What Is an Income Annuity?

An income annuity is a contract with an insurance company that exchanges a lump sum of money for a guaranteed stream of income.

It’s considered a type of fixed annuity because your payments don’t depend on market performance; they’re based on your age, the amount you contribute, and how long you want the income to last.

You can choose to start payments right away (an immediate income annuity) or at a future date (a deferred income annuity). Either way, you’re locking in a source of income you can count on for life.

Immediate

Income payments will begin within a year of purchasing the annuity.

Deferred

Income payments will begin one year or more after purchase.

Income annuities aim to provide a guaranteed income, rather than accumulating retirement savings. Unlike other types of annuities, they annuitize immediately regardless of when your payments actually begin. This differentiates them from accumulation annuities, which may never annuitize.

Unlike variable or indexed annuities, income annuities are designed for payouts, not growth. They focus on turning your savings into a guaranteed paycheck for retirement.

How Income Annuities Work

Income annuities convert your savings into a predictable stream of payments that continues for as long as you choose — sometimes for life. You decide when payments begin and whether they’ll cover just you or also your spouse.

How It Works at a Glance

- You pay a lump sum (the premium) to an insurance company.

- The insurer guarantees regular payments — monthly, quarterly, or annually.

- Payments continue for a chosen term or for life.

Plus, your income grows tax-deferred and you only pay taxes on the money as you receive it.

Immediate vs. Deferred Income Annuities

All income annuities turn savings into guaranteed income. The main difference lies in when those payments begin. Here’s a quick breakdown to help you decide which timeline best fits your retirement plan.

Immediate Income Annuity (SPIA)

Payments start right away — usually within 12 months of purchase — providing guaranteed income you can count on immediately.

- When Payments Begin

- Within the first year after you buy the annuity.

- Best For

- Retirees who want dependable income now to supplement Social Security or pension payments.

- Important

- Ideal for turning a lump sum into instant, predictable cash flow.

Deferred Income Annuity (DIA)

Payments begin later — at a future date you choose — allowing your premium more time to grow before income starts.

- When Payments Begin

- One year or more after purchase (often 5–10 years later).

- Best For

- People still working or planning ahead who want to lock in higher future income.

- Important

- Delaying payouts means larger guaranteed payments when income begins.

Why Choose an Income Annuity?

Income annuities are ideal for people who value stability and simplicity. They’re designed for peace of mind, not speculation.

You may benefit most if you:

- Want guaranteed income that lasts as long as you do

- Don’t want to worry about market performance

- Prefer to receive steady, predictable payments

- Already have an emergency fund and other liquid assets

By offering built-in guarantees and providing lifetime income, income annuities offer reassurance to individuals concerned about outliving their savings. In later years, the peace of mind, absence of investment risk and predictable income provided by these annuities contribute to a comfortable retirement lifestyle.

What Are the Pros and Cons of Income Annuities?

Like any financial product, income annuities have advantages and trade-offs. They’re designed to deliver guaranteed income and peace of mind, but that reliability comes with reduced flexibility. Understanding both sides can help you determine whether this type of annuity aligns with your retirement goals.

Pros

- Guaranteed lifetime income

- Protection from market volatility

- Customizable payout options

- Simple and predictable

Cons

- Little to no liquidity once purchased

- Limited or no inheritance value

- Inflation may reduce purchasing power

- Early withdrawals may face penalties

Income annuities are a great way to provide a consistent, stable form of income during retirement as a complement to other retirement assets.

