Of all the qualities a financial advisor may possess, integrity is perhaps the most valuable. Not only will they manage your life and family savings, but also have knowledge of and access to your most sensitive information. This is why it’s vital to hire someone trustworthy.

Even after you’ve chosen a financial advisor you can trust, you’ll have questions about how they are managing your money and how you can spend, save and invest wisely to achieve your financial goals.

Keep reading to discover the most important questions to ask during your yearly or quarterly meetings with your advisor.

Different advisors will have different specialties, skills and qualifications. To ensure you get the right kind of help, ask questions to make sure you are meeting with the right person. One of the first things I do when meeting with a new person or couple is make sure we are on the same page and are a good fit for each other.

Before Hiring: Questions To Ask When Interviewing

To make sure you match with a financial advisor who has your best interests at heart, an interview can give you a sense of their experience and working relationship with you. Here are 10 questions to help determine if a prospective advisor is the right fit for you.

1. What Scope of Services Do You Provide?

Since the term “financial advisor” is unregulated, it is critical for you as a client to understand the services that your advisor will provide. Many people hire an advisor who purports to provide “comprehensive” financial planning services only to discover that they are focused primarily on investing or selling insurance policies instead of truly handling the entirety of their money life.

Be clear on the scope of services you are seeking, and ask any prospective advisors detailed questions to get a solid handle on what you’re truly signing up for!

2. What Are Your Qualifications?

The first thing you’ll want to know is the advisor’s credentials and professional status. Since there are many financial advisor certifications, no two advisors are the same. One may focus on a different industry or niche than the other, so it’s best to choose an advisor whose practice is tailored to your specific goals and life circumstances.

Here are a few professional certifications to know:

3. What Is Your Compensation/Fee Structure?

Next, find out how the financial advisor will charge for their services. For example, some advisors are fee-only and never receive commissions from the financial products they may recommend, while others may both charge for services and accept commissions.

Below are common compensation methods financial advisors use:

- Fee-only: charges an hourly or flat rate for various services, or a percentage of your assets they handle, never commission

- Commission: accepts commissions for product recommendations, such as insurance and annuities

- Fee-based: charges primarily for services and also accepts commission

4. How Will We Work Together?

You’ll also want to inquire how your relationship will work. For example, will you check in with your financial advisor annually or quarterly? Will they have virtual and weekend availability? It’s important to know their preferred method of communication, how they plan to meet with you and any scheduling or meeting preferences.

5. What Is Your Investment Philosophy?

A professional advisor knows how to work with your risk tolerance and guide you through unanticipated setbacks, such as during a recession or inflation. Ask what protocol and data-driven strategies they have in place for these types of situations.

6. What Types of Clients Do You Typically Work With?

It’s also a good idea to ask what their ideal client looks like, to best match you with an advisor who meets your specific needs. For example, while many financial advisors work with a variety of individuals across various stages of life, some choose to only work with high-net-worth clients.

7. How Do You Work With Outside Advisors?

For more complex financial situations, such as business or estate planning, you may need legal counsel, a tax advisor and other specialized professionals in addition to your financial advisor. Therefore, an advisor who is willing to coordinate with these professionals or can, at the least, refer you to one can help narrow down your choices for ideal candidates.

8. Are You a Fiduciary?

A fiduciary is a person or legal entity, such as a bank or attorney, that is legally required to act in their clients’ best interests in all situations, even when it doesn’t benefit them. Not all financial advisors are fiduciaries or have to be, so it’s important to know if they are held to the standard of a fiduciary before deciding to hire them.

Also, consider asking for client references and looking into the advisor’s disciplinary history. Information on FINRA or SEC-registered advisors is available through FINRA’s BrokerCheck and the SEC’s Investment Adviser Public Disclosure databases.

9. How Do You Protect Client Confidential Information and Funds?

In today’s digital environment, financial scams are growing increasingly sophisticated. Consequently, advisors must be ruthless about protecting their clients’ funds and personal data. The advisor should have proper security protocols and procedures in place to help safeguard on this front. Also, ensure that other team members who may have access to your information are trained in these protocols to help reduce risk.

10. What Resources Will I Have Access to Through You?

A final and helpful question to ask when interviewing a financial advisor is if they offer resources. These may include online monitoring tools for your portfolio or educational links you can access. Anything additional the advisor can provide to assist you in your financial goals makes them stand out from the rest.

