Fixed annuities and certificates of deposit (CDs) are often compared to one another, as both products provide reliable growth with no investment risk. Annuity.org asked financial experts what steps to take when determining which of these products is right for your needs.

When searching for safe investment vehicles that provide guaranteed growth, you’ll likely come across two products: fixed annuities and certificates of deposit (CDs).

These two products share many similarities, but a few key differences set them apart. To decide which is right for you, consider each product’s contract conditions and tax consequences and your own financial goals and priorities.

Annuity.org spoke with financial experts Thomas Brock, Aamir M. Chalisa, Anthony DeLuca and Stephen Kates to learn more about how consumers can understand whether fixed annuities or CDs are a better place to put their savings.

CDs and fixed annuities are considered safer investment options because they offer predictable returns, fixed rates and different terms of maturity.

Compare Annuity and CD Contracts

The first thing most people will look at when shopping for fixed annuities or CDs is the interest rate. Both CDs and fixed annuities offer a guaranteed rate of return that compounds over the product’s term.

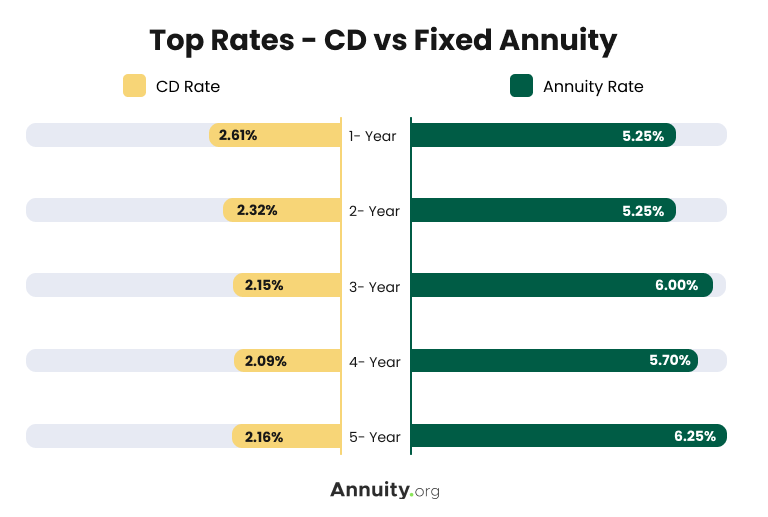

However, annuity rates are often higher than CD rates for the same term lengths. Rates for five-year fixed annuities in January 2025 averaged 5.66%, while the national deposit rate for five-year CDs was 2.07%.

Fixed annuity rates often outpace that of CDs because they tend to have longer terms. A certificate of deposit with a one- or two-year term is far more common than a fixed annuity with a term that short, and some CDs have terms of just a few months.

“I do not view CDs as long-term investments,” Brock, a Chartered Financial Analyst® and Certified Public Accountant, told Annuity.org. “I view CDs as a potentially sound place to store a portion of your liquidity reserve, which typically should span anywhere from three months to two years.”

Because fixed annuities typically carry longer terms, insurance companies can leverage the longer time horizon to generate more competitive returns than banks can for CDs.

Renewal Rates

If you’re planning on holding CDs or fixed annuities for longer than their term, you must consider what the contract’s renewal rate will look like.

“Fixed annuity companies hedge on the fact that they’re longer-term contracts, [and] that people are going to not just keep their annuities with the carrier for three years, but [also that] they will renew [their contracts],” Chalisa, the General Manager at Futurity First Insurance Group, told Annuity.org.

Because they want to retain you as their customer, most annuity companies will give you a good renewal rate, Chalisa said.

Chalisa noted that CDs, on the other hand, are more cyclical, meaning renewal rates for a CD likely won’t be as high as the initial rate because banks “want you to take that money out and put it somewhere else.”

Understand Tax Implications

Before allocating savings towards a CD or a fixed annuity, you’ll need to understand the tax treatment of each of these products.

