If you’re getting close to retirement, are you sure that you’ll have enough money to live the kind of life you want? The good news is that there are many options to help you reach your retirement goals — but picking the right one can be challenging.

Key Facts About Annuities vs. Traditional 401(k)s

- You can purchase various types of annuities through an insurance company with an upfront sum or multiple payments from your pre- or after-tax income.

- A traditional 401(k) allows pre-tax contributions of up to $23,500 or $31,000 (if age 50+) in 2025, and your employer might also contribute.

- While a traditional 401(k) can have fewer fees than annuities, the investments inside it might not offer a guaranteed return.

- You can buy an annuity using your 401(k) funds, and having both financial products may help provide financial security and better control your tax liability.

When considering investment vehicles, you may have thought about the differences between an annuity vs. a traditional 401(k). Both options have similarities but some important differences that could impact your retirement.

Annuity vs. Traditional 401(k): The Basics

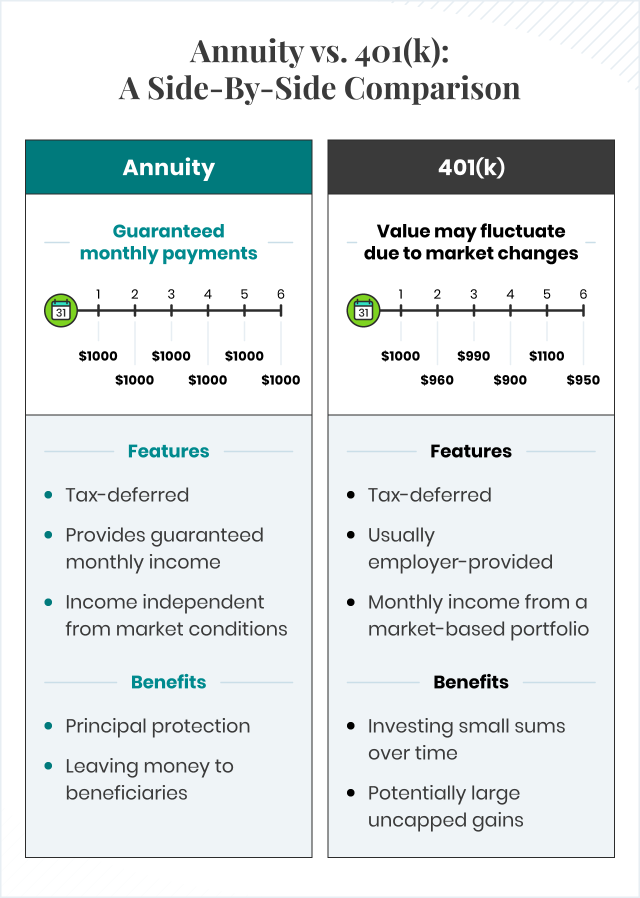

Annuities and 401(k)s are financial products designed to provide you with income in retirement. Traditional 401(k)s and annuities are both tax-deferred products, so you won’t pay taxes on the money you put into them until you make a withdrawal. Roth 401(k)s are different because you fund them with taxed income.

Other similarities include:

- Long-term savings. Both options enable you to grow your savings over time.

- Penalties for withdrawing money early. Because these products provide you with tax-deferred benefits, you can be penalized for withdrawing funds before the age of 59.5.

- Avoiding probate. By naming a beneficiary, the assets in an annuity or 401(k) can be transferred right to them instead of having to go through the probate process.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

What’s the Difference Between an Annuity and a 401(k)?

Now that we’ve seen the similarities between annuities and 401(k)s, let’s look at what makes them different.

What Is a 401(k)?

