recorded as a current asset. It represents an addition to your net worth, which is calculated as your assets minus liabilities.

Bonds, CDs and annuities are not the only kinds of financial instruments that accrue interest over time. If you’ve sold a home or paid off a car loan, you’ve most likely encountered accrued interest. The concept is similar to when interest accrues between interest payment dates, and this accrued interest is owed to the lender.