Tax Payments

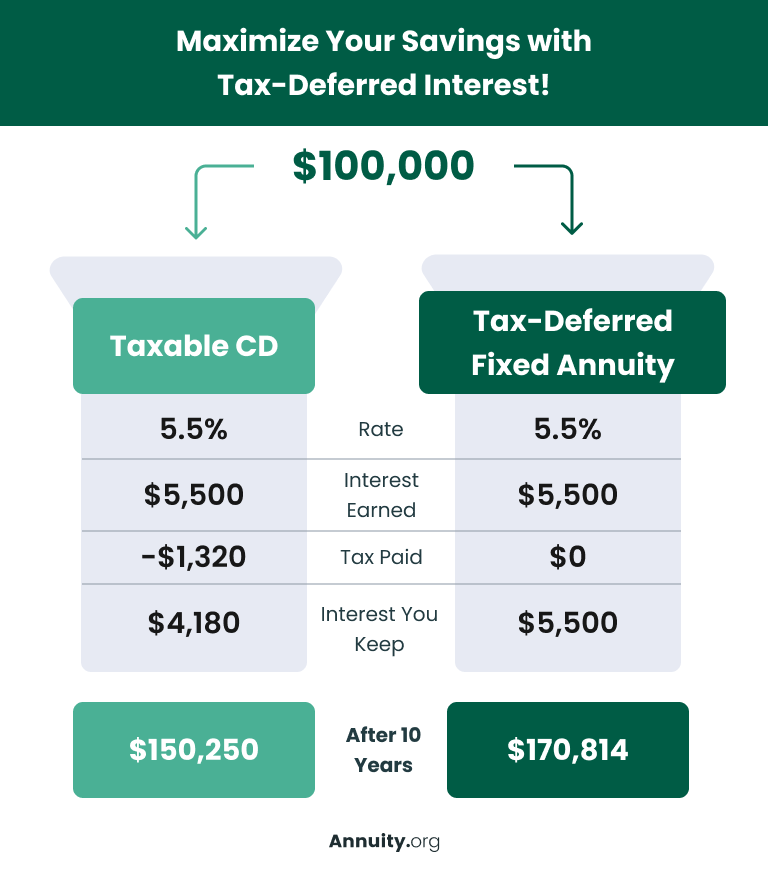

A significant advantage of fixed annuities is their ability to grow tax-deferred, meaning that the owner pays no tax on the annuity’s interest until they begin receiving payments. In contrast, CD owners must pay tax on the interest each year it’s earned.

By deferring taxes, the annuity can continue to have exponential growth as the money is left in the account to compound interest. DeLuca, a Certified Financial PlannerTM and senior financial advisor with Delta Capital Management, told Annuity.org, “In the beginning, it’s minute, but then it really starts to snowball itself.”Let’s look at an example:

Tax Brackets

Besides allowing your savings to compound even more, the tax deferral benefit of a fixed annuity can come in handy during tax season.

“CDs are taxable, so you get a 1099 every year,” Chalisa said. “A lot of people who want to invest don’t want additional 1099s, because that’s going to increase their tax bracket.”

The interest earned from CDs could push your taxable income into the next bracket, resulting in a higher tax rate on that income that undercuts how much you actually earn from your CD.

With a fixed annuity, you won’t pay taxes on the growth until you receive payments. Many owners use their annuity income in retirement to supplement other income sources like Social Security or a pension. Therefore, by the time they’re required to pay taxes on their annuity’s interest, they’re already in a lower tax bracket because they no longer earn a working income.

Consider Your Goals, Needs and Priorities

As with any financial decision, choosing CDs or fixed annuities requires you to consider your individual circumstances. Depending on your goals, needs and priorities, either CDs or fixed annuities (or both) could benefit your overall financial situation.

Access to Liquid Funds

For example, you may want to grow your savings at a predictable rate while maintaining some liquidity. Although neither CDs nor fixed annuities are fully liquid products, CDs often have a smaller withdrawal penalty than the surrender charges that fixed annuities impose.

“If you need to be more liquid, you would go into a CD,” DeLuca said. “You can still pull your money out of a CD. You’ll lose the last three months of interest, but you can get your money out of a CD versus an annuity [which has] surrender fees and all that stuff.”

Your Investment Timeline

Another major consideration when choosing between these two products is your time horizon, or how long you expect to have your money in the product you choose. Many experts consider CDs a shorter-term investment than a fixed annuity.

“CDs can be great options for one- to two-year windows if someone is planning a home purchase or other near-term large purchase,” Kates, a Certified Financial PlannerTM, told Annuity.org, “but longer than that and other investment options will be better.”

Fixed annuities, on the other hand, are designed to be held for the long term. If you’re near retirement and want to establish a stream of income, annuities can be particularly suited for this purpose.

Most fixed annuities have the option for a lifetime income guarantee, meaning you’ll receive payments for the rest of your life — even after your total payouts exceed the value of the annuity. For many retirees, this lifetime guarantee provides peace of mind and protection from outliving their savings.

Editor Tori Roughley contributed to this article.

Get Guidance Before You Decide