What Is a Fixed Index Annuity?

A fixed index annuity is a financial product whose terms are defined by a contract between you and an insurance company. It features characteristics of both fixed annuities and variable annuities. Fixed index annuities are also referred to as indexed annuities, index annuities or equity-indexed annuities.

Key Facts About Fixed Index Annuities

- An indexed annuity provides a rate of return based on the performance of a market index like the S&P 500.

- Indexed annuities guarantee a minimum interest rate and you don’t lose money even if the market underperforms.

- The issuing insurance company will cap or limit your gains relative to the underlying index.

Indexed annuities offer a minimum guaranteed interest rate combined with a credited growth tied to a broad stock market index, such as the S&P 500 or the Dow Jones Industrial Average.

This unique hybrid design offers protection against stock market losses, as well as the potential to profit from the market’s gains.

Access today’s best fixed index annuity rates.

If you are thinking about buying a fixed index annuity, make sure you understand how growth is credited to your account. You may have a minimum guaranteed return, but your upside will be capped as well.

How Does a Fixed Index Annuity Work?

Fixed index annuities work by crediting interest based on the performance of an underlying index. The interest earned is usually credited at the end of the crediting period, which typically ranges from one to seven years. At the end of the guarantee period, renewal rates will apply. These renewal rates will never be lower than the minimum listed in the contract.

You can customize your annuity contract by selecting the index on which to base your annuity’s interest. The most common index options include the S&P 500, the Nasdaq 100 or the Russell 2000.

Calculating Interest on a Fixed Index Annuity

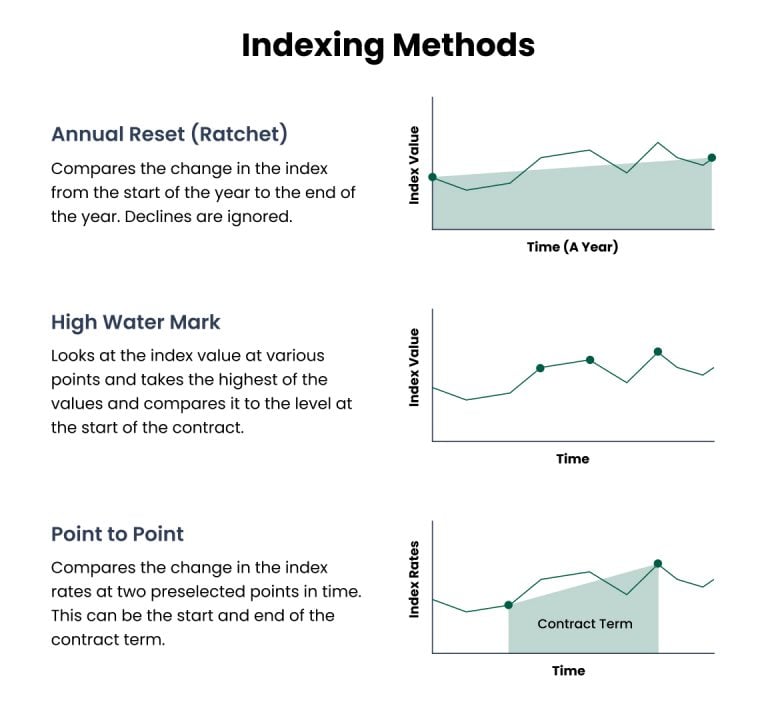

Annuity companies may calculate interest on a fixed index annuity in a variety of ways. According to the Institute of Business & Finance, there are three main methods of calculating indexed annuity interest.

Indexing Methods for Annuities

- Annual reset (ratchet)

- High-water mark

- Point-to-point

As the name suggests, in an annual reset, or ratchet, contract, interest is credited once per year. The interest is calculated by comparing the change in the index from the start of the year to the end of the year, but only in years when the index has a gain.

With both the high-water mark method and the point-to-point method, interest is credited at the end of the contract term. However, gains are determined differently with each method.