General Questions You Should Ask Regularly

To fully understand your finances, you should know what questions to ask a financial advisor and how often you should ask them. While some questions are specific to your situation and financial goals, you should always ask general questions that will give you a holistic view of your financial health.

Schedule regular meetings with your advisor, whether that be a quarterly phone call, an annual in-person visit or both.

In addition to the following questions, you may have some of your own. Conversely, you may not feel you need to ask every one of the questions below. Whatever you decide, be prepared ahead of time. Rob Schultz, a Certified Financial Planner™ professional at NWF Advisory Services, Inc. told Annuity.org, “Come to your meeting with, or email ahead of time, a list you keep on your phone of questions that you’re hearing in the media or things that you’re thinking about at night.”

Having a list of questions handy will ensure that you get the most out of the meeting and give your financial advisor some insight into which topics matter most to you and where you need further explanation.

1. Is My Investment Strategy on Track?

If your investments are a large portion of your retirement plan, you’ll want regular updates on your investment strategy. Ask to see recent reports. If you don’t understand them or have concerns about whether your strategy is helping you hit your goals, ask your advisor for clarification.

It is also helpful for you to educate yourself on investing fundamentals and how to interpret your portfolio so that you can ask informed questions.

While it’s normal to see some fluctuation, you want to make sure the strategy is still viable and will meet your expectations over time. If it’s not projected to do so, talk with your advisor about other options and ways to shift your strategy to make that happen.

2. How Can I Better Prepare for Financial Emergencies?

According to a recent survey, only 48 percent of U.S. adults have enough emergency savings to cover at least three months’ worth of expenses, and 22% have no emergency savings at all.

While you can’t plan for everything, having an emergency preparedness plan for your finances will give you peace of mind and help you stay on track to hit your goals if something — such as a job loss or illness — were to happen.

Talking with your advisor regularly about improving your financial plan for emergencies will help you prepare for the unexpected.

3. What Can I Do To Optimize My Tax Situation Each Year?

This is an important question to ask at any time of the year, but you may fare better if you ask before tax season arrives. Depending on your situation, your advisor may discuss making charitable donations throughout the year or opening a health savings account. Or they can also make recommendations such as claiming certain tax credits when you file your taxes.

However, be aware that your financial advisor doesn’t know everything. If they can’t answer your specific tax questions, they may know a tax professional who can.

4. Do I Need To Adjust My Retirement Plan To Hit My Goals?

Retirement planning can take a lot of time and research and is periodically subject to change. Checking in on the progress of your plan with your advisor will help you identify its weak points and show you how you can work together to ensure your plan remains solid.

According to Kris Maksimovich, founder of Global Wealth Advisors, “Throughout the various stages of life, you should ask if you are on track for reaching your goals, and if not, what adjustments you should consider making. Holding a continuous dialogue can ensure issues are caught early and that there is ample time for corrections.”

When it comes to long-term planning for things like retirement, the earlier you catch problems, the better your retirement will be. If you’re aiming to retire or achieve financial independence on an earlier-than-typical timeframe, it’s that more important for you to check in on this topic regularly.

5. What Should I Focus on More in My Financial Plan?

Discussing and ranking your priorities during your periodic check-ins can help you set your goals for the coming year or quarter. For example, if you have an upcoming vacation, are sending a kid to college or are getting closer to retirement, ask your advisor what you should be considering or researching in order to financially prepare for these events.

Likewise, your advisor can give you tips on how to focus more on specific things within your plans. For example, they could provide recommendations to focus more heavily on different investment vehicles or your 401(k) plan to build out your retirement plan.

6. Can You Explain This Concept to Me?

You’re not likely to understand every concept or term in the financial world if you haven’t spent years studying finance. Because you aren’t a financial expert, it’s important to ask the right questions.

“Your advisor should be passionate about financial education and encourage you to ask questions. It is the advisor’s role to help you make your own well-informed decisions — not just tell you what to do. Do not implement financial decisions you do not understand,” Cody Garrett, a Certified Financial Planner™ professional and owner of Measure Twice Financial, told Annuity.org.

Asking your financial advisor questions will keep you informed and confident in the decisions you’re making with your money, while simultaneously helping you identify areas for improvement.

