Annuities grow tax-deferred, meaning you don’t pay taxes on earnings until you withdraw them. However, taxation of the principal—the money used to fund the annuity—depends on whether the annuity is qualified or nonqualified.

Key Facts About Nonqualified vs. Qualified Annuities

- Qualified annuities are funded with pre-tax dollars, and withdrawals are fully taxable. Owners must start taking required minimum distributions (RMDs) at age 73.

- Nonqualified annuities are funded with after-tax dollars, so only the earnings are taxable upon withdrawal. There are no RMDs or age restrictions on withdrawals.

- Withdrawals before age 59 ½ typically incur a 10% early withdrawal penalty.

The key difference between qualified and nonqualified annuities is how they are funded. Qualified annuities use pre-tax money and are fully taxed at withdrawal, while nonqualified annuities use after-tax money, meaning only the earnings are taxable.

What Is a Qualified Annuity?

A qualified annuity is funded with pre-tax dollars, like those from retirement accounts like IRAs. Taxes on these annuities are deferred until withdrawal. The most common method of funding a qualified annuity is by transferring money from a 401(k), IRA or other tax-deferred or tax-free retirement account. There is no legal limit to the amount you can use to fund an annuity, although many companies may have their own limits. Contributing money to an annuity from a retirement plan does not offer additional tax deductions but retains the tax-deferral status already established for retirement assets.

If your annuity is part of an existing qualified retirement plan, such as an IRA or 401(k), you may be eligible to receive a tax deduction for the contribution. However, this deduction is subject to the rules governing IRA and 401(k) contributions, including income limits. In this example, the annuity would serve as an investment within the qualified plan.

What Is a Nonqualified Annuity?

A nonqualified annuity is funded with after-tax dollars. This type of annuity offers more flexibility in your retirement planning. They are typically bought with a lump-sum premium.

Because that initial investment is money that has already been taxed, you will only owe taxes on the earnings the annuity accumulates as it matures. There is no annual cap on how much money you can put into a nonqualified annuity and no mandatory distribution age.

Nonqualified annuities can be an advantageous investment option for people who have maxed out their employer-sponsored retirement plan contributions.

If you’ve contributed the maximum amount to employer-sponsored accounts and still want tax-deferred savings, you can purchase a nonqualified deferred annuity to continue growing your savings without excessive taxation. There are no tax deductions for contributions to a nonqualified annuity.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Key Features of Qualified and Nonqualified Annuities

| Key Features | Qualified Annuities | Nonqualified Annuities |

| Purchased with | Pre-tax funds (typically money from a retirement account such as a regular 401(k) or a traditional IRA) | After-tax funds |

| Annual limit on purchases | There is no legal limit on funding a qualified annuity. However, contributions to an annuity that is part of a qualified plan will be subject to the contribution and income limits of the qualified plan (e.g., 401(k) or IRA) | No limit |

| Tax treatment of distributions | All distributions of both principal and earnings are taxed as income | Only distributions of earnings are taxed as income; distributions of principal are not taxed |

| Distribution requirement | IRS generally requires distribution of funds by age 73 | No IRS requirement; state laws may differ |

| Early distribution penalty | A 10% penalty generally applies for distribution taken prior to age 59 ½ | A 10% penalty generally applies for distribution taken prior to age 59 ½ |

There are differences in why someone buys a qualified or a non-qualified annuity. Qualified annuities have a maximum amount that can be bought in conjunction with IRAs, Roth IRAs, SEPs, etc., whereas a person can generally buy as many non-qualified annuities as they want. Both types have their own reasons, but the fact that there is tax deferral either way is a big plus. Most of our clients divide their investments between qualified and non-qualified annuities as needed to enjoy the benefits of both. After all, a safe investment with good returns and an income stream can reduce headaches in retirement and allow you to enjoy the fruits of your lifelong labor.

Qualified Annuities and Retirement Plans

The IRS treats qualified annuities like tax-favored retirement plans. In fact, qualified annuities are often purchased through an employer tax-favored retirement plan. You can also purchase them with money from an IRA, 401(k) or other tax-deferred account.

Qualified Retirement Plans

- 401(k) plans

- 403(b) plans

- SARSEP plans

- SEP-IRA plans

- SIMPLE IRA plans

While there are no strict legal limits on how much or how little you can place into an annuity, many companies have established their own limits for liability purposes. The annuity holder’s income and whether they participate in other qualified pension plans govern these caps.

Retirees may choose to take their annuity income benefits in one of several payout structures.

Payout Options for Retirees

- A lump-sum payout

- An annuitized income stream for life

- An annuitized income stream for a specific time period

How Do Withdrawals Compare?

When an annuity owner withdraws funds from a qualified annuity, the entire amount is taxable because they have not paid taxes on those funds.

