Understanding the annuity exclusion ratio is essential for managing the tax implications of your annuity payments. This concept determines the portion of your annuity payouts that are tax-free, based on your initial investment. Knowing how it works can help you plan for taxes and ensure you’re not caught off guard when tax season arrives. Here’s a closer look at how the exclusion ratio affects your annuity distributions and how to calculate it properly.

Key Facts About the Annuity Exclusion Ratio

- The annuity exclusion ratio formula helps you determine how much of your annuity payment is subject to taxation.

- The insurance company you purchased the annuity from should also provide the exclusion ratio.

- The portion of the withdrawal that is attributable to earned interest is subject to tax.

What Is an Exclusion Ratio?

Once you begin receiving payouts from your annuity, a portion of each payment is not subject to income tax because it is considered a return of your principal. This is known as the exclusion ratio. Since this principal was paid for with after-tax money, the IRS won’t tax you on it again.

The IRS provides two methods for calculating the exclusion ratio: the General Rule or the Simplified Method. Most annuity owners are required to use the General Rule.

However, this is only part of the check you receive each month, quarter or year from the insurance company. Over the years, your initial principal earns interest, and that money is taxable just like the interest you earn on a CD or bond.

Likewise, gains made within a variable annuity’s investment subaccounts are also taxable. Essentially, any money that has not been taxed is taxable when it is distributed.

The exclusion ratio tells you the portion of each payment that is a return of your premium and, therefore, tax-free. The remaining portion is subject to taxation.

A powerful advantage of a nonqualified annuity is its tax-deferred nature. Essentially, this means your principal investment is allowed to grow free of tax, until you begin taking distributions. At this stage, the income distributed by your annuity is taxable, but not distributions of principal. The annuity exclusion ratio is the way the IRS determines the taxable vs. nontaxable portions of your distributions.

Example: How the Exclusion Ratio Works

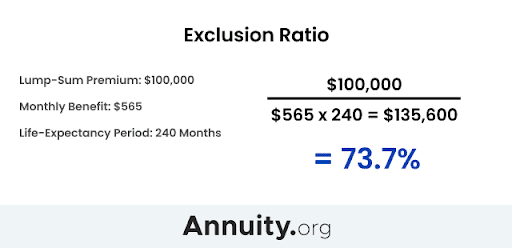

For a simple example, let’s assume you purchase an immediate annuity for $100,000 that promises to pay you $565 a month for the rest of your life.

To calculate the exclusion ratio on an immediate annuity, you divide the net cost, which is the premium minus certain adjustments (if there are any), by the expected return.

The IRS defines this as the total amount you expect to receive from the annuity based on your life expectancy, according to the appropriate actuarial table.

Suppose your life expectancy is 20 years, which would be 240 monthly payments of $565, equaling out to $135,600. Since you paid $100,000 for the annuity, $100,000 of the $135,600 is really a return of your own money. The remaining $35,600 is the growth, and that’s the part you’ll owe taxes on when you receive it.

The IRS rules require that you round the ratio to three decimal places, so 73.746% of each payment is a tax-free return of your premium. That is $416.67 out of each $565 payment. The insurance company is basically returning portions of the after-tax money you already gave them — plus interest.

Therefore, you will be responsible for paying ordinary income tax on only $148.33 of your $565 monthly payout.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Special Considerations

There is an important detail to keep in mind in the previous example: You have a 20-year life expectancy. But what if you live longer?

One of the main benefits of an income annuity is that you don’t have to worry about running out of money. The annuity guarantees you a steady stream of income for life. However, your entire payment becomes taxable once you surpass your life expectancy. That’s because after 20 years — your original life expectancy — you will have completely retrieved your original principal.

The National Association of Insurance Commissioners notes that some states may levy a tax on the value of your annuity when you annuitize. This is called a premium tax, and the insurer will subtract this amount from your total contract value.

If you use a tax-deferred account, such as an IRA or 401(k) retirement account to purchase your annuity, then you will pay taxes on all of the monthly payments you receive. After all, this money is tax-deferred, not tax-free.

Fixed Income Annuities vs. Variable Annuities

Calculating the exclusion ratio of a fixed income annuity is easy because the insurance company pays you the same amount of money with each distribution according to your contract. Therefore, the exclusion ratio should never change.

While variable annuities follow the same basic exclusion ratio idea, it is a little different to calculate and applies a couple of additional rules.

Variable annuities include subaccounts invested in the marketplace. As the name implies, variable annuity payouts vary based on market conditions.

The exclusion ratio of your variable annuity is calculated by dividing the net cost of your contract by the total number of payments you expect to receive. This will give you the specific dollar amount of each payment that is excluded from taxation.

Let’s consider our earlier example. You pay a $100,000 premium and have a 20-year life expectancy. So, $100,000 divided by 240 total payments is $416.67.

But unlike our earlier example, a variable annuity does not offer you the same $565 static monthly payment as the fixed annuity did. Some months you may receive $1,000. Other months it may be $750.

For 20 years, $416.67 of each payment is tax-free regardless of the total amount of the payment. If your payouts increase because stocks are performing well, that’s great, but you won’t get a bigger tax break. Therefore, the ratio of each payment that is excluded may fluctuate as the payment fluctuates.

However, if the amount you receive from a variable annuity is less than the tax-free amount, you can apply the leftover tax-free amount to future payments.

For example, one month, the market performs poorly, and your variable annuity earns only $300. But up to $417 a month is tax-free. This means you can roll over the tax savings on the extra $117 by refiguring the tax-free amount.

Be aware that the IRS has a procedure for refiguring your tax-free amount. You must file a statement with your tax return that includes the annuity start date, your age on that date, your original premium amount and the total amount of tax-free money you have received.

Worried About Your Retirement Savings?

Annuity Exclusion Ratio FAQs

To calculate a fixed annuity’s exclusion ratio, multiply the monthly benefit by the number of months in your life expectancy. Then divide the net cost you paid by the number you just calculated. This will give you your exclusion ratio. You do not have to pay taxes on the percentage of your withdrawal. Subtract that percentage from 100 and it will tell you what the taxable percentage is.

Variable annuity rates may be affected by market conditions. If your variable annuity performs below the exclusion ratio, you can roll over the difference and declare it a loss on your taxes.

You can face steep tax penalties for an early annuity payout. An early withdrawal could throw out the exclusion ratio altogether, resulting in having to pay taxes on all withdrawals until the annuity is drawn down to the amount of the original principal you paid into it.

Editor Sierra Campbell contributed to this article.