Your level of financial literacy plays an important role in the quality of your life. When you are living paycheck to paycheck, falling behind on your credit card debt and spending more than you make, life can get stressful. In contrast, when you practice healthy budgeting and saving habits, you can prepare yourself for a comfortable retirement down the road.

But does the average American practice healthy wealth management skills?

According to recent financial literacy statistics, the answer is no. In fact, Americans owe over $1.03 trillion in credit card debt, with over one-third of adults reporting that “just getting by financially” describes them completely or very well. This indicates that the U.S. needs to place more emphasis on teaching financial literacy for future generations.

To learn more about the state of financial literacy in the U.S. and abroad, we put together some of the most eye-opening facts you should know.

Key Takeaways

- 75% of American teens lack confidence in their knowledge of personal finance.

- 25% of Americans say they don’t have anyone they can ask for trusted financial guidance.

- 23% of U.S. adults ages 18 to 29 have credit card debt that’s over 90 days overdue.

- Americans owe over $1.03 trillion in credit card debt as of Q2 2023.

General Financial Literacy Statistics

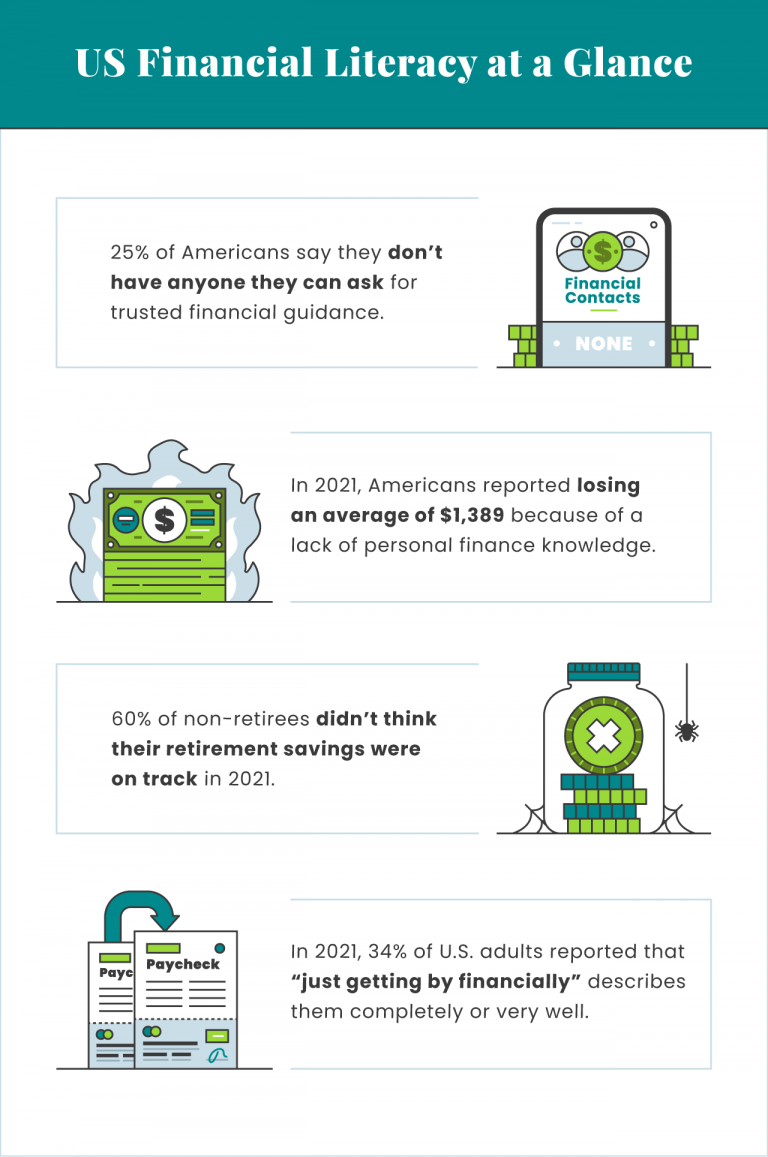

The majority of adults don’t worry about meeting their daily expenses, but not by a wide margin. In fact, 37% of adults say they’re just getting by financially and 60% of adults don’t believe their retirement savings are on track.

