With countless investment options to choose from, it can be challenging to weigh one investment against the rest. Luckily, there are metrics available to help you evaluate your options and strengthen your financial literacy.

ROI is a measure that is widely used to compare investment opportunities and their ability to generate economic value. Based on your financial goals, you can use ROI to make well-informed decisions for your retirement savings portfolio.

What Does ROI Tell an Investor?

ROI tells investors the profitability of investments. By calculating the ROI, an investor can determine whether an investment is worthwhile.

Thomas Brock, CFA charterholder and assistant vice president at a super-regional insurance carrier, told Annuity.org, “ROI is probably the most widely referenced investment metric in the finance world.”

ROI can apply to equity securities, fixed income instruments, commercial real estate and other business endeavors. ROI is also commonly used to evaluate the merit of investments in personnel, equipment and other business projects.

For example, if a shoe company pays $500 to host a booth at a running expo, and it earns $800 in sales as a direct result, this effort would have a positive ROI.

How Do You Calculate Return on Investment?

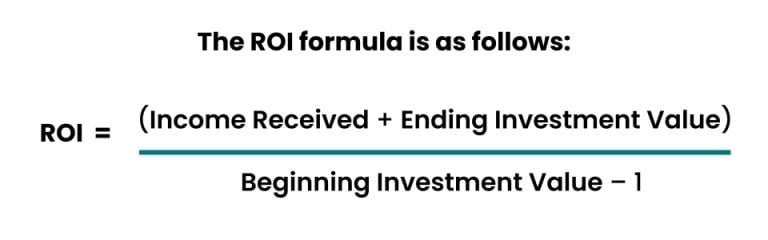

To calculate ROI, you first add income received — interest or dividends — to the ending investment value. Then, you divide this number by the beginning investment value, and subtract one from that amount.

The beginning investment value should include any start-up costs, like commissions or property taxes.

ROI Example

Consider this: You invest $3,000 into a stock. After one year, you sell your shares for $3,900. You have $0 in dividends.

$0 dividends + $3,900 ending investment value = $3,900

$3,900 ÷ $3,000 original investment = 1.3

1.3 – 1 = 0.3, or 30% ROI

In this example, the 30 percent ROI measures the performance over a one-year span. But ROI can be misleading for longer-term investments because it does not specify the time it takes to earn the return on the investment.

Limitations of ROI

The standard ROI calculation does not reflect time value of money considerations.

“This formula is ideal for computing the holding period return for an investment or the return for a discrete period of time — such as a quarter or a year,” said Brock, who is also a certified public accountant. “However, when assessing a long, multi-year investment, ROI can be deceptive.”

Time value of money refers to the concept that money is more valuable now than in the future, given that it can earn interest over time. Dollars invested today will have more time to earn compounding interest than dollars invested next year.

For example, a 200 percent return may appear to be a winning investment. However, if the investment earned the ROI over 30 years, 200 percent growth would be far less impressive. From one year to the next, the investment would have compounded at a significantly lower rate of return.

To find the compound annual growth rate (CAGR), you would use the formula below. In this case, the annualized return is only 3.73 percent.

CAGR = (1 + Cumulative Return) ^ (1 / Years) – 1

CAGR = (1 + 2.00) ^ (1 / 30) – 1 = .0373

Another way to gauge the performance of a long-held asset is to compute the internal rate of return, or IRR. Like the CAGR computation, IRR factors in the time value of money and presents an annualized rate.

Return on Investment and Annuities

An investor can use ROI to compare the profitability of some, but not all, annuities.

“If the basic terms of an annuity — amount of upfront investment, amount and frequency of future income payments, and duration of the income payments — are known with certainty, it is not difficult to calculate an ROI for an annuity,” Brock said.

However, depending on the type of annuity, unknown and unpredictable factors can make it virtually impossible to determine the ROI.

Annuities that guarantee income for life include an unknown factor: the exact date of the annuitant’s death. With lifetime income annuities, payments stop upon the death of the annuitant, so the actual ROI is not fully realized until the annuitant dies and the contract ends.

“Just like with life insurance, lifetime income annuities have the potential of providing the best return on investment that you will never see,” according to MarketWatch.

Instead of using ROI, the insurance company will quote lifetime annuity payouts in a clearer, more accurate calculation — in terms of cash flow, or the cash the annuity will generate.