Major financial decisions can create a lot of anxiety, particularly if they involve a product you may not know a ton about such as an annuity.

But buying one doesn’t have to be overwhelming.

Annuity.org spoke with multiple agents, insurance professionals and owners of annuities to learn more about the process of buying an annuity. Their insights can help you go into this journey surprise-free and possess the knowledge you need to have a successful buying experience.

Deciding if You Need an Annuity

It should come as no surprise that the first step when buying an annuity is determining if you need one at all. While these products can be a beneficial part of a retirement plan, it doesn’t mean they are right for you.

“I tell everybody that annuities are not for everybody,” Aamir Chalisa, general manager at Futurity First Insurance Group, told Annuity.org. “There’s a time and place for it.”

Various annuity product solutions are available.

“I tell everybody that annuities are not for everybody, there’s a time and place for it.”

Aamir Chalisa, MBA, LUTCF, MDRT, General Manager at Futurity First Insurance Group

For example, a person who wants to purchase a variable annuity to help bolster their retirement savings with an additional portfolio likely has very different financial goals than a person interested in purchasing a single premium immediate annuity to turn a lump sum of cash they already have into payments now.

One expert that Annuity.org spoke to compared determining what type of annuity you need to how you compare features and options when buying a car:

The easiest place to start when deciding if you need an annuity is identifying the problem that needs to be solved.

You might be concerned about outliving your savings and are looking to guarantee payments that can begin later in life. Or you might want to take advantage of high rates through a conservative product such as an annuity where that doesn’t risk your principal.

Nailing down your “why” will help you understand if an annuity is the proper “how.”

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Starting With Your Own Research

When you are interested in an annuity, purchasing one immediately to take advantage of the features and benefits can be tempting. However, annuities are not the kind of product that should be purchased without careful consideration.

Researching before reaching out to an advisor or agent can make a huge difference in how smooth and effective the process is.

Also, it can also set you up for success and help you to avoid an ill-advised decision that you will come to regret.

“The best people are those who have done their research and then gotten themselves educated through the help of an advisor and gotten all their questions answered,” Chalisa stated. “The majority of the people who come a year or two years or three years later and say ‘Oh my God, What did I buy?’ are the ones that didn’t do that and made an impulse purchase.”

When you’re ready to start diving in and doing some of your own research, it can help to breaking things down into products and providers.

Comparing Products

A good starting point in your research is learning more about the different types of annuities that are available. Various annuity product solutions available. Taking the time to learn about the options can help you decide which one is right for your situation.

A simple product where you agree upon a fixed rate of interest over a set amount of time.

The growth of your annuity is tied to the performance of an index, typically with caps on growth in exchange for principal protection.

You exchange a lump sum payment for a guaranteed income stream that begins immediately.

The money you place into the annuity is allocated into an investment portfolio, exposing you to risk but with the chance of significant growth.

Registered Index-Linked Annuity

A blend of variable and fixed index annuities, with the benefits of market growth but less volatility than a variable annuity.

When you want to learn more about different types of annuities, there are many great resources available online. The internet has made a huge difference by giving consumers the ability to easily educate themselves.

“We’re in a near-perfect information age,” Paul Garofoli, regional vice president for individual annuities at the Standard Insurance Company, told Annuity.org. “With a little bit of effort, there’s no reason you can’t know what you need to know about just about anything.”

Annuity.org offers a wealth of insight, and many other reputable resources offer helpful information.

“We’re in a near-perfect information age. With a little bit of effort there’s no reason you can’t know what you need to know about just about anything.”

Paul Garofoli, FLMI, RICP, Regional Vice President for Individual Annuities at Standard Insurance Company

Guarantee Income for Life With an Annuity

Good Online Resources for Educational Annuity Information

- Financial Industry Regulatory Authority (FINRA.org)

- Insurance Information Institute (iii.org)

- Internal Revenue Service (IRS.gov)

Tracy Neill, who recently went through the process of buying an annuity, felt that the research he did in advance set him up for success once he was ready to work with an agent.

“By the time I contacted them, I knew what I wanted,” he told Annuity.org “So it wasn’t a matter of going through a million variations of what it is you want.”

The full process of buying an annuity can vary in length significantly from person to person. However, coming in with a base level of knowledge on your options can help cut down that time.

By the time I contacted them, I knew what I wanted, so it wasn’t a matter of going through a million variations of what it is you want.

Comparing Providers

Just as important as comparing products is to comparing providers. These are the companies that you will actually buy your annuity from.

There are many providers and reviewing the material can be a conundrum with the amount of information to sift through. The good news is that the agent or advisor you eventually work with can help you evaluate your options.

