One of the biggest benefits of annuities is their ability to grow on a tax-deferred basis, ultimately increasing your earning power. Unlike the treatment of investments in a taxable brokerage account, growth within an annuity does not generate taxes as long as the money remains inside the contract. This includes all interest, dividends or capital gains throughout the life of the annuity.

Key Facts About Annuity Taxation

- Annuity taxation is dictated primarily by whether the contract was funded with pre-tax or after-tax money.

- Qualified annuities, which use pre-tax funds are taxable when you make withdrawals.

- Non-qualified annuities involve after-tax funds and tax your earnings before you make your original contributions.

This beneficial tax treatment ends when any money is withdrawn or paid out from the annuity contract. How much of each payment is taxable depends on two factors: How the annuity was funded and the type of payments or withdrawals.

Tax planning is an important endeavor, especially for individuals embarking on retirement with a lean fixed income. For example, a colleague of mine, Art, was worried his tax bill would not leave him enough money to live comfortably. Fortunately, after examining his annuity, it was evident the contract had been funded on a non-qualified basis, meaning only the earnings component of the distributions would be taxed.

How Are Annuities Taxed

Annuities can be funded from two different sources of money: qualified or non-qualified.

Qualified Annuities

Qualified annuities are contracts that have been funded with pre-tax money, usually through retirement accounts such as a 401(k) or IRA. Contributions into these accounts remain tax-deferred and will be subject to income taxes in the year withdrawals or payments are received.

Annuities funded with qualified money are subject to normal required minimum distributions (RMDs) at age 73, unless the contracts are annuitized. Certain types of annuities such as Qualified Longevity Annuity Contracts (QLACs) can be used to partially delay RMDs.

Have a Tax Question About Annuities?

Get quick, trustworthy answers based on Annuity.org’s expert-reviewed content.

Non-Qualified Annuities

Non-qualified annuities are funded with taxable contributions, typically from a brokerage or bank account. These contributions establish a tax basis within the annuity that is not taxable when eventually withdrawn. Only the earnings generated within a non-qualified annuity is taxable as income at the time of a withdrawal or payment.

Roth contributions are an exception. Although these contributions are after-tax, they are still considered to be qualified money. Annuities funded with Roth contributions are subject to the same rules for income tax exemption as normal Roth IRAs. Once satisfied, all withdrawals or payments from a Roth annuity will be completely tax-free.

Overwhelmed by Safe Retirement Options?

Non-Qualified Annuity Income

Annuities can distribute money to owners a few different ways and this can impact the amount and manner in which these payments are taxed. It is important to understand the rules that factor into taxation calculations on your specific annuity type.

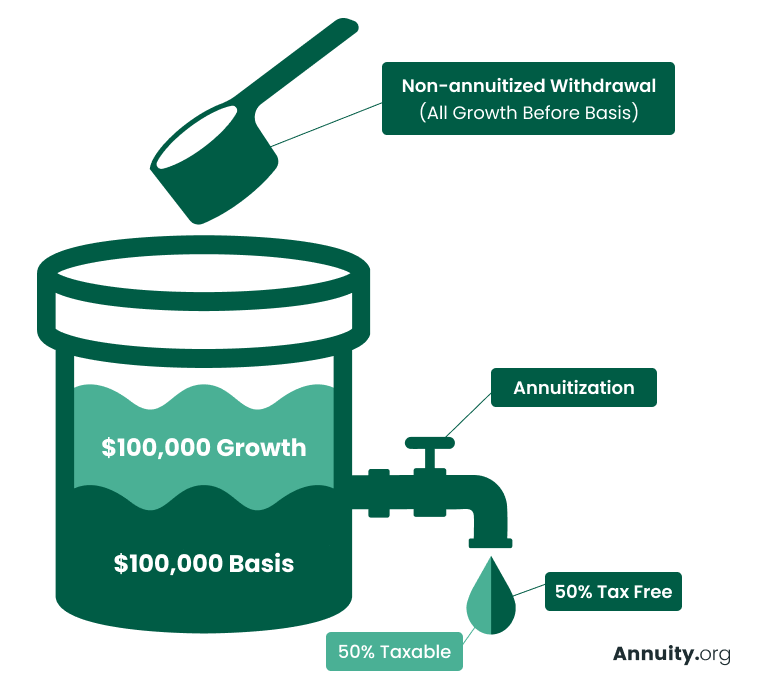

Qualified annuity income is fully taxable and the form of withdrawals does not impact how they are taxed. Alternatively, non-qualified annuity taxation will be different depending on how you access your funds. If your contract is annuitized and paid out regularly, lifetime income taxes are handled differently than if you are periodically withdrawing funds at your discretion.

