Cash flow, investments, savings — these are just some of the many valuable things to keep track of in your financial portfolio. Keeping them all organized may take some commitment, but it doesn’t have to be difficult. We’ve compiled helpful tips for how to get your finances in order, no matter your situation.

General Tips for Getting Your Finances in Order

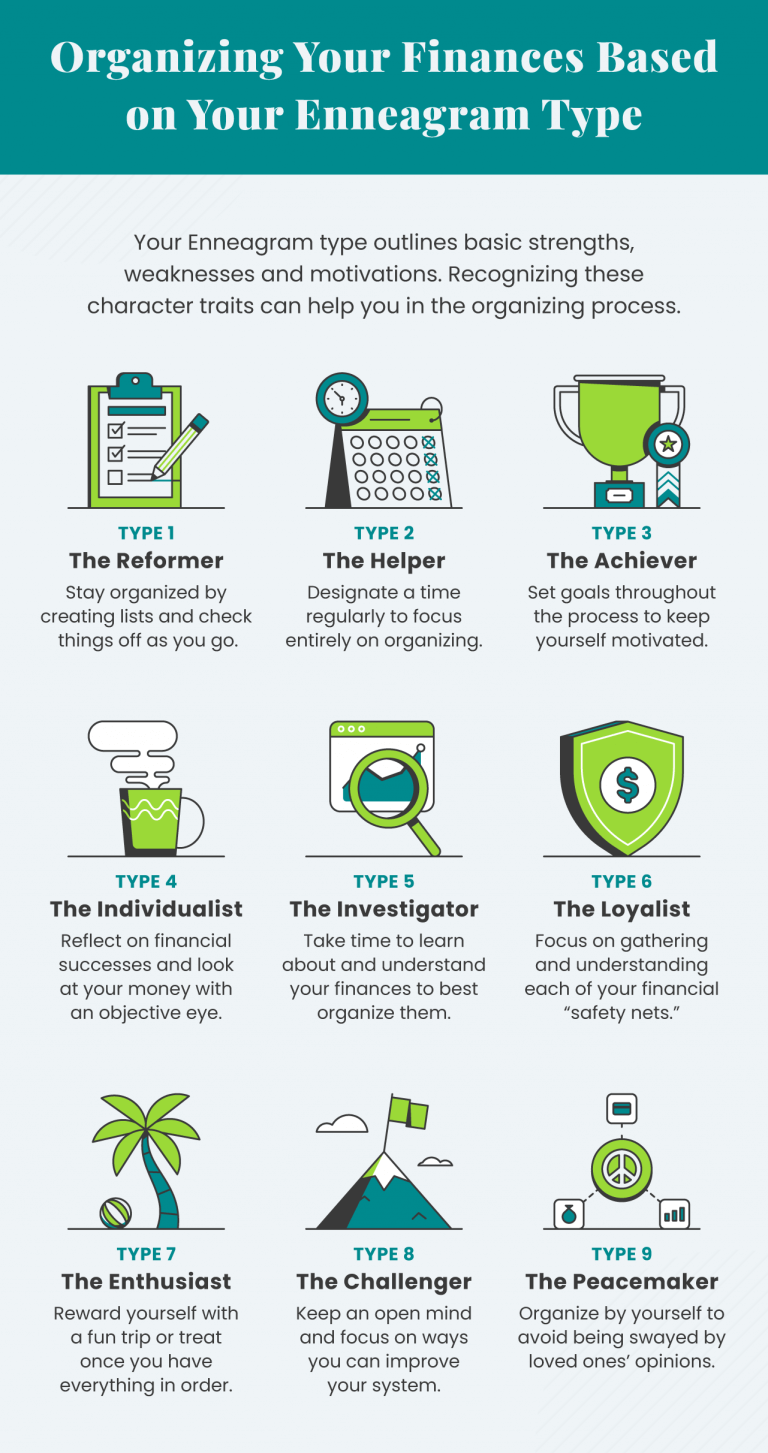

Everyone has their own organizing tricks: some are more systematic, while others embrace chaos. Consider how you sort through other aspects of your life and what works for you. These methods can also be applied when you work on getting your finances in order.

Below are tips for what should be organized and suggestions for how to go about it. However, you’ll be the most successful by applying personal techniques and experience.

One of the most effective ways to keep a pulse on your finances and stay organized is to monitor your net worth on a quarterly basis. Doing so heightens awareness and ensures you have a good feel for your various assets, liabilities and associated financial accounts. It can be difficult to launch the quarterly reporting process, but once you established the framework, future updates will be straightforward.