Doing some research in advance on your own is advisable. That way, you will be well informed on the types of companies you may be interested in working with.

What To Keep in Mind When Comparing Providers

- The products they offer

- Available rates

- The companies’ financial strength and credit ratings

- The compnies’ reputations

- Customer service and satisfaction

One important thing to keep in mind when learning about different annuity providers is to not confuse name recognition with reputation. According to Garofoli, just because you see a name often doesn’t mean it’s a good option.

“All that means is that some may have spent a lot of money on branding,” he said. “Don’t underestimate a company that you might not have heard of because all that says is they maybe haven’t been spending as much on commercials and maybe more money adding benefits into the products they offer.”

Looking beyond the rates that companies advertise can also be helpful. In fact, providers who offer the highest rates may be doing so to entice customers and to overcome what they lack in key areas such as history or financial stability.

Don’t Get Too Attached

Doing your own research is a great way to prepare yourself for the buying process. However, you should recognize that, ultimately, you may not possess expert-level knowledge.

It can be important to strike a balance between finding out more about what you want, and avoiding attachment to a company or product that you might discover isn’t the best choice when you speak with an agent.

“The social media side of it and the internet side of it, it has in my opinion, done a lot of good things but it has also done a lot of bad things,” Chalisa said. “People are looking at that and saying, ‘I want that’ and they don’t understand that product might not be for them.”

To increase financial security in retirement, more individuals are considering purchasing an annuity. When evaluating an annuity, it is important to consider the different options available, including the features and benefits, as well as the risks and limitations.

Connecting With an Agent or Advisor

Once you have completed your research, it’s time to connect with an insurance agent or financial advisor who can help you select the right product.

Agents play a key role in the annuity buying journey, helping make sense of what can be a confusing process with many options.

This will likely be the most significant step in your purchase, as agents can explain options and companies, help you sift through options and put you in touch with the carrier you choose.

The Benefits of an Agent

Working with an insurance agent or advisor can play a big role in ensuring that you choose a product that makes sense for you and to mitigate an erroneous purchase that could lead to regret.

Agents can expose you to options that you may not have found on your own. They can also help you learn more about whether a particular product makes sense for your financial plan.

Moreover, working with a reputable advisor that will help you look through all your options is important. Chalisa encourageds annuity customers to ask agents about their backgrounds and process.

“We are not married to a carrier,” he said. “My job and my agent’s job is to find the best product for the client based on their needs and then do the marriage, not the other way around.”

John Stevenson, also known as the Guaranteed Retirement Guy, said this about transparency when selecting the right advisor: “Make sure that your advisor is showing you everything on the market, not just what is paying him or her the highest commissions. Agents are incentivized to sell certain products which may or may not provide the highest return to the consumer.” He also said, “When it comes to selecting the right agent, just Googling their name will tell you a lot. Another thing to consider is whether your advisor is a Certified Financial Fiduciary. When this designation is obtained, it requires transparency and not pushing certain products for the benefit of the advisor.”

- Agents are the experts. They have a vast wealth of knowledge on different annuities.

- Agents can expose you to great products you may not have found on your own.

- You can gain certainty that an annuity makes sense for your financial situation.

- You are exposed to all options instead of being locked in on one carrier or type of annuity.

Simply put, leaning on the expertise and knowledge of a professional can make a huge difference in directing you toward the best possible product.

The Process of Working With an Agent

Once you contact an agent, you can begin the process of identifying and buying an annuity.

This process differs from advisor to advisor, but some of the same general steps are followed. Initially, they will be interested in learning more about your personal and financial situation.

“I actually encourage them to come out and sit down and just have a conversation first without looking at a product or looking at a company,” Chalisa said. “I need to first understand what is it that they’re trying to accomplish.”

For this reason, coming prepared to talk about your finances is important. This can be an uncomfortable subject for some people, but you run the risk of limiting your advisor’s ability to help you if they don’t have the full picture.

“In a perfect world, they’re ready to at least tell me their current income and if it’s enough to meet their current needs,” Nick Pangakis, a financial advisor with Capitol Financial Solutions, told Annuity.org. “They’re comfortable telling me all of their investable assets and what they’re in.”

The process can occur either over the phone or through email, and its initial stages will adjust according to your level of knowledge.

For instance, some agents will begin by talking you through the basic types of annuities and helping you cut choices from there. If you are more informed or aware of what you are looking for, they may be able to bypass this step.

“In a perfect world, they’re ready to at least tell me their current income and if it’s enough to meet their current needs. They’re comfortable telling me all of their investable assets and what they’re in.”

