In terms of investing, risk tolerance refers to the level of risk a person is willing and able to assume within their investment portfolio. It is largely dependent on an individual’s investing time horizon.

Generally, the longer your horizon, the higher your risk tolerance. Conversely, the shorter your horizon, the lower your risk tolerance. That said, there are various factors that influence risk tolerance.

Key Facts About Risk Tolerance:

- Risk tolerance refers to the level of financial risk you are willing and able to assume.

- It serves as a key factor in shaping the construction of investment portfolios.

- At a high level, there are three risk tolerance levels and corresponding types of investment portfolios – conservative, moderate and aggressive.

- Many investors leverage the help of financial advisors to assess risk tolerance. The process typically entails completing a thorough risk tolerance questionnaire.

The Two Components of Risk Tolerance

Risk tolerance is comprised of one’s willingness and capacity to assume risk. Willingness refers to your psychological leanings regarding uncertainty (risk-seeker vs. risk-avoider). Capacity refers to your level of financial wellness and ability to endure losses.

While the two components of risk tolerance are usually aligned, they can diverge. When that happens, an investor should refrain from allowing a psychological inclination to overshadow their capacity. Doing so will likely lead to optimal financial outcomes.

It’s important not to assume that you just have one risk tolerance. Take two different accounts with long (10+ year) time horizons – a college fund for a young child and a retirement account. I have had past clients who have had vastly different risk tolerances for those two accounts (aggressive in the retirement account and moderately conservative in the college fund). So not only does each person have their own risk tolerance, each account may have it’s own too.

Factors That Influence Risk Tolerance

As indicated previously, investing time horizon significantly influences risk tolerance. Below, we expand on the importance of this factor and discuss a few other prominent determinants of risk tolerance.

Investing Time Horizon

Investing time horizon is the amount of time available to achieve a financial goal, such as making a down payment on a home, funding a child’s college education or financing your retirement.

Generally, the longer the horizon, the greater your ability to withstand market fluctuations and temporary losses. Thus, with a relatively long horizon, you can invest aggressively – with an eye toward long-term wealth accumulation, not short-term market volatility.

Conversely, with a relatively short horizon, you do not have the ability to withstand significant market chop. The shorter your horizon, the greater the importance of stability and liquidity. Growth is an afterthought in this case.

Investment Objectives

Investment objectives are the things you intend to accomplish through your investment positions. Generally, they include some combination of ensuring liquidity, preserving capital, generating income and fueling growth.

Collectively, these objectives help determine your level of risk tolerance and underpins the types of investment strategies you should pursue.

For example, if you have a long runway and are predominantly focused on accumulating wealth, you are likely to be highly tolerant of risk and well-positioned to own growth-oriented assets.

Alternatively, if you are retired and only care about safely generating cash flows to meet your spending needs, you are likely to be very intolerant of risk and well-positioned to own stable-value, income-bearing instruments.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Comfort With Volatility

Beyond your time horizon and investment objectives, risk tolerance depends on your psychological response to market volatility. You may have the financial ability to endure turbulent markets, but extreme drawdowns could be mentally overwhelming. Alternatively, your finances may be deficient, but you may have little to no concern for market volatility.

This brings us back to a key idea expressed above. Risk tolerance is comprised of two components – willingness and capacity – and they need to be married to establish a holistic tolerance for risk. Doing so can be challenging but is necessary.

Levels of Risk Tolerance

The most discernible sign of one’s risk tolerance level is the strategic design (or asset allocation) of their investment portfolio. There are three fundamental asset allocation structures.

- Conservative

- A conservative portfolio is appropriate for investors that have high income and liquidity needs, and minimal ability to withstand volatility and sharp drawdowns. For them, capital preservation is a high priority. Oftentimes, a conservative asset allocation is suitable for investors that are near or in retirement.

- Aggressive

- An aggressive portfolio is appropriate for investors that have minimal liquidity needs and value long-term growth over income and stability. Generally, an aggressive asset allocation is best for relatively young investors that can leave their money invested over multiple economic cycles.