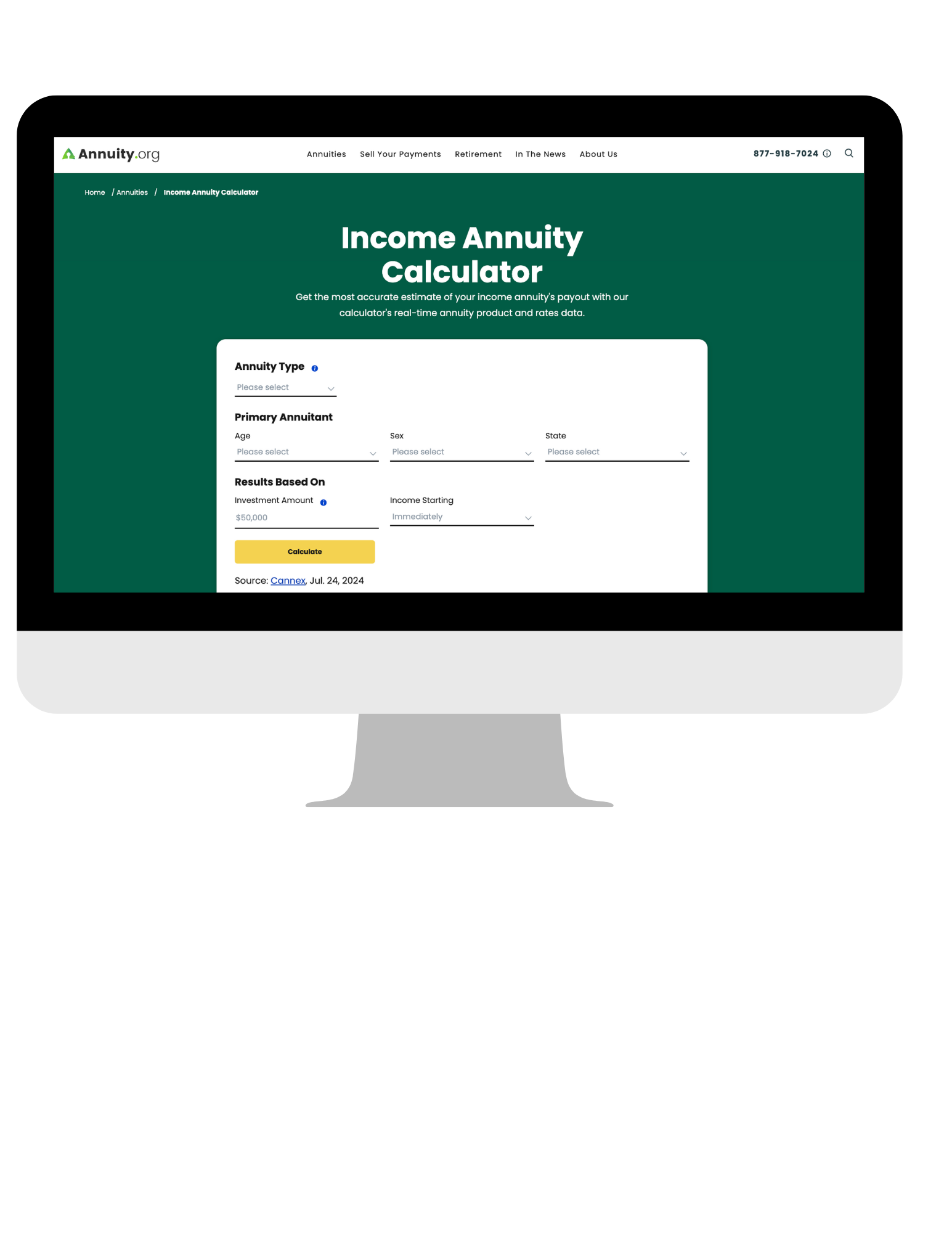

Calculate Your Annuity Payout Instantly

How Much Money Can You Expect To Receive From an Income Annuity?

Your payout depends on how much you invest, how long payments last, your age, and current interest rates.

You’ll receive higher monthly payments if you choose income for your lifetime only, but slightly lower payments if you want them to continue for your spouse or another beneficiary.

Example:

A 65-year-old woman who buys a $100,000 immediate income annuity could receive about $608 per month for life. In comparison, a 65-year-old couple would receive roughly $567 per month for joint lifetime payments, according to the Institute of Business & Finance.

Because insurers invest your premium in low-risk assets like corporate bonds, payouts tend to rise when interest rates are higher. Buying during a high-rate period lets you lock in larger guaranteed payments for the life of your contract.

Longevity Risk Protection

Income annuities help protect against one of the most significant retirement risks: outliving your money. They achieve this through a concept called mortality credits, which enables insurers to pool premiums from multiple annuity owners.

When you buy an income annuity, your money joins that pool. Some people will live longer than expected, and others will pass away earlier, leaving unused funds behind. The insurer redistributes those leftover funds to the surviving annuity holders as ongoing income.

This system lets insurance companies guarantee lifetime payments, even if you live well beyond your original life expectancy.

Adding a rider to your contract can ensure that remaining payments go to your beneficiary if you pass away early.