Confidence in financial knowledge doesn’t always translate to financial well-being, especially for younger generations facing unprecedented challenges. My millennial clients, in particular, are grappling with mounting student loan debt, a fiercely competitive job market, surging inflation rates, and rising interest rates. These hurdles make achieving financial security a formidable task.

- 25% of Americans say they don’t have anyone they can ask for trusted financial guidance.

- In 2020, 28% of adults reported they only have a financial cushion of one week’s worth of expenses, assuming they lost their main source of income. 25% report they could support themselves for one month and 15% for three to six months.

- About 4% of adults reported they fell victim to some type of financial fraud in 2020.

- 42% of adults worry about meeting their daily expenses as of 2020. 40% were concerned about their financial status, while 37% reported they were just getting by financially.

- When adults were asked about what areas of personal finance worried them the most in 2019, 17% said they worried about retiring without having set aside enough money.

- In 2019, 60% of U.S. adults had credit card debt.

- 60% of non-retirees didn’t think their retirement savings were on track in 2021.

- In 2021, Americans reported losing an average of $1,389 because of a lack of personal finance knowledge.

If you’re part of the 17% of Americans who are worried about retiring without enough wealth saved beforehand, you may consider connecting with a financial advisor to help plan your financial future.

US Financial Literacy Statistics

While almost half of states require either a personal finance or economics course to graduate high school, over one-third of American adults said they’re just getting by financially.

- 23 U.S. states require high school students to take a personal finance course to graduate as of 2022. 25 states require students to enroll in an economics course to graduate.

- Americans owe over $1.03 trillion in credit card debt as of Q2 2023.

- 89% of adults report they have emergency savings funds.

- 70% of U.S. adults have non-retirement savings funds as of 2019.

- 65% of U.S. adults say they save a portion of their annual income for retirement as of 2019.

- 27% of U.S. adults are not confident that they’re saving enough as of 2019.

- In 2021, 34% of U.S. adults reported that “just getting by financially” describes them completely or very well.

- 19% of Americans say they are very uncomfortable with their level of emergency savings.

- 6% of American adults didn’t have bank accounts in 2021. Hispanic and Black respondents were less likely to have a bank account compared to American adults overall.

- 11% of American adults with bank accounts paid overdraft fees in 2021.

- 17% of American renters were behind on rent at some point in 2021.

- In 2021, 12% of those with student loans were behind on payments.

- 64% of American adults report that money is a significant stressor in their life.

On the other hand, the majority of Americans are good savers, as indicated by the fact that 89% of adults report having emergency savings funds and 70% of adults have non-retirement savings funds.

US Financial Illiteracy Among Teens

Before teens are saddled with financial obligations like paying rent or student loans, it’s important that they learn about personal finance. But our statistics suggest that while teens are interested in financial subjects, schools don’t always arm them with the necessary knowledge to achieve financial wellness.