7. What Does a Realistic Spending Plan Look Like Based on My Goals?

Knowing how to budget to reach your goals will help you accomplish them in the time frame you set for yourself. Your advisor can walk you through what a successful spending plan looks like, recommend tools to help you and even explain how best to spend, save and invest your money to hit your long-term and short-term goals.

To do this, you must be open with your advisor about your financial situation and what you want to accomplish. This can include annual earnings, current retirement savings and upcoming expenses you need to prepare for.

8. How Should My Financial Goals Change Based on My Recent Life Changes?

As you age and experience different life events, your financial plan may need some adjusting. This can be the case after getting married, having kids, losing your job or retiring. It’s important to communicate these changes to your advisor so you can adjust your plans as needed.

According to Nick Kolbenschlag, CEO and co-founder of Crown Wealth Group, “When your life changes, your questions should too. Do I need to change my goal, or my plan to accomplish it? Are there new goals I have in this new life stage? What will it take to get on track for those? Should we scrap the old plan and start from scratch?”

Asking yourself a few of these questions before meeting with your advisor will give you a clearer direction and picture of what you want to accomplish. When you have a solid understanding of what you want, your advisor can more easily create a plan and provide guidance to help you accomplish that.

9. Could Recent Market or Legislative Changes Affect My Finances?

This question has two parts. The first part concerns the market. Ask your advisor what has been happening in the market and how recent trends could potentially affect future returns.

The second part of this question involves laws and regulations. Not knowing about these changes can be detrimental to your finances as well as your long-term goals.

For example, if tax policy changes arise, you should adjust your financial plan to account for those shifting variables. Asking your advisor about recent changes to regulations that may affect your finances will help you avoid setbacks.

10. What Else Can I Do to Maximize and Protect My Money?

Asking about additional things you can do is a good catch-all question to compensate for any missed opportunities. Your advisor can point out ways you could be saving more, how you could earn a larger return on your investments or what you could do to better protect yourself against financial fraud or emergencies.

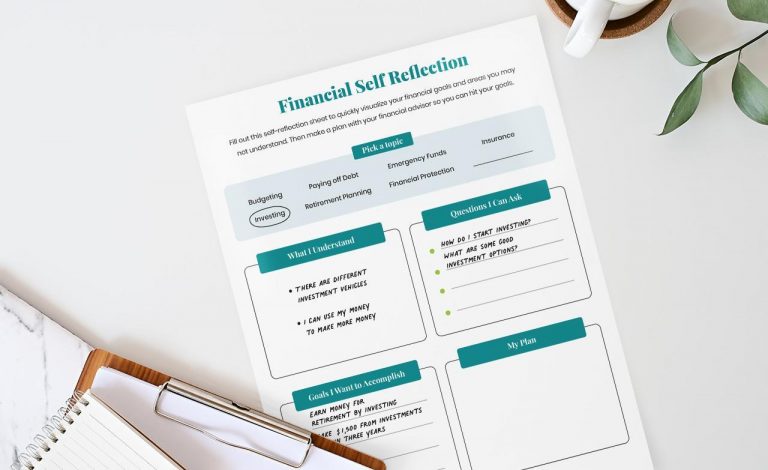

It may also help to conduct a self-reflection to identify areas for improvement on your own. You can then take those ideas to your advisor for their advice or recommendations. Use the financial self-reflection sheet below to get started.

Questions to Ask if You Have a Family

Depending on your current stage of life, there will be different questions you’ll want to ask your advisor.

For example, when you start getting close to retirement, you’re more likely to ask questions about purchasing an annuity for guaranteed income or different tax strategies for withdrawing retirement funds. Those who have just graduated from college likely won’t be worried about these things yet.

Nishank Khanna, CFO of Clarify Capital, told Annuity.org, “If you have a family, your questions will not only be based on your own best interest but the best interest of your entire family. You might inquire about how much you should set aside to save for your child’s education, or how your beneficiaries will be taken care of in the event that something happens to you.”

Additionally, Jacquelyn Lui, a wealth manager for Point One Percent Financials, recommends asking the following questions if you have a family:

- How can I start saving/growing money for my children’s college expenses? What if they don’t want to go to college?

- What happens if something unexpected happens to me and my spouse?

- What is the most efficient/tax-saving way for my situation to transfer my wealth to my children?

Everyone’s situation is different so there will likely be additional questions you should ask in regard to managing your finances when you have a family. If you’re unsure whether your financial advisor can answer your questions, ask anyway. If they can’t answer them, they may know someone who can.