Fixed annuities are a safe way to grow your savings if you want a steady and predictable option instead of putting your money in a bank or the stock market. They work in some ways like certificates of deposit (CDs), but they come with extra benefits that can help you save more money in the long run.

CDs usually have a maximum term of five years and do not let your money grow tax-free. Annuities, on the other hand, can last longer and delay taxes on earnings until you take the money out. This is called tax deferral, and it helps your savings grow faster over time.

The following table shows 5-year fixed annuity rates from some of the nation’s top providers. The term of the annuity refers to how many years the initial rate is guaranteed.

Current 5-Year Fixed Annuity Rates

Loading...

| Product |

Rate

|

Guarantee Period

|

Surrender Period

|

AM Best Rating

|

|---|---|---|---|---|

|

Security Benefit Life Insurance Company Advanced Choice |

4.90% | 5 Years | 5 Years | A- |

|

American Life & Security Corp American Classic |

5.40% | 5 Years | 5 Years | B++ |

American Freedom Aspire 5 |

5.05% | 5 Years | 5 Years | A++ |

American Freedom Classic 5 |

5.00% | 5 Years | 5 Years | A++ |

American Freedom Classic 5 - 2025 |

5.00% | 5 Years | 5 Years | A++ |

Case Study: Buying a 5-Year Fixed Annuity

Amy

Age: 62

Amount Invested: $100,000

Amy plans to retire at the full retirement age of 67 in five years. She is satisfied with her current financial situation and doesn’t want to risk losses for the opportunity to grow her nest egg. But, with a few years to go, she’s interested in finding somewhere to put her money that can give her predictable growth without market risk.

She finds out about a 5-year fixed annuity offering a rate that exceeds 5%. Additionally, the product is tax-deferred. This intrigues her for two reasons: the annuity may grow more effectively than a 5-year CD since the interest will not be taxed each year, and she will be in a lower tax bracket when she retires.

She decides to purchase the annuity with $100,000 of her retirement nest egg. The more than 5% interest rate is guaranteed through the five years, and Amy can increase the value of her money by more than $30,000 by the time she retires.

5-Year Fixed Annuity vs. 5-Year CD

Five-year fixed annuities are often compared to 5-year certificates of deposit (CDs). Both offer the safety and protection of your principal and can grow your money in a predictable, guaranteed way.

One big difference is the purpose of each. CDs can be an appealing option in place of a regular savings account, growing money that would otherwise remain stagnant.

On the other hand, 5-year fixed annuities generally serve as retirement products that help you grow your money with the benefit of tax-deferred growth.

Fixed annuities can also pay out in different ways. For example, your contract could be structured to provide you with guaranteed, lifelong payments as well as guaranteed income payments over a certain period, such as 10 or 20 years.

A critical benefit that a 5-year annuity could provide is the ability to withdraw all of the money before maturity without incurring any surrender charges in the case of terminal illness or if the contract owner is confined to nursing care. This feature can be particularly beneficial for an older client who seeks guaranteed growth without losing access in times of real need.

5-Year Fixed Annuity vs. 5-Year CD

| Option | 5-Year Fixed Annuity | 5-Year CD |

| Purpose | Grow your money in a tax-advantaged way for retirement | Grow money that is otherwise sitting in a savings account without interest |

| Tax Treatment | Tax-deferred | Interest is taxed each year as ordinary income |

| Liquidity | Typically can take 10% of the value of the contract out, but is otherwise locked up | Can’t touch your money while it’s within the CD, but the penalty for early withdrawal is light |

| Safety | Guaranteed by the issuing insurance company | FDIC-insured within registration and ownership limits ($250,000) |

Another factor to consider when deciding between a CD and fixed annuity is the length of time. If you are more interested in a short-term product, such as 12 months or less, a CD, treasury bill or high-yield savings account can be superior choices.

Calculate Your Returns Based on Today’s Best Rates

How We Get Our Rates Data

Annuity.org supplies fixed annuity rates through Cannex — an independent company that provides access to a database of updated annuity products.

We synchronize and update our rates information several times each week using the newest Cannex data to help ensure you have access to the most recent interest rates available.

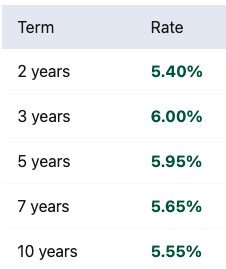

Annuity.org features rates for fixed annuities from one- to 10-year terms. In addition, we list the carrier that offers the rate and its respective AM Best financial strength rating.