- Moderate

- A moderate portfolio lies between the conservative and aggressive asset allocation structures. It is best for investors that desire a balanced mix of assets that offer liquidity, safety, income and growth potential. This “middle of the road” structure is popular with a myriad of investors and can be shifted to favor either end of the risk tolerance spectrum.

3 Fundamental Asset Allocation Structures

Incidentally, risk tolerance can fluctuate over time depending on your financial condition and life circumstances. Generally, it declines as you get closer to retirement, and it levels out during your nonworking years.

Worried About Your Retirement Savings?

Determining and Articulating Risk Tolerance

Assessing risk tolerance can be difficult to do, which is why many investors leverage the help of financial advisors. Reputable advisors assess risk tolerance by asking clients a series of probing questions that sheds light on their financial condition, investing objectives and time horizon, psychological leanings and behavioral biases.

The CFA Institute underscores this assertion, pointing out that best practice is “to use psychometric tools (often questionnaires) that have demonstrated reliability and validity in predicting an investor’s emotional and behavioral tendencies around loss of portfolio value and investing discipline.”

According to the National Endowment for Financial Education, the following questions are regularly used to assess risk tolerance.

Examples of Risk Tolerance Questions

- How much money do you have saved and how is it currently invested?

- What are your sources of income?

- Do you have a budget?

- What are your savings goals and associated timeframes?

- Do you intend to track your investments daily?

- How varied do you want your portfolio to be?

- Are you more concerned about losing money or losing purchasing power?

- How much money are you willing to lose?

- How worried do you think you would be in a severe market decline?

- What type of investments keep you up at night?

Assess your risk tolerance by using the investment risk tolerance calculator.

How Does Risk Tolerance Influence an Investment Portfolio?

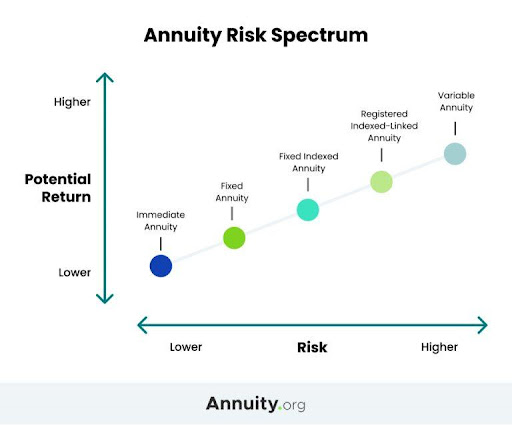

Investors with high levels of risk tolerance usually have very large allocations of growth-oriented assets, such as stocks and variable annuities, in their portfolios.

Conversely, investors with low levels of risk tolerance usually maintain large allocations of stable-value, income-oriented assets, such as investment-grade bonds and fixed and indexed annuities.

A Closer Look at Annuities

An annuity is a financial contract issued by an insurance company. It entails a lump-sum purchase in exchange for a customizable series of immediate or deferred income distributions.

There are many annuities available in the market, all of which can be categorized into one of the following three types of annuities.

- Can be immediate or deferred and are the safest type of instrument, offering investors a guaranteed rate of interest with zero volatility.

- Deferred in nature and a bit riskier than fixed annuities. However, they offer upside potential and downside protection.

- Can be immediate or deferred and are the riskiest type of annuity. They entail investment positions in volatile assets, such as stocks and bonds, which can lose value in adverse market environments.

3 Types of Annuities

Other Frequently Asked Questions About Risk Tolerance

Investment risk can be defined in a variety of ways, but it is usually expressed in terms of asset price volatility. The lowest-risk assets exhibit a high degree of price stability, while the highest-risk assets exhibit sharp price fluctuations.

The risk-return tradeoff is a fundamental investing concept that states higher levels of returns are only attainable by assuming higher levels of risk. Similarly, reducing investment risk entails forgoing return potential.

Risk tolerance varies from one investor to the next depending on a variety of factors, including investing horizon, investment objectives and comfort level with risk. Generally, the longer your horizon, the higher your risk tolerance and vice versa.

The prudent approach is to reassess your risk tolerance whenever your financial condition or life circumstances change significantly. Additionally, it’s wise to implement a period checkup, perhaps, on a triennial basis. If you work with a financial advisor, consult with them about the optimal cadence for your situation.