Annuitization

When a contract is annuitized, payments can be partially taxable since they contain some tax-free cost basis as well as taxable investment earnings.

Each payment incorporates a principal component (not taxable) and an earnings component (taxable). The larger your earnings are relative to your original premium amount, the more taxable each payment will be.

Payments will become fully taxable after the date of your assumed life expectancy.

The exclusion ratio takes into account the principal that was used to purchase the annuity, the amount of time the annuity has been paying, the interest earnings and the annuitant’s life expectancy.

With the exclusion ratio, your annuity payments, beginning at age 67, are structured based on an assumed life expectancy of 87. Over the next 20 years, a portion of each payment will include a tax-free return of the premium you used to fund your annuity. After age 87, however, the exclusion ratio no longer applies, and all payments will be fully taxable as income.

- Your annuity was funded with $48,000

- Your monthly payout is $318 ($3,816 annually)

- Each month, $118 is taxable as income and $200 is a tax-free return of premium

- At age 87, all $318 per month is taxable as income

Annuities are popular with clients seeking tax deferral through IRA, SEP and other accounts, allowing investments to grow without triggering taxable gains. I help clients choose between qualified and non-qualified annuities based on their financial goals. Tax-deferred growth maximizes compounding and helps maintain tax brackets. A good agent always tailors the plan to the client’s needs.

Aamir Chalisa, MBA, LUTCF, MDRT

Last In, First Out (LIFO)

When an annuity contract is not annuitized, the taxability of withdrawals is calculated using a Last In, First Out (LIFO) standard. All earnings are considered to be “Last In” and will be withdrawn first for tax purposes. This means that you will pay taxes on all withdrawals up to the point you have exhausted your earnings. Then all withdrawals will be complete tax-free.

Here’s an example of how the LIFO method affects the taxation of your annuity withdrawals:

- Your annuity was funded with $60,000

- The balance is now $120,000 ($60,000 of growth)

- You plan to withdraw $2,000 per month until the contract is spent

- All withdrawals will be fully taxable for 2.5 years (30 payments) as you draw down the earning of your contract

- After all the earnings have been withdrawn, only then are payments tax-free

Inherited Annuities

Inherited annuities, unlike many other inherited assets, do not have a step-up in tax basis. This means that the owner’s original tax basis on non-qualified annuities will remain the same. All earnings will still be taxable as income to the beneficiary. Qualified annuities are fully taxable as income in the year the money is received.

The tax consequences of an inherited annuity will depend on how the beneficiary will receive the payout. Some contracts will allow the beneficiary to spread payments over multiple years, while others will payout in a single lump sum. It is important to work with a tax advisor to plan for how any additional income will impact your tax situation. Additional income may elevate you into a higher tax bracket, resulting in an increased tax liability.

Frequently Asked Questions About Annuity Taxation

Annuities are taxed when you withdraw money or receive payments. If the annuity was purchased with pre-tax funds, the entire amount of withdrawal is taxed as ordinary income. You are only taxed on the annuity’s earnings if you purchased it with after-tax money.

In a few states, you may have to pay a premium tax when you first purchase an annuity contract.

Inherited annuity earnings are subject to taxation, with the amount taxed varying based on the payout structure and the beneficiary’s relationship to the annuity owner, such as whether they are a surviving spouse or another type of beneficiary.

Taxes are deferred until you begin receiving your distributions from the annuity. Then, the payments are taxable based on whether the annuity was purchased with qualified (pre-tax) or non-qualified (post-tax) funds. Your withholding strategy should depend on your overall income and tax bracket at that time.

While it’s impossible to avoid paying taxes on an annuity completely, you can reduce the annual tax burden of your annuity by converting a deferred annuity into an income annuity. The income annuity’s payments will be made of both taxable interest and tax-free return of premium, lowering your tax liability for each income payment.

The amount of tax you’ll owe on an annuity withdrawal depends on the type of annuity you have. A withdrawal from a qualified annuity will be taxed as normal income at your current tax rate, while non-qualified annuity withdrawals may be fully taxable or only partially taxable depending on whether the payments are annuitized.

If you cash out your annuity early, you’ll have to pay taxes on the full value of the annuity if it’s a qualified annuity. When cashing out a non-qualified annuity, you’ll only owe taxes on the earnings of the annuity.

Roth IRA annuities are funded with after-tax dollars, but are still considered to be qualified contracts. Since tax has already been paid on this money, the withdrawals are not usually subject to income tax as long as all eligibility requirements are met.

Writer Anna Baluch contributed to this article.