10 easy ways to get your finances in order:

- Automate paying your bills

- Pay down debt and build up credit

- Shop around for and compare insurance quotes

- Keep physical copies of your financial documents

- Back up your documents digitally

- Review your finances annually

- Diversify your portfolio

- Use apps to track your finances

- Create a timeline of your retirement income

- Track your assets

1. Establish an Effective and Automated Bill-Paying System

One of the most difficult aspects of managing finances is keeping track of due dates for bills. According to The Simple Dollar, the average American is likely to have at least seven or more bills per month, some of which include:

- Water

- Energy

- Mortgage/rent

- Insurance

- Phone(s)

- Internet

- Streaming service

- Car payment

- Credit card

Unfortunately, most of these payments are due on different dates throughout the month. If you’re not organized, you’ll likely miss one or two. Late payments can negatively affect your credit score if made 30 or more days after the due date, making it harder to qualify for competitive loan rates and mortgages. This is just one reason why knowing how to get your finances in order can greatly benefit you.

To mitigate the risk of making a late payment — or worse, forgetting to make the payment at all — create an automated bill-paying system. For some of your bills, you’ll simply need to go online to set up a recurring payment each month. For other bills, you may need to call your city office or another appropriate entity.

Setting up automatic bill-pay can be very beneficial for both your sanity and your credit. Your credit card payment history alone accounts for 35 percent of your FICO credit score. While this makes the biggest impact, other missed payments can be detrimental as well.

2. Deal With Debt & Credit

To get a better idea of where you stand with debt, make a list of all the people or institutions you owe money to. Although it’s a simple step, this can make a big difference in visualizing your financial situation.

According to a survey conducted by U.S News and World Report, one in five Americans don’t know if they have credit card debt. If you’re the one in five, look through your credit report to find any credit card debts or other outstanding payments. Each year you can receive one free credit report from each of the three major credit bureaus:

Despite the impact your credit has on helping you obtain personal loans, mortgages and credit cards, data from LendingTree shows that only 33 percent of Americans checked their credit score in the past year. Additionally, checking your credit score often can help you spot fraud and make a plan for the future if you notice your score is dropping or lower than you thought. Make it a habit to check your credit periodically and schedule it out on your calendar so you don’t forget.

If you see something on your credit report that looks wrong, you can dispute those matters with the credit bureau or directly with the lender or creditor involved. If you spot something that looks suspicious or fraudulent, report it to the Federal Trade Commission.

Once you’ve identified your debts, make a plan for repaying them. You can do this by starting with the smallest loan and working your way up or focusing on the loan with the highest interest rate first.

3. Review Insurance Policies

Whether due to feeling loyal to an insurance company or being generally happy with the service provided, many Americans don’t shop around for insurance quotes. This is part of the reason car owners overpay on their car insurance by nearly $330, according to Insurance Business America.

By reviewing your various insurance policies and receiving quotes from other companies, you can ensure you have the right amount of coverage without overpaying. You should also take time to review your policies after major life changes, such as marriage, divorce or retirement.

Likewise, insurance policies often lapse or require renewal after a certain period. Before absentmindedly renewing your policy, get a few free quotes from other companies and make your move if you find a better policy elsewhere.

4. Round Up Financial Documents on Paper

Financial documents are extremely important but very easily misplaced. You can avoid this by creating a financial file or binder that all your relevant documents belong in. This is also helpful for your beneficiaries in the case of an accident or passing as all of the information they need will be all in one place.

When gathering your documents, gather together any records that affect your finances. This includes payments you make on a yearly or monthly basis such as the following:

5. Gather Digital Financial Documents

With the digital world growing more advanced by the day, you may prefer to opt out of the paper document method. Even if you rely on digital files to house your financial documents, they should also be in one, easy-to-find location. Rather than keeping them on your computer, consider using a hard drive that can be kept in a safe or lockbox.

Having some documents online and some on paper isn’t ideal and can make it harder to keep track of everything. If this is the case, consider scanning your paper documents (and subsequently shredding them) to eliminate paper storage.

6. Set a Recurring Date To Review Your Finances

Planning a recurring date to conduct a full financial check-in will help you stay organized. This can be on a certain day of the month or once every few months, whatever best fits your lifestyle and financial situation. To avoid forgetting to do these, mark them in a personal planner or set reminders in your phone.

During your regular review, go through each portion of your financial portfolio, including:

- What’s happening with your investments

- Your progress towards financial goals

- How you’re sticking to your budget (or how you’re falling short)

- Automatic payments that have been processed

- Questions you have for your financial advisor

While it’s important to do a full check-in to assess your overall financial health from time to time, you should also review individual aspects of your financial situation more regularly. You won’t want to wait until your monthly check-in to review your credit card balances, and you should review your budget at least once a month, if not more often.

