What Is a Variable Annuity?

A variable annuity is a retirement product that lets you invest in the market while enjoying tax-deferred growth and the option for future income.

You purchase it from an insurance company — either with a single payment or through installments — and the company invests your money in subaccounts, which function similarly to mutual funds.

Unlike a fixed annuity, your returns aren’t locked in. They depend on how those subaccounts perform. If the market does well, your potential earnings increase. If it drops, your account value can decline.

That’s why variable annuities tend to appeal to people who still want to invest for higher growth but also want insurance features, like lifetime income or a death benefit for their loved ones.

Fixed Annuity vs. Variable Annuity

| Fixed Annuity | Variable Annuity |

|---|---|

| Guaranteed interest rate | Returns vary with the market |

| No market risk | Gains and losses possible |

| Lower growth potential | Higher long-term growth potential |

| Simple structure | Greater flexibility and complexity |

Find the Right Annuity for You

When do you plan to retire?

What's your primary goal for this annuity?

When would you like your income to begin?

How comfortable are you with investment risk?

Do you want this annuity to provide income for life?

How important is leaving money to heirs?

How do you feel about fees?

Want a deeper understanding of your annuity type? Share your email and we'll send you a one-page guide explaining how it works — plus tips on what to consider next.

✓ Thank you!

How a Variable Annuity Works

A variable annuity has two main stages: accumulation and payout. Think of it as building and then drawing from a personalized retirement account, all within an insurance wrapper.

Accumulation Phase

This is your growth period. Your money is invested and earns returns over time, all without paying taxes on gains until you withdraw.

Payout Phase

This is when your annuity starts paying you back. You can choose steady income for life or take money out as you need it.

1. Accumulation Phase

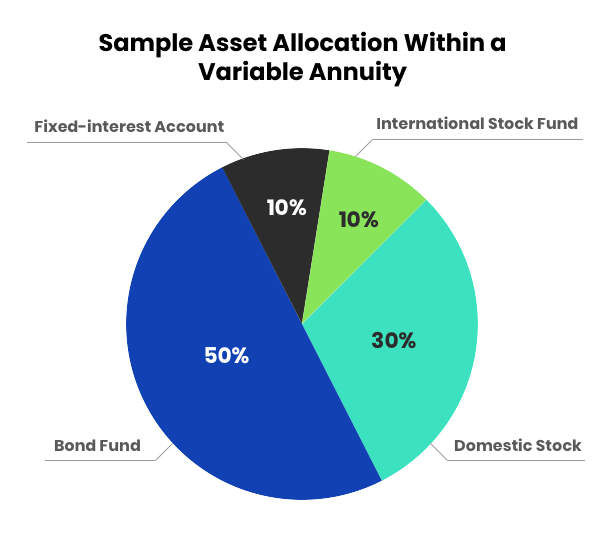

During the accumulation period, your money is invested in the market through various subaccounts; some focused on stocks for growth, others on bonds for stability.

Your earnings grow tax-deferred, meaning you don’t pay taxes on investment gains until you withdraw them later, often at a lower rate in retirement.

You can also switch between subaccounts as your goals or market conditions change, usually without triggering immediate taxes (though some contracts charge small transfer fees).

Example: Let’s say you invest $100,000 and choose a mix of 50% bond funds, 30% domestic stocks, 10% international stocks and 10% in a fixed-interest account. If the market performs well, your stock investments can boost your overall growth. If the market drops, your bond and fixed portions help cushion the loss, showing how diversification balances risk and reward.

2. Payout Phase

Once you’re ready to retire, you can “annuitize” your balance in the payout phase, converting it into guaranteed payments that last for a set period or even the rest of your life.

If you’d rather keep investing, you can make partial withdrawals instead of converting the entire amount to income. Many retirees appreciate this flexibility because it all

Variable Annuity Fees and Costs

Variable annuities typically charge higher fees than fixed products — usually around 2% to 3% per year — in exchange for investment flexibility and insurance guarantees.

Common Fees Include:

- Mortality & Expense Risk Fees: Support insurance guarantees.