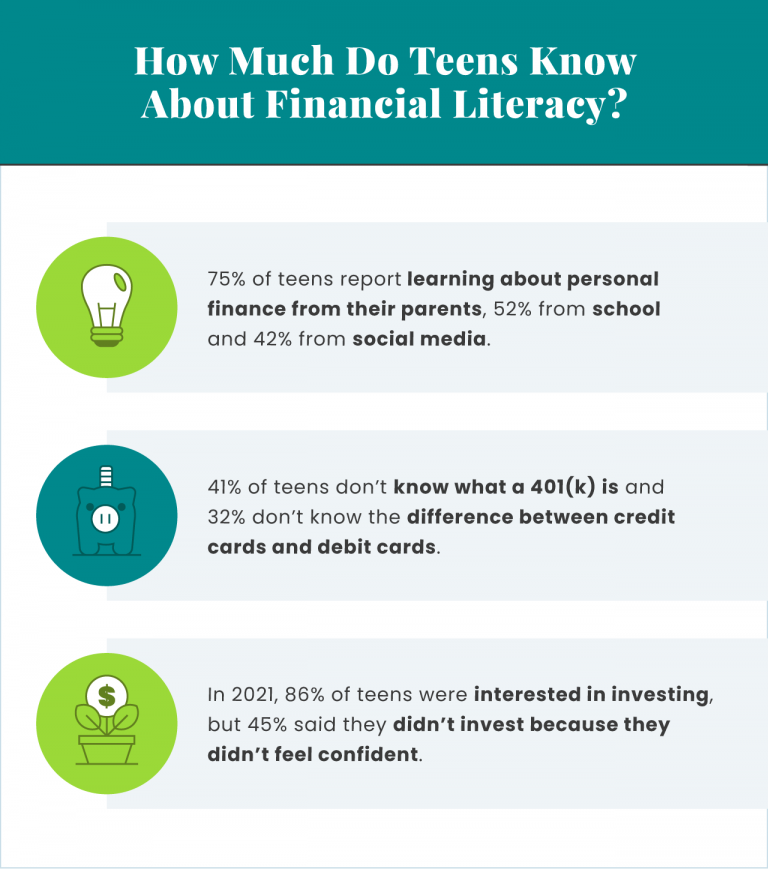

- As of 2021, 75% of teens report learning about personal finance from their parents. 52% of teens learn from school and 42% from social media.

- 73% of teens reported wanting more personal finance education in 2021.

- 75% of teens lack confidence in their knowledge of personal finance.

- 41% of teens don’t know what a 401(k) is and 32% of teens don’t know the difference between a credit card and a debit card.

- In 2021, 86% of teens were interested in investing, but 45% said they didn’t invest because they didn’t feel confident.

- 62% of teens said they had learned about saving, 50% about earning, 44% about saving for college and 42% about budgeting.

While only about half of teens said they learned personal finance from school, the majority said they learned from their parents. This suggests that there’s a need to provide more financial education to teach kids about money.

Let’s Talk About Your Financial Goals.