In a high-water mark contract, gains are determined by subtracting the beginning index value from its highest anniversary date value over the entire term. In a point-to-point contract, gains are determined by subtracting the beginning index value from the ending index value.

Using Index Averaging in Interest Calculations

In addition to understanding indexing methods, it is also important to know how insurers use index averaging in interest calculations. According to the Institute of Business & Finance, over 75% of fixed index annuities include an averaging feature.

Averaging can be used in different ways depending on the structure of the contract. In a point-to-point contract, for example, the insurer might use the average of the last year of the contract to compare to the beginning contract value.

Averaging generally means that indexed annuity customers will never receive interest based on the highest point of the index value, but also that they will never be credited interest based on the lowest point of the term.

Three in 4 fixed index annuities include an averaging feature.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Fixed Index Annuity Yields

Besides indexing methods, there are other contract provisions that go into calculating the interest on your fixed index annuity. According to the Financial Industry Regulatory Authority (FINRA), the computation may typically involve three factors.

- Participation Rate

- This is the percentage of the gain in the stock index you will receive on your annuity. For example, if the participation rate is 80% and the index gains 10%, the annuity would be credited with 80% of the 10% gain, or 8%.

- Spread/Margin/Asset Fee

- Some fixed index annuities use this in place of or in addition to a participation rate. This percentage is subtracted from any gain in the index. If the fee is 3% and the index gains 10%, then the annuity would gain 7%.

- Interest Rate Caps

- Some indexed annuities put an upper limit on your return. So if the index gained 10% and your cap was 7%, then your gain would be 7%.

Factors That Can Impact Index Rate

Guaranteed Minimum Return

Fixed index annuities guarantee a minimum return that’s credited at the end of the contract’s surrender period. This means that when you buy a fixed index annuity, you’re guaranteed to receive at least a certain amount of return on your investment.

According to the Institute of Business & Finance, the most common guaranteed minimum return for a fixed index annuity is 3% of 90% of the amount invested.

If your index performs consistently well, you could earn a higher return than traditional fixed annuities, but the amount of interest credited from the underlying index is not guaranteed.

On the other hand, if the stock index underperforms, your growth will not fall below a determined level, and it will not be subject to market risk. It is crucial to understand that the value of your contract at the end of the surrender period will be the greater of this minimum guaranteed surrender value or the total of your index returns. These two calculations are not added together.

The guaranteed minimum return helps make fixed index annuities a more reliable source of growth and income than other riskier products like registered index-linked or variable annuities. Many people use fixed index annuities to set up an income stream that allows them to maintain a comfortable lifestyle in retirement.

Fixed Index Annuities in 2024

The first quarter of 2024 saw unprecedented growth in fixed index annuity popularity, as reported by the industry group LIMRA. Total sales of fixed index annuities totaled $28.6 billion in the year’s first quarter, an increase of 24% over the previous year. This marked a record quarter for fixed index annuities and the twelfth consecutive quarter of year-over-year growth.

In the report, LIMRA’s head of research, Bryan Hodgens, suggested that the sustained elevated interest rates throughout 2023 and 2024 have allowed annuity providers to offer more attractive fixed index annuity features.

LIMRA expects that fixed index annuities would become even more popular throughout this year and the next. The organization predicts that fixed index annuity sales could total as high as $100 billion in 2025.

What Are the Fees and Commissions Associated With Fixed Index Annuities?

Like any other type of annuity, fixed index annuities may come with fees that must be paid on top of the initial premium. Most fixed index annuities do not include annual product (percentage) fees. While the simplest ones don’t have mandatory product fees unless you add on an optional rider, some products are created with built-in riders and, therefore, built-in product fees. The more complex an annuity is, the more expensive the fees tend to be. For the right annuity, the value you will receive will be worth the costs of the product.

The most common fee associated with fixed index annuities is built into the methodology for crediting growth to your contract. The most common methods for crediting growth are participation rates, growth caps, or spreads. Different crediting methods will impact your contract performance differently, even in the same market environment.

A 4% spread fee might reduce a 12% index gain to just 8% growth credited to the annuity’s value.