- Investment Management Fees: Cover fund-level costs.

- Administrative Fees: Pay for recordkeeping and account servicing.

- Surrender Charges: Apply if you withdraw early during the contract term.

Even minor fee differences can affect your long-term growth. Ask your insurer or advisor for a clear fee breakdown before investing.

Pros and Cons

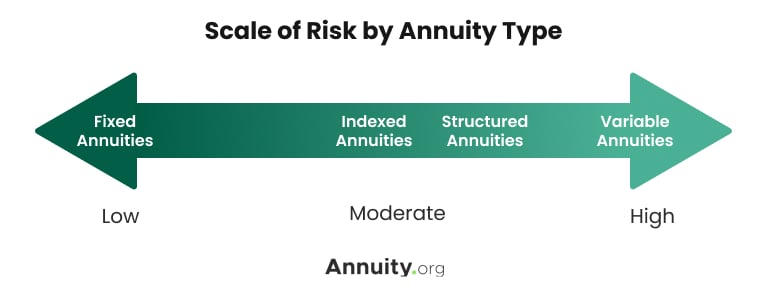

A variable annuity gives you more growth potential than fixed options, but it also carries more risk. Here’s a quick look at what works in your favor, and what to keep in mind before investing.

Pros

- Higher growth potential

- Tax-deferred growth

- Optional lifetime income

- Death benefit for heirs

Cons

- Market losses possible

- Complex fee structure

- Performance risk

- Earnings taxed as income

Learn how an investment today can provide guaranteed income for life.

Variable annuities can offer valuable benefits during both the accumulation phase and contribution phase of the contract. It is important to consider your cash flow constraints, time horizon, risk tolerance and tax bracket to determine if a variable annuity is appropriate for your personal situation.

Who Should Choose a Variable Annuity?

A variable annuity can be a smart fit for investors who have time to ride out market ups and downs. According to Annuity.org expert contributor Chip Stapleton, people in their early 50s may benefit most. “They have enough time to weather the downs,” Stapleton explained. “Over a 15-year time period, there haven’t been any stretches where the S&P 500 was negative.”

That makes variable annuities well-suited for long-term investors seeking higher growth potential than a fixed annuity — and who are comfortable taking on some market risk.

They can also make sense for retirees who already have steady income from Social Security or a pension. “If the market’s up, they’re getting even more money,” Stapleton said. “If it’s down, that’s alright because they have other guaranteed sources of income.”

Variable annuities may appeal to people who:

- Want tax-deferred growth beyond what 401(k)s or IRAs offer

- Like choosing their own mix of stocks and bonds

- Value added features such as death benefits or lifetime withdrawal options

Example: Tyson’s Long-Term Strategy

Tyson, 52, still has more than a decade until retirement and isn’t afraid of some market risk. After maxing out his 401(k), he wanted another way to grow his savings tax-deferred, but with more flexibility and long-term upside than a fixed annuity could offer.

He chose a variable annuity that lets him invest in both stock and bond subaccounts. Some years, his balance may dip when markets fall. But Tyson knows that over time, those market gains can add up. Plus, his contract’s optional income rider gives him the security of future guaranteed payments if he needs them.

For someone like Tyson, a variable annuity strikes

Curious How Today’s Annuity Rates Compare?

Other Frequently Asked Questions About Variable Annuities

Your account value may decline, but many contracts include optional riders that guarantee a minimum income or protect your principal. These features can help cushion the impact of a downturn, though they usually add to your annual cost.

They can be. Because part of your money is invested in stocks and bonds, your returns may outpace inflation over time. However, returns are not guaranteed and can fluctuate with market performance.

Earnings are taxed as ordinary income when withdrawn. Your original contributions, if made with after-tax dollars, aren’t taxed again. Withdrawals before age 59 ½ may also face a 10% IRS penalty.

Variable annuities aren’t insured by the FDIC, but they are issued by licensed insurance companies and regulated by state and federal authorities. Each state also has a guaranty association that offers limited protection if an insurer fails.