Money Literacy Statistics by Generation

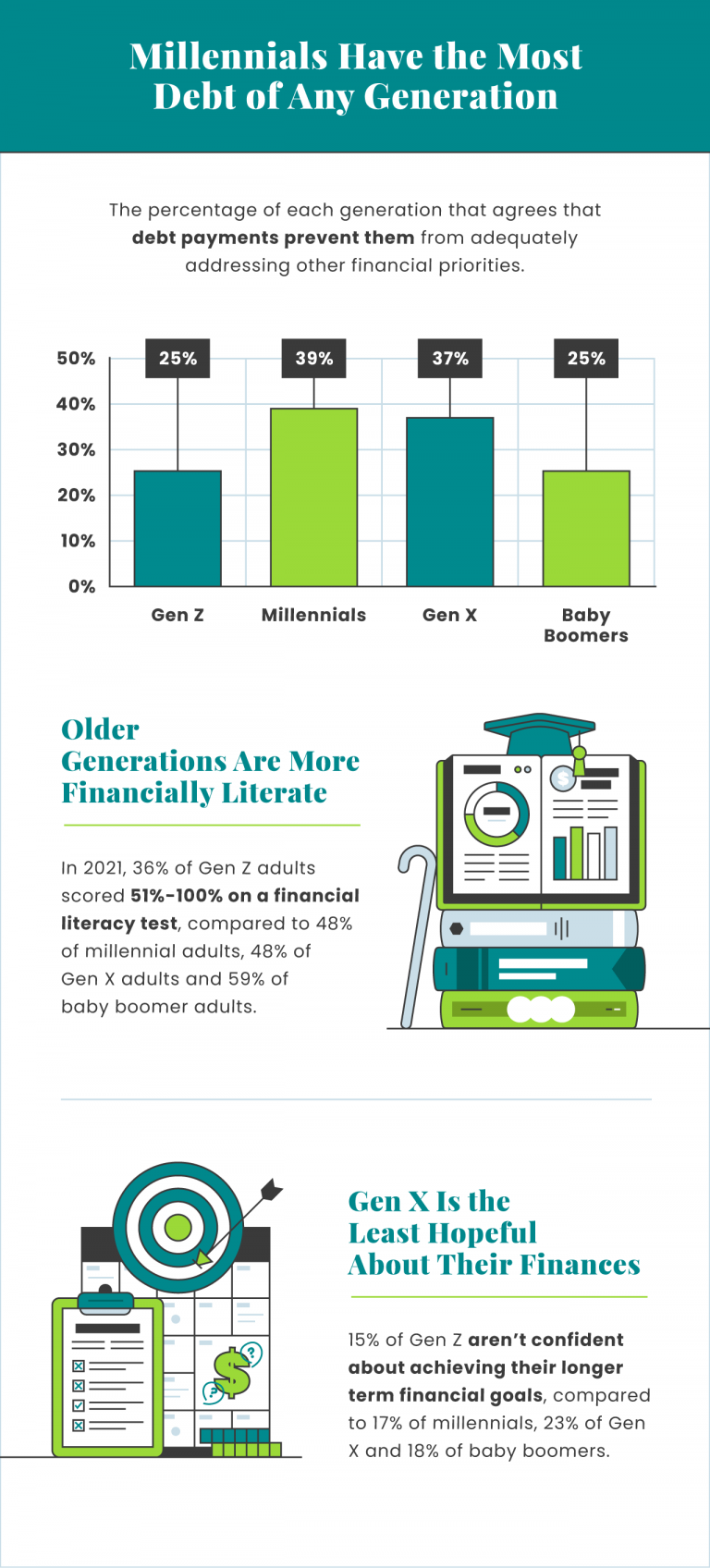

While millennials have the most confidence in their knowledge of investing and cryptocurrency, they are also more likely to be financially constrained with debt. In contrast, baby boomers are the least confident in their investing knowledge, but the least likely to be dissatisfied with their financial condition.

- In 2021, 36% of Gen Z adults scored 51%-100% on a financial literacy test, compared to 48% of millennial adults, 48% of Gen X adults and 59% of baby boomer adults.

- 44% of millennials report they have advanced investing knowledge, compared to 37% of Gen X, 31% of Gen Z and 26% of baby boomers.

- 41% of millennials claim to have an advanced knowledge of cryptocurrency, compared to 30% of Gen Z, 29% of Gen X and 8% of baby boomers.

- In 2021, 21% of Gen Z agreed that it’s difficult for them to make ends meet in a typical month, compared to 22% of millennials, 28% of Gen X and 18% of baby boomers.

- In 2021, 19% of Gen Z reported they certainly could not come up with $2,000 if an unexpected need arose in the next month, compared to 19% of millennials, 24% of Gen X and 16% of baby boomers.

- 25% of Gen Z agreed that debt and debt payments prevent them from adequately addressing other financial priorities, compared to 39% of millennials, 37% of Gen X and 25% of baby boomers.

- 18% of Gen Z spends 10 hours or more per week thinking about and dealing with issues related to personal finances, compared to 22% of millennials, 23% of Gen X and 14% of baby boomers.

- 30% of Gen Z are dissatisfied with their current financial condition, compared to 29% of millennials, 29% of Gen X and 22% of baby boomers.

- 15% of Gen Z aren’t confident about achieving their longer term financial goals, compared to 17% of millennials, 23% of Gen X and 18% of baby boomers.

- 52% of Gen Z agreed that the economic uncertainty created by COVID-19 motivated them to increase their financial literacy, compared to 48% of millennials, 44% of Gen X and 29% of baby boomers.

If you accumulate debt through student loans or otherwise, it’s important to prioritize paying off your debt. So long as you outline a budget for yourself and stick to it, you can work toward financial wellness.

