What Is a Long-Term Care Rider?

Long-term care riders serve to help insulate annuity customers from the potential expenses of things like nursing homes or extended medical care.

The average cost of long-term care in the United States ranges from $5,148 per month to as high as $9,034 or more per month in 2025, according to The Senior List. Additionally, seven out of 10 Americans who turn 65 years old today will need some type of long-term care services in their remaining years, according to the U.S. Department of Health and Human Services.

Key Facts About Long-Term Care Riders

- Long-term care riders can be added to annuities to help cover the high costs of long-term care.

- Annuities with long-term care riders allow for immediate access to long-term care funds while providing a separate cash fund, with benefits often significantly enhancing monthly payouts if care is needed.

- Long-term care annuities are attractive due to their single-premium payment and lack of annual premium increases, contrasting with traditional long-term care insurance that can have rising costs and a use-it-or-lose-it structure.

One way to offset the added expense of long-term care is to purchase an annuity with a long-term care rider. Annuities are customizable insurance contracts that convert a premium into a steady stream of income. Riders are provisions you can add to your annuity for an additional fee to optimize the contract, so it meets your financial needs.

Annuities that have a long-term care rider added into the contract are sometimes referred to as long-term care annuities.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How Does a Long-Term Care Annuity Work?

A deferred long-term care annuity is available to people up to the age of 85. You pay an insurance company a single premium payment in exchange for regular monthly income for a designated period of time. The annuity creates a fund specifically for long-term care expenses and a separate cash fund for however you choose to use it.

“The consumer owns the benefit and purchases it upfront,” according to LIMRA. “If needed, the funds for long-term care are there. If not, the value of the product will go to heirs in the event that end-of-life care isn’t needed either.”

The long-term fund is there for you to access immediately, but you must wait until the date stipulated in your contract to access the cash portion. Your contract will outline the amount you can access each month for long-term care and the amount you can access each year from the cash fund.

I have many clients who reach out for long-term care coverage through annuities, but often, an actual long-term care policy provides higher payouts than an annuity. The downside is that it only covers long-term care, not other needs. If more income is desired than anything else regardless of the need for long-term care, the retiree should consider funding an annuity for guaranteed income in their later years to cover additional expenses, including long-term care needs.

Accessing Your Long-Term Care Fund

You will have to meet certain health criteria to qualify for a deferred long-term care annuity. To access the benefit, you must show that you need help with activities of daily living, such as eating, getting dressed, taking a shower or bath, using the bathroom or moving from one place to another. It doesn’t matter if the health condition is permanent or temporary.

If you need to access the long-term care fund, the monthly payout will usually be a multiple of your normal monthly income stream from the annuity, and sometimes, these riders can double or even triple your monthly payout for a certain period. For example, a $100,000 annuity may pay out $200,000 or $300,000 worth of long-term care benefits for up to five years.

Pros and Cons of Purchasing a Deferred Long-Term Care Annuity

Pros

- You can access your long-term care fund immediately.

- You can pass on the value of the product to your heirs.

- The long-term care portion of your annuity may qualify for a tax deduction.

- The insurance company can’t raise the premium on your policy.

Cons

- Tax implications are complicated.

- An annuity can affect your Medicaid eligibility.

- You’ll need money on hand to pay the one-time premium up front.

- The annuity may not be enough to cover all long-term care expenses.

Additional Options

A long-term care rider is an option for both fixed and fixed index annuity contracts. There may be limitations, such as the number of years of care that this benefit will cover.

Another option is to purchase an annuity contract that allows you to make large withdrawals from your initial premium if you need long-term care.

