Form 1099-R plays a key role in reporting distributions from retirement accounts, including annuities and pensions. Understanding how it works and when to expect it is essential for accurate tax filing. In this article, we break down everything you need to know about Form 1099-R, its contents and what to do with it.

Key Facts About Form 1099-R

- Form 1099-R reports distributions from annuities, pensions, retirement accounts and similar sources, ensuring proper taxation.

- If you receive a distribution of $10 or more, you will get a 1099-R by Jan. 31 each year.

- Distributions may not always be taxable; consult with a tax professional for guidance on taxability.

- The form includes key details like the gross distribution, taxable amount and federal tax withheld.

What Is Form 1099-R?

Form 1099-R is a document used to report distributions from annuities, pensions, retirement plans, profit-sharing plans, individual retirement accounts (IRAs), insurance contracts and survivor income benefit plans to the IRS. While the form is primarily to report distributions from a retirement plan, there are other situations when you might get one before you retire. Ultimately, it is used to ensure that the income you received is properly taxed.

When Might I Receive a 1099-R?

Anyone who receives a distribution of $10 or more from any of the sources, also known as payers, will receive a 1099-R on or before Jan. 31 of each year. If you receive money from multiple payers, you will receive multiple forms. Copies of all forms are sent to the IRS and the appropriate state and local tax departments.

If you receive an inaccurate Form 1099-R, immediately contact the payer or investment custodian to resolve the situation. This will allow you to avoid filing an incorrect tax return.

What Do I Do with a 1099-R?

Generally, all 1099-R distributions are to be reported on your annual tax filing. However, not all distributions are subject to taxation. For example, a direct rollover from a 401(k) plan to a traditional IRA is not taxable because the tax-deferred natures of these vehicles are consistent.

It can be difficult to determine whether your distributions are subject to taxation. The U.S. income tax code can be complex, and form 1099-R is just one of them. If you don’t have specialized knowledge on the matter, you may want to consult with a tax professional.

On the other hand, if you are someone who enjoys educational research and would rather do it yourself, then you can use the IRS’ instructions sheet to help you understand and handle the process on your own.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

What Information Is Reported on a 1099-R?

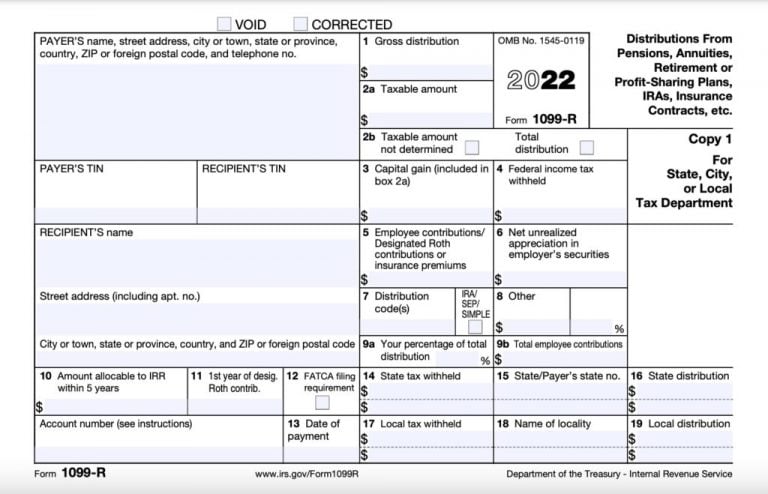

A 1099-R form specifies the payer’s name, address, telephone number, and taxpayer identification number (TIN), which is usually a social security number.

There are other key items disclosed on the 1099. Line items include the gross distribution paid (line 1), the taxable amount (line 2a), the federal income tax withheld (line 4), any contributions made or insurance premiums paid (line 5), and a code indicating the type of distribution(s) made to the recipient (line 7).

