What Is a FERS Annuity Supplement?

The FERS annuity supplement, also known as the special retirement supplement, is a retirement benefit for eligible federal government employees who retire before they turn 62. The supplement represents the income an employee would be earning from Social Security if they were old enough to start claiming it.

Federal employees who are covered by the Federal Employees Retirement System (FERS) receive benefits from three sources: Social Security, the Thrift Savings Plan and the FERS basic benefit, which is distributed in the form of an annuity. Those who retire before the age of 62 are ineligible to receive Social Security benefits, so the FERS annuity supplement kicks in to provide an income stream until the employee can access Social Security.

The supplement is paid by the federal government’s Office of Personnel Management. Common recipients of the FERS supplement include law enforcement officers, firefighters and air traffic controllers, all of whom have special provisions for retiring early.

Eligibility Requirements

To be eligible for the FERS annuity supplement, an employee must have at least one calendar year of FERS service.

The person’s retirement must apply to one of the following scenarios.

- They have retired with an immediate annuity from FERS not reduced for age.

- They have retired before reaching the minimum retirement age due to a reduction in force, a major reorganization or an early retirement.

Unless the retiree’s situation falls under the first scenario – retiring with an immediate annuity not reduced for age – the retiree will not receive their special retirement supplement until they attain minimum retirement age, which ranges from 55 to 57 depending on the year of their birth.

Once you start receiving the supplement benefits, your eligibility continues until one of two dates; either the last day of the month you turn 62, or the last day of the month before the first month you are entitled to receive Social Security benefits, whichever comes first.

I have many clients who work within the federal government and have retirement plans such as the Federal Employees Retirement System (FERS) through their employer. Many federal employees opt for early retirement, utilizing annuity benefits to supplement their income in retirement, in addition to Social Security.

How To Calculate a FERS Annuity Supplement

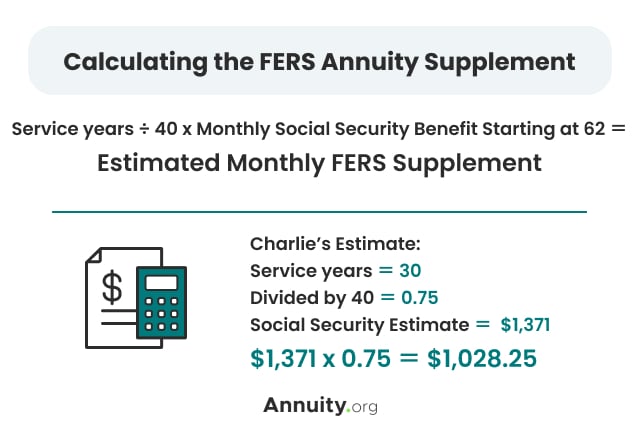

The formula to calculate a FERS annuity supplement uses your years of creditable civilian service and the value of the monthly benefits you’d get if you start collecting Social Security when you turn 62 to determine what benefits you’ll receive from the supplement.

So to calculate your FERS supplement, you must first calculate the monthly Social Security benefit you’d receive if you started collecting at 62. Once you have that number, you can calculate the supplement benefit by dividing your service years by 40 and then multiplying that number by your estimated monthly Social Security benefit.

Here’s an example of what that calculation might look like. Charlie is a 50-year old FERS employee. When he retires in 10 years, Charlie will have 30 years of creditable civilian service. Charlie’s estimated Social Security benefit is $1,371 a month.

Using the FERS supplement estimation formula, Charlie can predict that he’ll receive about $1,028 a month with his FERS annuity supplement.

The FERS annuity supplement is subject to an earnings test and can be reduced if the retiree makes more than the income limit. In 2024, the income limit is $22,320. For every $2 you earn over the limit, your supplement is reduced by $1.

So, looking at the above example, let’s say Charlie gets a part-time job in retirement and earns $22,000 a year. His income exceeds the limit by $320, so his benefit will be reduced by $160 annually. That means that Charlie’s monthly benefits are reduced by $13.33 a month, for an actual monthly benefit of $1,014.67.

Strategies for Maximizing Your FERS Annuity Supplement

As seen above, the value of the benefits you receive from a FERS annuity supplement depends on how many years of service you have and how much you’re expected to get from Social Security. The formula doesn’t leave much room for maximizing the benefit amount.

The calculation specifies that the Social Security benefit must be what you would earn if you started collecting at 62, so delaying Social Security will not have any effect on your supplement amount.

This means that the only real variable you can change to adjust your FERS supplement amount is the number of creditable service years you have when you claim the supplement. The more years of service you have, the greater your benefit will be.

Because of this, the only real way to maximize your FERS supplement is to delay retiring until you have a few more service years under your belt. This is not always possible depending on your circumstances, but some FERS employees might find waiting out a few more years is worth it to increase their monthly annuity supplement.

How Other Retirement Benefits Impact Your FERS Annuity Supplement

As previously mentioned, the FERS annuity supplement is greatly impacted by your estimated Social Security benefits. Because of this, rules that affect how much you are entitled to in Social Security benefits can also impact your FERS supplement.

For example, some federal employees may have worked in a job where they didn’t pay Social Security taxes. In such cases, the Windfall Elimination Provision can change how much you get in Social Security benefits. If you collect a pension from a job that didn’t require you to pay Social Security taxes, your benefits from Social Security – and therefore your FERS supplement benefits – may be reduced.

Get Guidance Before You Decide