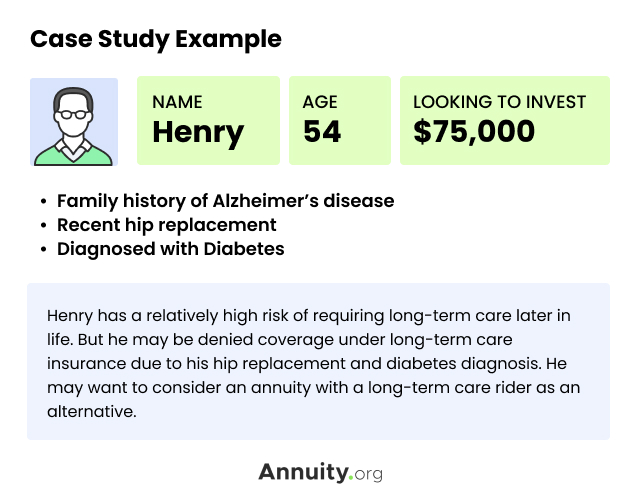

You could also purchase an immediate annuity. Like other annuities, the insurance company will pay you a specified monthly income in exchange for a single premium payment. This option is available no matter your health status, and you can still purchase an annuity if you are already receiving long-term care or if you do not qualify for long-term care insurance because of poor health or age.

With an immediate annuity, the amount of income you receive monthly depends on your age, your sex and how much you pay in your initial premium. There’s a chance the annuity amount you receive may not be enough to cover all long-term care costs. Other considerations include tax implications and the effect of inflation on the value of your monthly income.

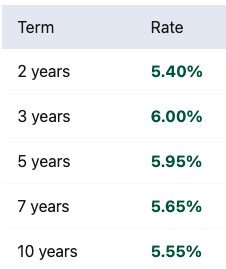

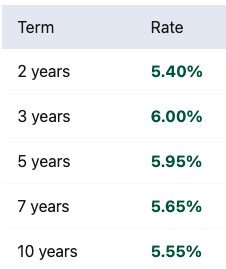

Calculate Your Returns Based on Today’s Best Rates

When Does a Long-Term Care Annuity Make Sense?

A long-term care annuity makes the most sense if you are looking for long-term care coverage, but you don’t want to pay for a separate long-term care insurance policy.

With a long-term care annuity, you can have regular annuity payments — providing a guaranteed lifetime income. And if you end up needing long-term care, you can take advantage of the long-term care rider to pay for necessary nursing care costs.

While Medicare may cover some costs at nursing homes and assisted-living facilities for 100 days following a hospital stay, the federal government’s health insurance program does not cover the cost of long-term care, including extended stays at these facilities.

What’s more, if you retire at the full retirement age of 67 in 2024, the maximum possible Social Security benefit you can receive is $4,018, according to the Social Security Administration. Even if you wait to retire at age 70, your maximum benefit will be $4,873 — still below the average monthly cost of assisted living.

Secure Retirement Without Hidden Fees

Long-Term Care Annuity vs. Long-Term Care Insurance

Long-term care annuities and traditional long-term care insurance policies both are designed to cover personal and custodial care for an extended period, but the two are different insurance products.

For example, with long-term care insurance, the insurance company may raise the premium on your policy, forcing you to pay higher monthly premium payments. A long-term care annuity does not carry the same risk because you can buy an annuity with a single lump sum.

“For some clients, the lump sum upfront is more attractive than the uncertainty associated with paying an annual premium, which could rise over time,” according to Financial Planning contributor Donald Jay Korn.

Equally as attractive as paying only a one-time premium is knowing you don’t face the same use-it-or-lose-it dilemma with an annuity as you would with traditional policies. An annuity with a long-term care rider will provide income whether you need long-term care coverage or not. A stand-alone long-term care insurance policy won’t pay out anything unless you need coverage for long-term care costs.

Traditional long-term care insurance policies can provide a greater level of reimbursement than long-term care annuities. However, traditional policies are typically more expensive and annuities with long-term care riders generally have less stringent medical underwriting than traditional long-term care insurance policies.

Calculate Your Returns Based on Today’s Best Rates

“Very informative and easy to understand. Now I know where to go from here! Sounds like a good alternative for those who do not have long-term care insurance. Wished my parents had signed up for LT care, as well as myself! I had the opportunity to sign all of us up with NO health questions when I worked for the U.S. government. Big mistake.”