Key Takeaways

- The chief benefit of a joint and survivor annuity is the guarantee of payments that will last for the rest of the original annuitant’s life and the life of another person.

- This is distinct from a jointly owned annuity, which only triggers a death benefit when one owner dies.

- Joint and survivor annuities are popular with married couples, though the two annuitants on a joint and survivor annuity do not have to be married.

What Is a Joint and Survivor Annuity?

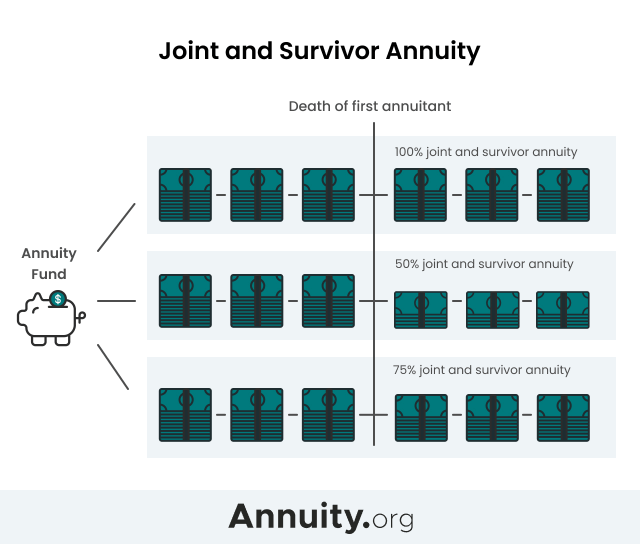

A joint and survivor annuity is an annuity contract that provides payments for two people’s lifetimes. Depending on the contract terms, the annuity may or may not continue to pay out 100% of the original payment amount upon the death of the first annuitant.

Often, survivors receive 50% or 75% of the amount of the initial payments. A 50% joint and survivor annuity will pay the surviving annuitant half the payment amount that payees were receiving when both annuitants were alive. A 75% joint and survivor annuity will pay three-quarters of that amount to the surviving annuitant.

IRS regulations require that the surviving annuitant receive a payment that falls between 50% and 100% of the total payments made by the annuity during the first annuitant’s lifetime.

The higher the percentage the surviving annuitant is guaranteed, the lower the initial payments will be. Payment amounts are guaranteed regardless of which person dies first.

Joint and Survivor Annuity vs. Jointly Owned Annuity

A joint and survivor annuity is not the same thing as a jointly owned annuity, which is an annuity contract that includes two owners. When two people own an annuity with a death benefit, the death of one owner will trigger a death benefit. This can be problematic if the owners intended for the payments to the surviving annuitant to continue.

For this reason, it’s important to understand the distinction between a joint and survivor annuity and a jointly owned annuity.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

IRS Rules and Tax Treatment

Joint and survivor annuities are popular with married couples who want to set up income payments to last both spouses’ lifetimes. However, the second annuitant on a joint and survivor contract does not have to be the first annuitant’s spouse.

But if the two annuitants on a joint and survivor annuity are not married, the IRS imposes additional rules. For example, the secondary annuitant cannot be 10 or more years younger than the contract’s primary annuitant and continue to receive 100% of the amount payable to the primary annuitant. There are no age restrictions if the non-spouse secondary annuitant is older than the primary annuitant.

No matter the case, the surviving annuitant remains on the contracted payment schedule after the death of the first annuitant. This tax treatment is advantageous in that it eliminates the obligation to pay taxes on money that the second person would have received as the beneficiary of a single-life annuity.

Just as the first annuitant must report the annuity payments on their taxes, the survivor must report the earnings on their income taxes when they begin receiving payments. The surviving annuitant won’t, however, need to worry about the administrative actions and fees that typically accompany other beneficiary payouts.

Contact a trusted tax advisor for specifics on your scenario.

A joint and survivor annuity is sensible for a conservative, hands-off investor that wants to generate a lifelong stream of income for himself or herself and a loved one. However, it is not appropriate for all investors, particularly those that seek higher potential returns and can withstand market volatility.

Benefits of a Joint and Survivor Annuity

Owning a joint and survivor annuity offers a key benefit: it guarantees that payments will last for the rest of the annuity owner’s life and the life of another person. This ensures lasting financial support.

One of the risks to consider when you invest in an annuity is the chance of unexpected early death, which could potentially mean not getting the full value out of your annuity. A joint and survivor annuity somewhat reduces this risk, as payments will continue even if one annuitant passes away.

Because the second person is an annuitant, not a beneficiary, the payments will most likely last longer with the tax liabilities spread over a longer time period. This extended payment schedule can help reduce tax burdens.

Joint and survivor annuities can also give married retirees a sense of security, knowing that their spouse will have a reliable income when they’re gone. For many, this peace of mind outweighs any drawbacks of the payout structure.

Drawbacks of a Joint and Survivor Annuity

You may ultimately find that a joint and survivor annuity doesn’t fit well into your financial plan. For example, if your partner has other sources of retirement income, you may decide that the extended payments from a joint and survivor annuity aren’t necessary.

CBS News consulted a group of actuaries to learn about their strategies regarding joint and survivor annuities. These mathematicians and longevity experts indicated that, depending on life expectancies, you may actually stand to lose more money through the reduced payments than your partner stands to gain after your death.

In addition to the possibility of lower individual payments, joint and survivor annuities restrict the surviving spouse’s ability to access a lump sum of cash. In contrast to the variety of payout options available to beneficiaries of single-life annuities, the only option with a joint and survivor annuity is continuing the existing payment schedule.

Consider that funeral and burial costs can be high. Without the ability to take a lump sum, the surviving spouse will need an alternative way to pay them.

As with all financial decisions, consult a professional if you’re not sure which product or payout option best suits you and your personal circumstances. Financial advisors help people make these important determinations every day, and your financial security is worth the investment.

Can You Retire Comfortably?

Frequently Asked Questions About Joint and Survivor Annuities

The payments on a jointly owned annuity stop when one of the joint owners dies. At that point, the annuity pays a death benefit. With a joint and survivor annuity, payments continue to the survivor on the contracted schedule after the first person dies.

Beneficiaries of a joint and survivor annuity could include the annuity owner and their surviving spouse, former spouse or another person designated by the purchaser.

The money earned on a joint and survivor annuity grows tax-deferred, meaning you don’t pay taxes until you make withdrawals. Once payments begin, the owner or survivor is responsible for applicable income taxes on those annuity payouts.

Worried About Your Retirement Savings?