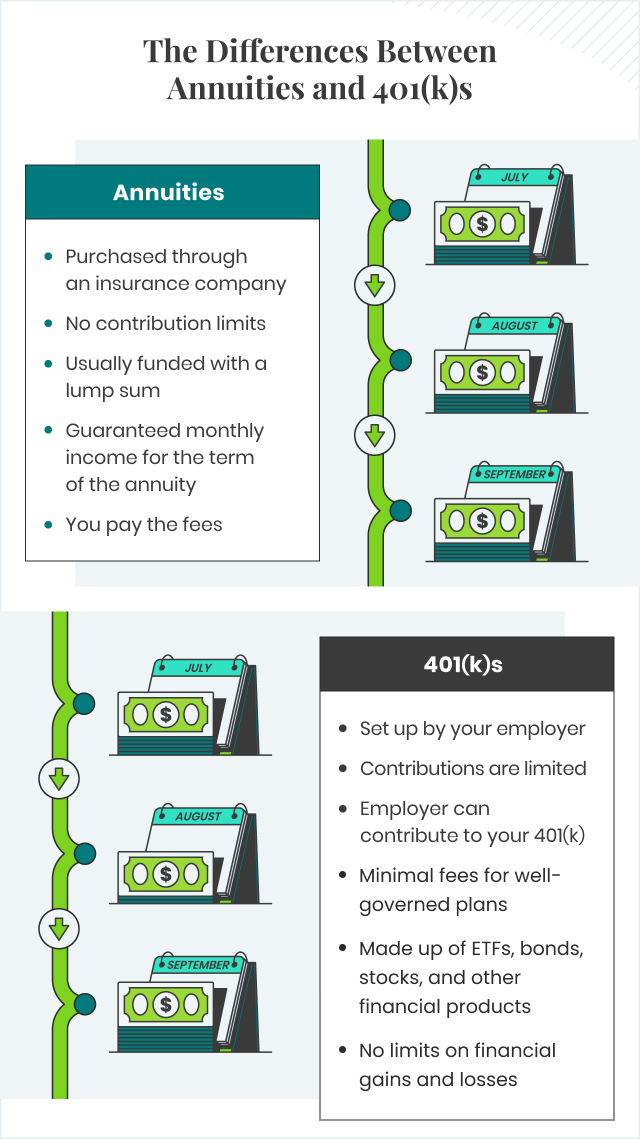

401(k)s are retirement plans usually offered through your employer. With a traditional 401(k), you contribute a set percentage of your pre-tax income to a fund that is specifically designed to grow at a steady rate over time.

More information about 401(k)s:

- There are limits on contributions. The government sets yearly limits on how much money a person can contribute to their 401(k). In 2025, the 401(k) contribution limit is $23,500 with an additional $7,500 in catch-up contributions for people 50 and older, per the Internal Revenue Service (IRS).

- Minimal fees for well-governed plans. Your employer almost always pays for the fees for a 401(k).

- 401(k)s are made up of different financial products. These can include stocks, bonds, mutual funds, and money market funds.

- Some employers will contribute to your 401(k). As an employment benefit, an employer can match a portion of your 401(k)contribution. Over time, this can help you build a much larger account than you’d be able to grow on your own.

- There are limited investment options. These plans have set allocations that you can’t change.

- You could see uncapped returns (and losses). Because a 401(k) is funded by investments, there are no limits on the amount you can gain or lose. While these plans are designed to grow at a predictable rate, there are no guarantees. Inflation can lessen the benefits of your 401(k).

What Is an Annuity?

An annuity is a financial product offered by an insurance company. You can fund an annuity all at once with a lump sum or add to it over time to grow its value before you start taking money out of it. While some employers provide options for annuities in retirement plans, they’re usually purchased directly from an insurance company.

According to Lou Cannataro, a founder and partner at Cannataro Family Capital Partners, “a good-performing annuity is another great tool to have in your financial toolbox if done properly.”

There are a few different types of annuities, each with their own levels of risk and returns.

A fixed annuity earns a guaranteed interest rate for a set period of time. Index annuities earn a small minimum interest rate and credit interest based on the performance of an index like the S&P 500. Variable annuities have investment portfolios composed of stocks, bonds and mutual funds that can add to or subtract from the annuity’s value based on market performance.

- Annuities can provide guaranteed lifetime income. Many annuities will provide you with payments for the rest of your life. Some annuities will continue to pay out to your beneficiaries after you pass away. With an annuity, you don’t have to worry about losses in the market because your income is guaranteed by the contract you signed with the provider.

