The Main Types of Annuities

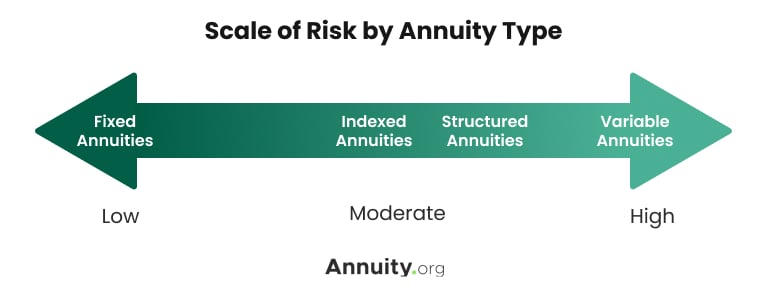

Not all annuities work the same way. Some products focus on safety and steady income, while others offer more growth potential but with added risk.

The three most common types — fixed, fixed index, and variable annuities — fall along a spectrum of risk tolerance, ranging from safe to risky, depending on your retirement plan.

Fixed Annuities

Fixed annuities are considered the safest option, providing predictable returns with guaranteed interest rates that stay steady for the entire contract term.

Fixed Index Annuities

Fixed index annuities serve as the middle ground, offering growth tied to a market index while protecting your principal with a minimum interest guarantee and limiting risk by avoiding market losses.

Variable Annuities

Variable annuities carry the highest risk,

with income and growth tied directly to investment subaccounts that fluctuate based on market performance.

Fixed Annuities

Fixed annuities are the simplest type of annuity. They guarantee a set interest rate for the contract term, so your payouts remain steady regardless of market swings. This predictability makes them a popular choice for retirees seeking steady income they can count on.

There are two common types of fixed annuities:

- Multi-Year Guaranteed Annuity(MYGA): A MYGA locks in a fixed rate for 2 to 10 years and often features higher rates than CDs.

- Single Premium Immediate Annuity(SPIA): An SPIA converts a lump sum into guaranteed income that starts within a year.

What This Mean Look Like for You

Linda, 67, wants a steady income she can count on during retirement. She chooses a MYGA that guarantees 4.8% annually for five years, providing her with predictable growth without worrying about market swings.

Fixed Index Annuities

Fixed index annuities provide a middle ground between safety and growth. Your earnings are tied to a stock market index, but floors protect your principal from losses while caps limit gains.

They offer a way to capture some market upside without risking your savings, which is appealing if you want growth potential with a safety net.

What This Could Look Like for You

David, 62, wants more growth than a fixed annuity but fears market losses. He chose a fixed index annuity tied to the S&P 500 with a 0% floor. When the market dipped, his savings stayed protected — and when it rose, he gained a portion of the upside.

Variable Annuities

Variable annuities work more like investment accounts inside an insurance contract. Your money goes into subaccounts such as stocks, bonds and funds, and your income fluctuates based on market performance.

Because your principal isn’t guaranteed, this type of annuity carries more risk, but there is also more upside. Investors can benefit from tax-deferred growth and optional income riders.

What This Could Look Like for You

Mark, 58, already has a steady income from his pension and Social Security. He chose a variable annuity for its tax-deferred growth, accepting market fluctuations in exchange for higher return potential.

Compare The Types of Annuities

| Feature | Fixed Annuity | Fixed Index Annuity | Variable Annuity |

| Risk Level | Lowest – guaranteed interest | Moderate – tied to index, with floors/caps | Highest – tied to market subaccounts |

| Growth Potential | Low – predictable, steady growth | Moderate – partial market gains | High – fully market dependent |

| Principal Protection | Yes | Yes (with limited upside) | No |

| Best For | Conservative savers | Balanced investors | High-income, risk-tolerant investors |

| Common Uses | Reliable retirement income | Growth and protection | Tax-deferred investment growth |

| Example Product | MYGA (Multi-Year Guaranteed Annuity) | S&P 500–linked FIA | Variable annuity with subaccounts |

Find the Right Annuity for You

When do you plan to retire?

What's your primary goal for this annuity?

When would you like your income to begin?

How comfortable are you with investment risk?

Do you want this annuity to provide income for life?

How important is leaving money to heirs?

How do you feel about fees?

Want a deeper understanding of your annuity type? Share your email and we'll send you a one-page guide explaining how it works — plus tips on what to consider next.

✓ Thank you!

Immediate vs. Deferred Annuities

Once you’ve identified the best type of annuity for your goals, the next question is when you want income to begin. Timing can make just as much difference as the contract itself.

- Immediate annuities: Immediate annuities start paying income within the first year, often using a lump sum from a savings or retirement account. They’re designed for those who are retiring now and want quick income to replace their paycheck.

- Deferred annuities: Deferred annuities delay payouts until a future date, allowing your investments to grow tax-deferred. They’re a fit for long-term planners who want to secure income later in life.

There are some key differences to consider to help you determine which type of annuity best aligns with your retirement strategy.

Compare Immediate vs. Deferred Annuities

| Feature | Immediate Annuity (SPIA) | Deferred Annuity |

| When Payments Start | Within 12 months of purchase | Years later, typically at retirement |

| Typical Funding | Lump sum | Lump sum or flexible contributions |

| Growth | Minimal for guaranteed income | Tax-deferred growth until payouts begin |

| Best For | Immediate income for retirees | Future income for long-term planners |

| Common Uses | Paycheck replacement at retirement, expenses | Delayed Social Security, tax-deferred growth |

| Flexibility | Fixed income stream | Choice of start date, riders and payout period |

Other Annuity Options

Annuities can be tailored to your specific retirement needs through with specialized products. Some focus on delayed income, while others are designed for tax planning or long-term care. Some even serve unique purposes, such as charitable giving or workplace benefits.

These are some popular annuity options and how they can benefit your retirement strategy.

| Product Type | Purpose |

|---|---|

| Qualified Longevity Annuity Contract (QLAC) | Helps with RMD planning |

| Registered Indexed-Linked Annuity (RILA) | Market-linked with capped losses |

| Long-Term Care Annuity | Coverage overage for long-term care expenses |

| Charitable Gift Annuity | Income for donor, remainder to charity |

| Group/Employer Annuity | Available via workplace plans |

| Thrift Savings Plan (TSP) Annuity | Uses funds from a TSP account |

Why People Choose Annuities

For most retirees, annuities aren’t about chasing the highest return. They’re about striking a balance between safety, growth, and timing to match your personal goals. Whether you’re worried about outliving your savings, delaying Social Security or protecting your spouse’s financial future, annuities can be structured to meet those needs, helping to ensure a more rewarding retirement.

See How Much You Could Earn With Today’s Best Rates