A fixed index annuity is a long-term savings product whose return is based on a stock market index. While fixed index annuities are often tied to major market indexes such as the S&P 500, they can also be tied to less common indexes depending on the financial institution or insurer that sells them.

Key Facts About Fixed Index Annuity Pros and Cons

- Fixed index annuities offer a safe and principal-protected way to benefit from market gains, with your contract tied to the performance of an index.

- Pros of this type of annuity include tax-deferred growth, guaranteed minimum returns and the ability to grow your money from market performance without risking your principal.

- Cons include caps on growth, sometimes complex contracts and lack of liquidity.

Unlike stocks and other types of annuities, fixed index annuities provide security against losses if the market falls. A contract typically ensures that you will never lose your principal in exchange for a cap on potential earnings. Similar to other annuities, they are intended to provide a steady income stream during retirement and can be used to round out a 60/40 investment portfolio.

But along with a cap on earnings, fixed index annuities are generally illiquid, and contracts can be complex.

It’s essential to weigh the pros and cons of a fixed index annuity before determining if one is right for you.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Pros of Fixed Index Annuities

- Tax-deferred growth

- Principal protection from market downturns

- Minimum guaranteed rate

- Higher potential return than CDs

- Legal contract between you and the insurance company

- If the index performs well, your contract value increases

- Might hedge against inflation

Protection from Loss

Fixed index annuities are generally safe products because they are designed to protect investors from market downturns while still allowing them to benefit from upswings.

Buying a fixed index annuity is typically structured in a format where you see limited losses when the index that it is tied to declines, but benefit from a percentage of the growth when that index improves.

Different products offer several crediting strategies, with options ranging from different indexes to selecting floors and caps that make sense for you.

A floor places a percentage limit on how much you can lose — and a minimum on how much you can earn. For example, if the floor is set at 5% and the index decreases by 12%, you would only lose 5% of your contract value.

Learn how an investment today can provide guaranteed income for life.

Minimum Return Guarantee

Another potential benefit of a fixed index annuity is that the company issuing the product may include a minimum return guarantee.

This means that — even if the index your annuity is tied to declines — you can still experience a small, guaranteed amount of growth. This adds an extra level of safety to the product, guaranteeing you at least some level of return.

Higher Potential Return Than CDs

In some ways, fixed index annuities operate similarly to CDs by presenting a safe way to grow your money at a solid rate. The main difference, of course, is that fixed index annuities base their rate of growth on an index, while CDs generally offer a fixed rate.

That chance to participate in the market’s upside allows fixed index annuities to offer potentially higher returns than CDs. Ultimately, the rate of return is dependent on the market environment and the prevailing interest rates during the investment period.

Additionally, the tax deferral component offered through fixed index annuities is not available with a CD. This means your money can grow even more than it would in a CD since your interest can go untaxed while it grows.

Indexed Annuities have a 3.27% average annual return*

*Based on a study from 2007-2012

CDs have a 1.76% average annual return*

*Based on 12-month CDs from 12/31/2001-12/31/2020

Tax-Deferred Growth

Tax-deferral is a significant benefit of opting for a fixed index annuity since it’s a feature not commonly available through many financial products.

When you purchase an annuity, you will only owe taxes once you withdraw money from the product. This is a notable difference from a CD, where you pay tax on the annual interest earned.

Since the money in your annuity account is untaxed, you have the opportunity for even more growth since that money can continue to compound on itself uninhibited through the course of your contract term.

The obvious benefit to fixed index annuities is the downside risk protection. These annuities offer investors protection from market losses while still offering (limited) growth potential connected to the underlying market index.

However, these are complex contracts and should be entered into only with complete understanding of the terms, rules and costs. These products will not produce equity-like returns since the growth limitations usually cap or reduce upside potential in exchange for the negative performance protection.

Overwhelmed by Safe Retirement Options?

Cons of Fixed Index Annuities

- Gains are capped by crediting methodology used

- Surrender charges might apply on excess withdrawals prior to maturity

- Long crediting periods of one year or more

- Contracts and crediting can be complex

- Potentially limited liquidity or income options without riders

Gains Are Capped

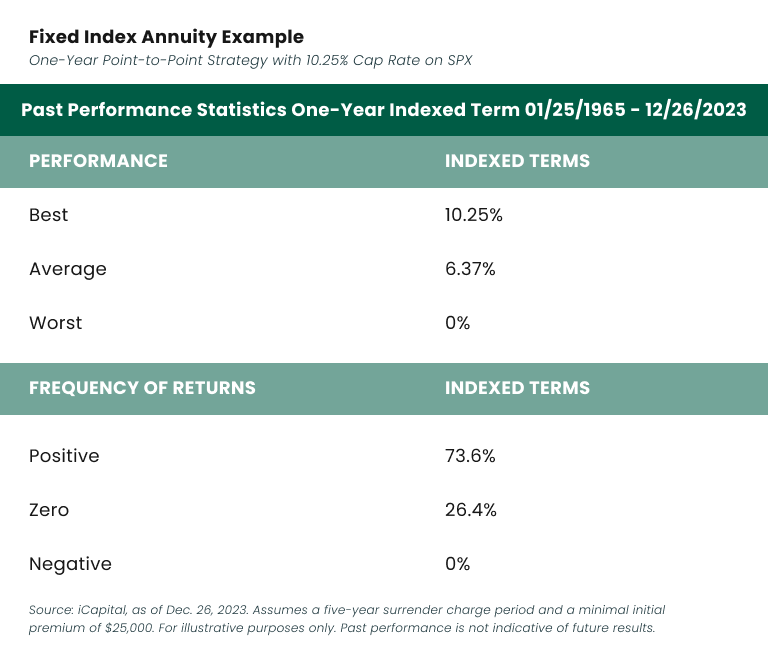

One downside of fixed index annuities is that the gains are capped. Your insurance company will cap or limit your gains relative to the underlying index. Most contracts will allow the annuity issuer to revise your cap at the beginning of each new annual term.

Surrender Charges

A surrender charge is a penalty for taking money from an annuity before it matures, usually within six to eight years of purchasing the annuity. This can be as much as 7% of your annuity’s value.

To avoid or reduce this charge, wait until the surrender period ends. If you close your annuity, you’ll receive the cash surrender value after considering any charges and adjustments.

Long Crediting Periods

With fixed index annuities, you can have longer crediting periods, typically of at least one year or more. Depending on the market, one crediting method could result in more interest than others.

Fixed Index Annuity Alternatives to Consider

If you’re unsure if fixed index annuities are the right option for you, there are alternatives worth considering.

Fixed annuities offer fixed rates of return that let you benefit from generally high rates without any market risk.

CDs operate similarly, offering higher interest rates than traditional savings accounts while restricting access to your funds for a set period.

Bonds are debt securities under which an investor lends money to a borrower for a certain amount of time in exchange for interest payments. They are often considered straightforward and low-risk investments.

The choice that makes the most sense for you will likely come down to your goals and your risk appetite. Speaking with a financial advisor can help you clarify your options and which choice you stand to benefit from the most.

Editor Sierra Campbell contributed to this article.