- Annuities are usually after-tax savings vehicles. Funding an annuity with taxed income means that you won’t pay tax on the principal when you start taking payments. Instead, you only pay taxes on any gains during annuitization.

- Employers might not contribute to annuities. This could limit the overall amount of money you have to retire.

- There are no limits on contributions. Unlike 401(k)s, the government doesn’t cap contributions to non-qualified annuities. Contributing to a non-qualified annuity if you’ve met the cap on your 401(k) can help you continue to save for retirement and provide additional income later.

- You could pay more fees with an annuity. Depending on the type of annuity you choose, as well as any riders, there are several fees you may need to pay each year.

Should You Invest in a 401(k) or an Annuity?

Your specific circumstances will determine which investment options are best for you.

Speak with a qualified financial advisor before making decisions about investments and retirement. They can provide you with information and options that you might not otherwise be able to find.

It’s important to know that you can invest in both an annuity and a 401(k). For many people, a combination of these products might be the best way to ensure the standard of living you want. With an annuity that is designed to provide you with specific benefits like paying for long-term care, you can ensure that your 401(k) is available to pay other costs or to pass it on to your beneficiaries.

Depending on your 401(k) plan provider, you might be able to allocate some of your 401(k) contributions towards an annuity. A few 401(k) providers have started offering target date funds that contain annuities, so part of the money invested in the fund is allocated to an annuity contract. When the plan participant retires, they’ll have the option to annuitize a portion of their 401(k) portfolio, creating a guaranteed income stream in retirement.

Having multiple sources of income is crucial to maintaining your existing lifestyle in retirement. An Annuity.org survey asked Americans aged 45 and up what income sources they planned to rely on in retirement and how confident they were that they would be able to maintain their existing lifestyle in retirement.

The study reported that 83.6% of respondents who felt “very confident” in maintaining their retirement lifestyle had multiple retirement income sources, compared to 51.2% of respondents who were “not confident at all.”

Having both an annuity and a 401(k) also gives you more control over your tax liability each year.

Annuities and 401(k)s are not choice of only one or the other. They are both tools for building a robust and successful retirement plan and should be used in ways that accentuate their strengths. 401(k)s are a foundation of retirement saving and planning because they are so ubiquitous as employer benefits. Annuities can replace the lost pension income that generations passed depending on for peace of mind in retirement.

Should You Buy an Annuity With Your 401(k)?

You may be able to use some of the money from your 401(k) to invest in an annuity. This is an option if you don’t have extra money to invest. If you are nearing retirement age and you aren’t certain that you have enough time to accumulate and annuitize an annuity, your 401(k) could be the answer.

Legislation has expanded the availability of lifetime income annuities as purchase options within tax-advantaged retirement plans like 401(k)s. The SECURE 2.0 Act, which was signed into law at the end of 2022, eliminated a barrier which had excluded certain types of annuities from being included in 401(k)s.

Buying an annuity from a 401(k) can be a good option because:

- It could provide you with a better payout.

- If you’re a woman, buying an annuity within a 401(k) means a lower price (since women live, on average, longer than men).

- It may be the only way you can fund an annuity. Without a large lump sum of savings, the money you’ve accrued in a 401(k) can provide you with the capital to get an annuity.

But there are some potential drawbacks of going from a 401(k) to an annuity, including:

- Lower growth. Because it takes years for a deferred annuity to grow, you could miss out on other opportunities. Other investments, like stocks or ETFs, could provide better growth faster.

- Limited options for changing your mind. You may have to pay surrender charges if you need to pull money out while an annuity is growing. And you can almost never get a refund on an annuity after you start taking payments.

- Not breaking even. It’s possible to pass away before the principal has been paid out. Depending on the kind of annuity, your beneficiaries may not receive payments.

It’s vital that you talk to a financial advisor before removing money from your retirement funds. They can explain any pros and cons, as well as let you know what kind of penalties you may face if you withdraw money early.

A financial advisor can help you find ways to fund an annuity while providing you with other guidance about how to prepare for retirement.

Worried About Your Retirement Savings?

Writer Ashley Donohoe contributed to this article.