Let’s Talk About Your Financial Goals.

How To Get Your Finances in Order With More Than One Income Stream

Be it annuity payments, passive income or investment returns, multiple income streams provide a security blanket in case something were to happen to your main source of income. Having more than one income stream also increases your ability to build wealth and can prepare you better for retirement.

Knowing how to get your finances in order with more than one income can positively affect your cash flow and help prevent you from losing money.

7. Open Additional Accounts for Different Goals

When you have more than one income stream, it can often be simpler to have each stream of income deposited in a different account. Each account should then have a goal attached to it. By doing this, you’ll avoid accidentally spending money you intended to save or use for something else.

For example, imagine you earn regular stock market dividends and passive income from real estate. Your goal is to save for a retirement bucket list vacation. To do this, you set up automatic deposits for these two income streams that go directly into a Flexible Certificate of Deposit account. By doing this, you know exactly what that money is going towards and won’t unintentionally use it for something else.

8. Use a Finance App

There is no shortage of finance apps to organize your income, create a budget and track spending. A few apps that you may find useful are:

Each app has different features that may suit your lifestyle better than another. Because of this, it’s best to do your research to find out which one will work best for your situation. Before signing up for any account, you also want to be aware of fees for using the service and have securities in place to protect your money.

How To Organize Your Finances When You’re Retired

Reaching a point where you can retire is a thrilling moment. You can leave your 9 to 5, go on vacation, enjoy your hobbies or spend more time with family. Whatever your ideal retirement lifestyle looks like, knowing how to get your finances in order during this phase of your life will help you avoid running out of money.

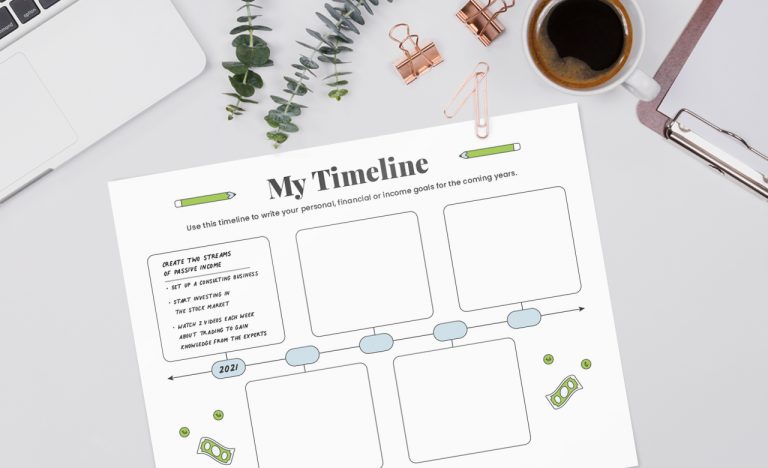

9. Create an Income Timeline

Not all of your retirement funds will be disbursed at the same time, so you must understand what income you’ll live off of and when. An income timeline will help you visualize exactly when you’ll have access to certain retirement funds which can help you plan accordingly.

Start by drawing out a timeline for the next 10 or 15 years of your life. Depending on the age you retire this number will be different. Label each of these years, starting with your current age. For example, if you retire at 60, you’ll start your timeline at age 60, the next point will be 61, the next will be 62, etc., until you reach 70. Since you can withdraw funds from your IRA or 401(k) at 59 ½, you’ll mark this at age 60.

From there, you’ll mark when you can begin withdrawing other retirement funds. If you have an annuity that will start payouts at 65, write that down. If you plan to delay Social Security benefits until age 70, write this down as well.

From here, you’ll see the funds that are available to you in the coming years. This will help you create an effective retirement budget that will protect your hard-earned money for years to come.

Use the timeline template below to get started with your income timeline, or use it to track your financial goals in the coming years.

10. Track Your Assets and Net Worth Regularly

The last thing you want to worry about during retirement is running out of money. For this reason, you should track your assets on a consistent basis. Rather than only looking at retirement funds, review the financial health of other assets such as real estate or bonds.

If you have debts that still need to be paid off, you should also keep track of the outstanding balance. By doing this, you can accurately identify your net worth by subtracting your liabilities from your assets. This is the most efficient way to see your financial health.

Knowing how to get your finances in order can take some time, but it doesn’t have to be stressful or overwhelming. By utilizing automatic bill-pay, handling your debts, reviewing your finances regularly and implementing the other tips mentioned above, you’ll be on your way to taking control of your money and your life.