Financial Status by Demographic

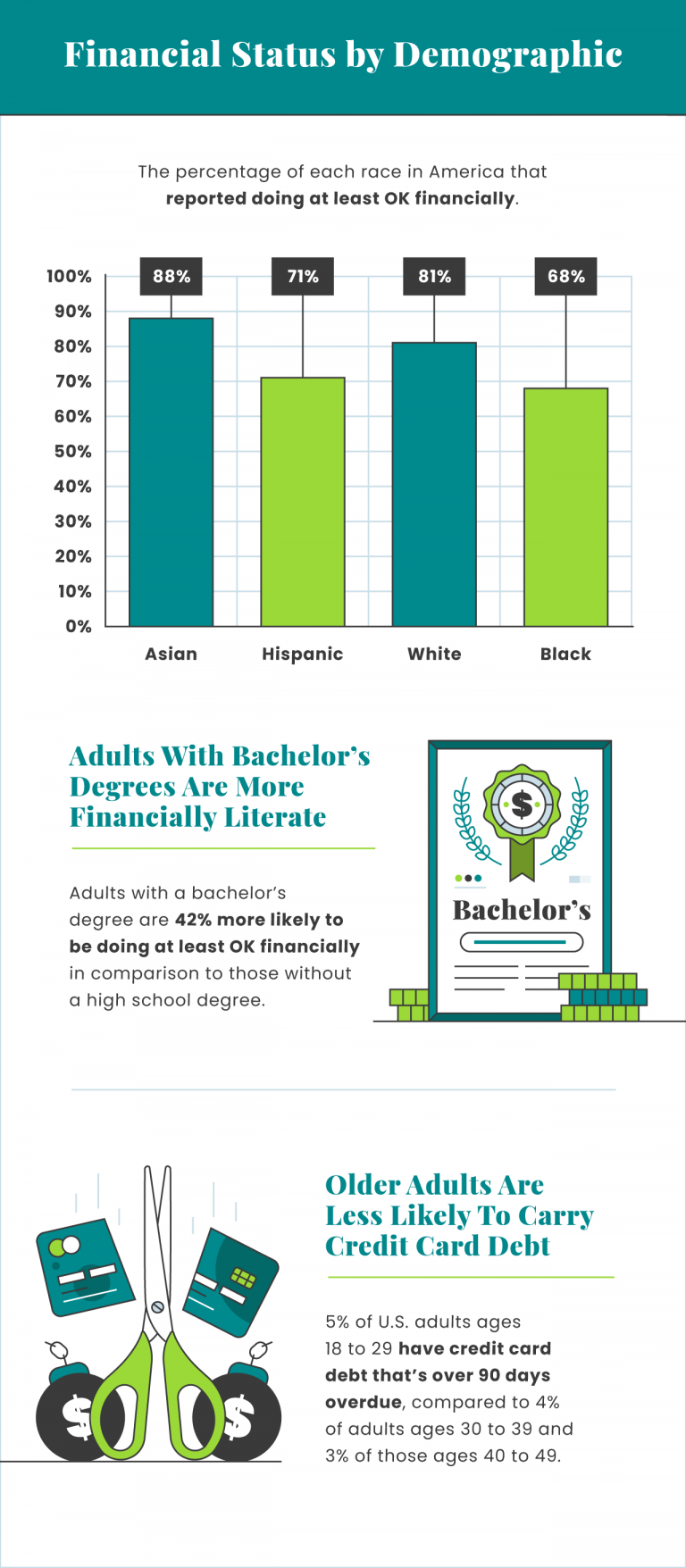

Our statistics suggest that financial status varies depending on your demographic. For example, Americans who identify as Hispanic, Black or LGBTQ+ are less likely to be doing OK financially compared to white and Asian adults.

- 88% of Asian Americans reported doing OK or better financially, compared to 81% of white Americans, 71% of Hispanic Americans and 68% of Black Americans.

- 67% of adults identifying as LGBTQ+ reported doing OK or better financially as of 2021, compared to 78% of the general population.

- 62% of adults who identified as transgender or nonbinary reported doing OK or better financially in 2021.

- 60% of adults with a disability reported doing OK or better financially as of 2021.

- 20% of white Americans made less than $25,000 in 2021, compared to 43% of Black Americans, 40% of Hispanic Americans and 17% of Asian Americans.

- 37% of white Americans made $100,000 or more in 2021, compared to 17% of Black Americans, 20% of Hispanic Americans and 51% of Asian Americans.

- Adults with a bachelor’s degree are 42% more likely to be doing OK or better financially in comparison to those without a high school degree.

- 73% of those who attended college and have student loans for their own education reported doing OK or better financially as of 2021.

- 75% of parents reported doing OK or better financially as of 2021. This marks an 8% increase in financial well-being for parents from the previous year.

- 5% of U.S. adults ages 18 to 29 have credit card debt that’s over 90 days overdue, compared to 4% of adults ages 30 to 39 and 3% of those ages 40 to 49.

Additional Financial Literacy Resources

The more aware we are of our current levels of financial literacy, the better we can prepare future generations to manage their money. While U.S. rates of financial literacy might not be where we want them to be, we’re making progress toward educating our society about money management.

Other financial resources you can use to educate yourself and others include:

- Guide to Financial Literacy

- Students and Financial Literacy

- How To Save Money for Retirement

- How To Get Your Finances in Order

Check out our full infographic on financial literacy statistics below.