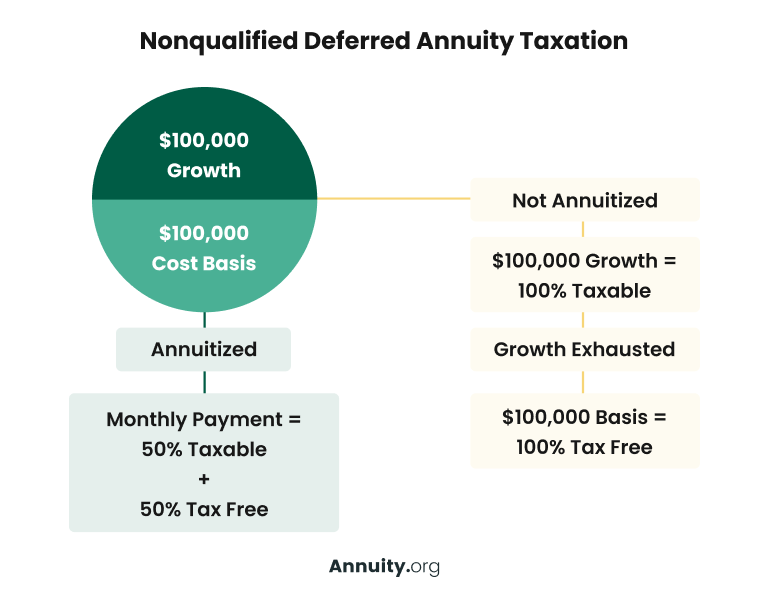

When they withdraw money from a nonqualified annuity, on the other hand, there are no taxes due on the principal. The IRS levies income taxes only on earnings and interest.

The IRS differentiates between nonqualified and qualified annuity withdrawals in terms of taxation. In nonqualified annuities, they tax only the earnings portion. In qualified annuities, they tax all money withdrawn as regular income.

If you purchased your nonqualified annuity after August 13, 1982, your distributions will follow the “last-in-first-out” protocol of the IRS. According to this rule, it’s assumed that any money you withdraw from your annuity is taken first from the contract’s accumulated earnings. This means they tax nonqualified annuity withdrawals as income until the withdrawal amount exceeds the annuity’s growth.

Taxes impact nearly every part of your financial plan, and annuities are no exception. Whether your annuity is qualified or nonqualified determines how it is taxed.

Brandon Renfro, Ph.D., CFP®, RICP®, EA Co-Owner of Belonging Wealth Management

Worried About Your Retirement Savings?

Comparing Distributions and Transfers

The IRS requires you to be at least 59 ½ years old to receive distributions from your annuity. Any withdrawals made before reaching that age incur a 10% tax penalty on earnings. These rules apply to both qualified and nonqualified annuities.

Federal law requires the owners to begin taking distributions from qualified annuities at the age of 73. There are no federal legal requirements for when distributions must begin for nonqualified annuities.

Some state laws may set requirements, however. These may be in the annuity contract you have with the annuity provider.

Tax Treatment

Income payments from qualified annuities are taxed the same as ordinary income, according to investment expert Nate Nead.

“That means the amount you withdraw will get taxed at your regular income tax rate,” Nead, the managing principal at Invest.net and a FINRA Series 63 license holder, told Annuity.org.

Distributions from a nonqualified annuity are only partially taxable. According to the IRS, payments from a nonqualified annuity are made of two parts. One part is the annuity’s earnings and is subject to income tax; the other part represents the return of the owner’s principal and is not taxable.

The IRS determines which portion of a nonqualified annuity distribution is taxable by using a calculation known as the exclusion ratio. This ratio is based on the annuity’s principal and earnings as well as the annuitant’s life expectancy. The exclusion ratio is designed to spread the principal and earnings over the annuitant’s lifetime. If the annuitant lives longer than their calculated life expectancy, all payments beyond that time period are taxed as income.

So, for example, if your calculated life expectancy is 85 years old, then the exclusion ratio will determine how much of each payment from your nonqualified annuity will be considered taxable earnings until you turn 85. After the age of 85, all payouts from the annuity are considered taxable income.

Transfer Options

With nonqualified annuities, you can transfer the funds between different kinds of annuities, such as fixed and variable, without facing an early-withdrawal penalty because the exchanges are covered by Section 1035 of the Internal Revenue Code. These transfers are 1035 exchanges.

With qualified annuities, you can make a transfer to another qualified account without incurring taxes or penalties. “This type of transfer is commonly known as either a direct rollover or trustee-to-trustee transfer, where all the funds are moved directly between the financial institutions involved,” Nead said. This includes moving the money placed in a qualified variable annuity that has not yet been annuitized back into an IRA.

Still Not Sure Where to Begin?

Frequently Asked Questions About Qualified vs. Nonqualified Annuities

Annuities can be either qualified or nonqualified. You pay for a qualified annuity with pre-tax dollars. When you get money from a qualified annuity, you have to pay income taxes on the entire amount. But you pay for a nonqualified annuity with after-tax money, so you only pay taxes on the money your annuity has earned.

Because you’ve already paid income taxes on the money you placed into a nonqualified annuity, there is no required minimum distribution (RMD). This is one of several annuity strategies to take into account when considering an annuity.

A simple way to know if you have a qualified annuity is to check your statement. If you have not been paying taxes on your earnings, it’s qualified. Qualified annuities are tax-deferred annuities, meaning you don’t pay income taxes on the money in the annuity until you take it out.

Writer Anna Baluch contributed to this article.