Several of my clients take advantage of the backdoor Roth conversion, a great option for those who may not qualify for direct Roth IRA contributions due to income limits. Even though this is largely a non-taxable event, the brokerage will issue Form 1099-R to report the distribution from the non-deductible IRA. It’s important to obtain a copy of the 1099-R for your tax return, as the IRS receives a copy and will follow up if the information doesn’t match. You also need to include Form 8606 with the Form 1040 to properly account for the conversion. I help my clients understand how to find and use these forms.

What Are the 1099-R Distribution Codes?

The 1099-R distribution codes consist of numbered and lettered codes that indicate the characteristics of a distribution. The distribution codes are entered on Line 7 of the form.

The IRS provides a description for each code to help you identify the distribution you received. For more information on these distributions, you can refer to the IRS instructions sheet.

| Code | Description | Code | Description |

| 1 | Early distribution, no known exception. | G | Direct rollover and direct payment. |

| 2 | Early distribution, exception applies. | H | Direct rollover of a designated Roth account distribution to a Roth IRA. |

| 3 | Disability. | J | Early distribution from a Roth IRA. |

| 4 | Death | K | Distribution of traditional IRA assets not having a readily available FMV. |

| 5 | Prohibited transaction. | L | Loans treated as deemed distributions under section 72(p). |

| 6 | Section 1035 exchange. | M | Qualified plan loan offset. |

| 7 | Normal distribution. | N | Recharacterized IRA contribution made for 2023. |

| 8 | Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2024. | P | Excess contributions plus earnings/excess deferrals taxable in 2023. |

| 9 | Cost of current life insurance protection. | Q | Qualified distribution from a Roth IRA |

| A | May be eligible for 10-year tax option. | R | Recharacterized IRA contribution made for 2023. |

| B | Designated Roth account distribution. | S | Early distribution from a SIMPLE IRA in the first 2 years, no known exception. |

| C | Reportable death benefits under section 6050Y. | T | Roth IRA distribution, exception applies. |

| D | Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411. | U | Dividends distributed from an ESOP under section 404(k). |

| E | Distributions under Employee Plans Compliance Resolution System (EPCRS). | W | Charges or payments for purchasing qualified long-term care insurance contracts under combined arrangements. |

| F | Charitable gift annuity. |

Ultimately, the IRS and other taxing authorities use this information, along with other information you file, to determine your tax liability each year.

Worried About Your Retirement Savings?

Related Income Tax Forms

Form 1099-R is one of the many 1099 forms, all of which are referred to as information returns. The forms are used by the IRS to track and tax important income.

Each type of information return reports on a certain type of distribution. There are nearly two dozen types of information returns, but most taxpayers will only ever receive a handful of them.

Other Common Types of 1099 Forms

- Form 1099-B is issued by brokerage firms and barter exchanges to report clients’ gains and losses.

- Form 1099-DIV is issued by financial institutions to investors who receive dividends and distributions from any type of investment during a calendar year. The threshold for reporting a 1099-DIV is $10.

- Form 1099-G is issued by government entities to individuals who receive unemployment compensation payments, state or local income tax refunds and/or certain other payments. The reporting threshold is $10.

- Form 1099-INT is issued by financial institutions to savers and investors. It includes a breakdown of all types of interest income received and related expenses paid during a calendar year. The threshold for reporting a 1099-INT is $10.

- Form 1099-K is issued by payment settlement entities (PSEs) to report payments made to settle transactions executed during a calendar year. PSEs include credit card companies and third-party payment processors, such as PayPal and Zelle. The reporting threshold is $600.

- Form 1099-MISC is issued by payers to report miscellaneous distributions made, such as rents, prizes and awards, healthcare payments and/or payments to an attorney. The reporting threshold is $600.

- Form 1099-NEC is issued by payers to report compensation given to independent contractors, freelancers and self-employed individuals for services rendered. The payments are often referred to as non-employee compensation. The reporting threshold is $600.

If you receive any of these forms, the information generally must be included on your annual tax filing. However, exceptions apply. Consult with a tax professional to ensure appropriate handling.

Editor Sierra Campbell contributed to this article.