How Laddering Annuities Works

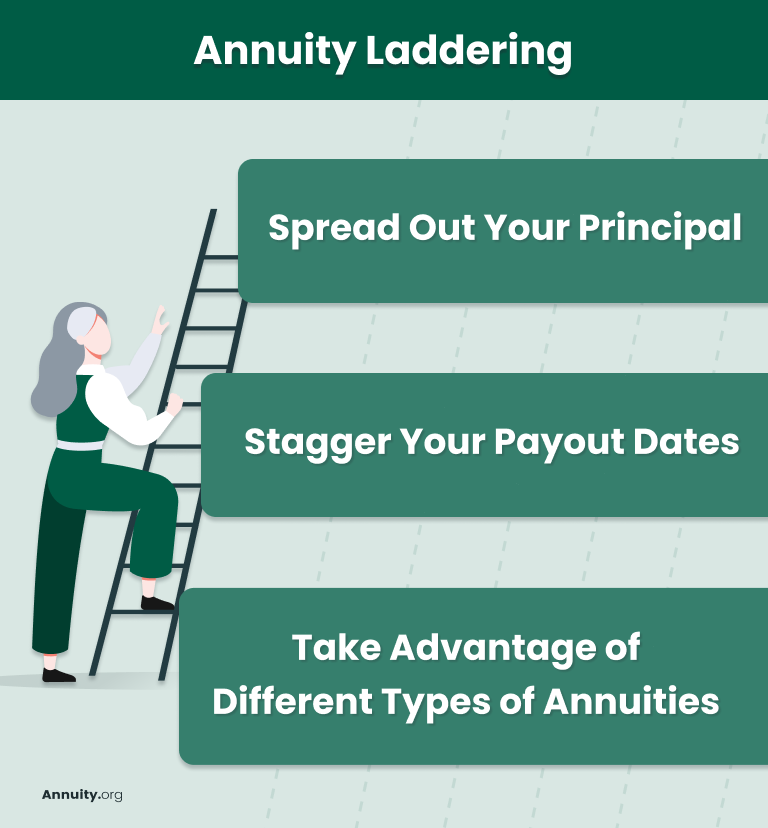

Laddering annuities works by splitting the premium that would be used to purchase a single annuity and purchasing multiple annuities instead. You build an annuity ladder with these different products.

One of the challenges of purchasing an annuity or any other type of investment is entering the market at an opportune time to maximize your return. Laddering cuts into that risk by giving you multiple entry points.

Key Facts About Laddering Annuities

- Laddering is a strategy where someone purchases multiple annuities with different guarantee periods or surrender periods.

- By laddering annuities, you can start multiple income streams at different ages, mitigating longevity risk.

- You can also use laddering to diversify your exposure by purchasing different types of annuities or purchasing annuities from different providers.

If you purchase an annuity with your entire principal at a 3.5% interest rate and, a year later, annuities become available with a 5% interest rate, you are unable to take advantage of the higher rate.

By laddering annuities, you break up your principal into smaller amounts to buy multiple annuities over time. For example, you could buy one smaller annuity at the 3.5% rate and then lock in another at the 5% rate a year later.

Matt Carey, a retirement expert with experience at the U.S. Department of the Treasury, summarizes the advantages as follows: “The main benefits of laddering are spreading interest rate and reinvestment risks over time, and getting short-term liquidity, while taking advantage of longer-term rates.”

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

I have many retirees, who are scared of what inflation might do to their earning power, purchase multiple income annuities. They intend to activate income streams at different times to give themselves periodic raises in income to combat inflation. Income annuity laddering is also helpful for planning out long term income needs down the road, such as when a spouse dies and a pension or social security income stream is lost.

Different Laddering Strategies

Annuity laddering can take various forms, with each one serving to mitigate different risks. One common approach is to split your principal and make multiple purchases over time to reduce interest rate risks.

This approach eliminates much of the stress and fear associated with trying to time interest rates, allowing you to benefit from multiple snapshots of the market instead of just one.

Another potential advantage of splitting your principal into multiple annuities is staggering your payout dates. By purchasing multiple annuities over time or with different terms, you can arrange for more income streams to activate as you age. For example, instead of receiving a single guaranteed annuity stream starting at age 75, you could ladder your annuities so that new streams begin at ages 75, 80 and 85.

This strategy helps combat longevity risk by providing more guaranteed income as you age, reducing the likelihood of exhausting your retirement savings.

Laddering annuities by payout date can also help combat inflation as well by providing you with more income as costs rise over time.

A final way to ladder is to leverage different types of annuities. For example, you can invest a portion of your funds in fixed annuities and another portion in fixed index or variable annuities.

This allows you to diversify your exposure and take advantage of the positive aspects of each type of annuity. By combining the reliability and guaranteed interest income of fixed annuities with the unlimited, albeit volatile, growth potential of variable annuities, you can create potentially more lucrative investment opportunities while maintaining adequate downside protection.

You can also consider buying contracts from a variety of reputable insurance companies. This will provide you with an additional layer of protection in the rare event that an issuer becomes insolvent or encounters other financial problems.

Writer Christy Bieber contributed to this article.