The other common fee type is a rider fee. While most riders are optional, some contracts include a mandatory fee associated with the inclusion of certain features. This is a fixed percentage subtracted from the total value of the account.

Because fixed index annuities are not as simple as fixed annuities or income annuities, they tend to have higher commissions. The commission on an indexed annuity can range from 6% to 8%, compared to the 1% to 3% commission you can expect for a fixed annuity. However, the commissions are typically baked into the cost of the annuity contract. Commissions are not deducted from the value of your principal payment.

Who Should Get a Fixed Index Annuity?

Fixed index annuities are best suited for investors who don’t need the money right away. According to licensed financial advisor Chip Stapleton, fixed index annuities are most beneficial for investors with 10 to 15 years before they’ll need income because they’ll have time to weather any downturns that might reduce the annuity’s return.

Most fixed index annuities have some downside protection, said Stapleton, who is a FINRA Series 7 and Series 66 license holder and CFA Level II candidate.

“It might even be a floor of zero, so you’re never going to lose money,” Stapleton told Annuity.org. “But then your upside is also capped there too, so if you want to limit your bad, you also have to limit your good.”

Case Study: When a Fixed Index Annuity Is a Good Fit

The hypothetical case study below provides an example of how someone about to retire can benefit from the features of an indexed annuity. It is not intended as financial advice.

Name: Hallie

Age: 65

Looking to Invest: $100,000

- Hallie is looking for a way to generate guaranteed income to supplement her Social Security checks.

- She has considered purchasing bonds, but with low interest rates, a large bond investment won’t keep pace with inflation.

![]() Best Option: Fixed Index Annuity

Best Option: Fixed Index Annuity

Fixed index annuities offer a low-risk way to generate predictable income.

Client Profile: Hallie, 65, is nearing retirement and is looking for a way to generate guaranteed income to supplement her Social Security checks.

Background: She wants to add some flexibility to the conservative part of her portfolio. She considered purchasing bonds, but she’s worried a large bond investment won’t keep pace with inflation.

Conclusion: A fixed index annuity is a good fit for someone like Hallie because these annuities offer a low-risk way to generate predictable income. She’s guaranteed not to lose money, so it’s a more predictable investment compared to a variable annuity, which would expose her to downturns in the stock market.

Fixed Index Annuity Pros and Cons

Like any investment, fixed index annuities have their benefits and costs. Since they are essentially a hybrid of fixed and variable annuities, they carry a mixture of pros and cons. They have the potential for higher returns without the risk of losing your money. But, because these annuities are complicated, they can be more difficult to understand.

Pros & Cons of Fixed Index Annuities

Pros

- Tax-deferred growth

- When your index performs well, your contract value increases

- Principal protection from market downturns

- Minimum guaranteed rate

- May hedge against inflation

- Rates may be better than CDs

Cons

- Gains are reduced or capped by the crediting methodology used

- Surrender charges may apply on withdrawals prior to maturity

- Long crediting periods of one year or more

- Contracts and crediting are complex

Worried About Your Retirement Savings?

Frequently Asked Questions About Fixed Index Annuities

Fixed index annuities are not securities and do not earn interest based on specific investments. Rather, fixed index annuity rates fluctuate in relation to a specific index, such as the S&P 500. In contrast to variable annuities, fixed index annuities are guaranteed not to lose money.

Fixed index annuities guarantee that you won’t lose money. If the index is positive, then you are credited a certain amount of interest based on your participation rate. If the market tanks, you’ll receive a fixed rate of return — or no loss of your original principal instead.

The advantages of fixed index annuities include the potential to earn more interest and the premium protection they offer. The disadvantages include the complexity of the contracts, the limitations on gains compared to the underlying index, and reduced liquidity during the guarantee period.

Fixed index annuities are safer than variable annuities because they have principal protection. Principal protection allows these to offer the same level of safety as fixed annuities. They are not without opportunity cost, however. The returns are less predictable than fixed annuities, and the minimum guaranteed rates may fall below the prevailing rates on fixed annuities of similar maturities.