Nick Pangakis, RICP, FSCP, LUTCF, Financial Advisor with Capitol Financial Solutions

However, even if you think you know all you need to, it can still be a helpful conversation.

“He confirmed what we knew, which was perfect,” Lana Zotman, who recently went through the buying process, told Annuity.org. “Overall, it was a good experience.”

Sharing more of your financial information with your agent can help them more easily narrow down the best annuity options for you.

From there, how many meetings you take and how long the process lasts will partially be up to you. Agents will spend more time working out what is best for you if you are unsure of your options. Ultimately, it hinges partly on the level of relationship you seek to establish.

“Some clients really want our guidance and those are great calls because we can dig in with people and really get to know them,” Pangakis said. “Other people say ‘Just give me this.’”

Your agent will then introduce viable product options tailored to your situation, discussing the nuances of each annuity to assist you in determining the best fit.

He confirmed what we knew, which was perfect. Overall, it was a good experience.

Like previous stages, the duration of this process is flexible based on your preferences. You might prefer exploring numerous options or be ready to proceed upon finding a suitable product.

Find the Right Product That Fits Your Goals

What Happens When You Pick Your Product?

Assuming everything progresses smoothly, you’ll eventually reach a stage with your agent where you’re satisfied with a particular product and prepared to proceed.

This phase involves handling paperwork. With your agent’s or advisor’s assistance, you’ll complete and submit an application to the carrier for the desired annuity.

Many annuity carriers offer – or even require – electronic documents versus traditional paper documents. You can let your advisor know if you are not comfortable with this so they can adjust your choices accordingly.

This application will require you to share personal information.

“Basically, it will be the sharing of the basic information, identification information, address and things like that,” Garofoli said.

Afterward, what is often the most challenging part of the process begins: suitability assessment.

What Suitability Is and Why It Matters

Multiple agents that Annuity.org spoke to for this guide referenced suitability as a potential pain point for customers. What’s ironic is that this step is designed specifically to protect you.

Annuities are typically subject to suitability regulations, meaning that the carrier must ensure that the product you wish to buy is suitable for your financial situation before it can sell it to you.

This means that you will have to share a lot of financial information.

“We go through a process called suitability and it can get pretty detailed,” Garofoli said. “It can get into the weeds.”

Some customers may feel hesitant about sharing extensive information with a third party. However, this step is not only normal but also designed to protect you from making a poor investment choice.

Suitability helps cut back on the possibility of buying an annuity that didn’t make sense for you or may hurt your financial situation.

“Contrary to some popular opinion, nobody wants you to get something you don’t need or don’t want,” Garofoli said. “We have a high opinion of the products and services we offer, but there’s an obligation not only on the agent’s side but also on the carrier’s side to make sure you’re getting something that you need or want and not something that you don’t.”

If you are interested in purchasing an annuity, sharing financial information is simply part of the journey.

Funding Your Annuity

Your final step involves funding your annuity, which can take various forms and entail different processes. You might fund it with a lump sum of cash, a retirement account or even another annuity.

Ways To Fund Your Annuity

- A lump sum payment

- Money from 401(k) or other retirement plan

- Another annuity

How you fund your annuity will play a big role in how long this process takes.

If you involve another entity or company in funding your annuity, such as using a previous annuity, the process may slow down. The other institution might not be prompt in providing the necessary funds.

“That’s the biggest thing in today’s day and age that I see that people are surprised by,” Garofoli said. “You want it, it makes sense for you, but yet it’s still taking the company or institution where your funds are, they’re dragging their feet. The time sequence surprises a lot of people.”

This obviously doesn’t mean that you will never get your annuity. It may take only a few days. However if your funds are coming from another institution, it can be helpful to be prepared for a wait.

How Long Before My Annuity Is Issued

There’s no definitive answer to how long it will take for your annuity to be issued. The timeline can vary depending on the company, the product and the source of your funds.

An agent Annuity.org interviewed recounted a recent experience where he submitted a customer’s application at 4 P.M., and the annuity was issued by the following morning.

However, not everyone has the same experience. Sam Walter, who recently purchased an annuity, was surprised and disappointed by the length of time it took for the carrier to establish and issue his new annuity.

“I just finished doing other annuities and I’ve had no problems like this at all,” he told Annuity.org.

In the end, it can be challenging to predict precisely what to anticipate. Assuming your funding source is prompt and there are no significant obstacles in the application process, the wait shouldn’t be too lengthy.

What It Takes To Have a Successful Buying Process

The process of buying an annuity can be complicated, but that doesn’t mean it has to be stressful. Following some of these basic steps can help facilitate your annuity purchasing journey.

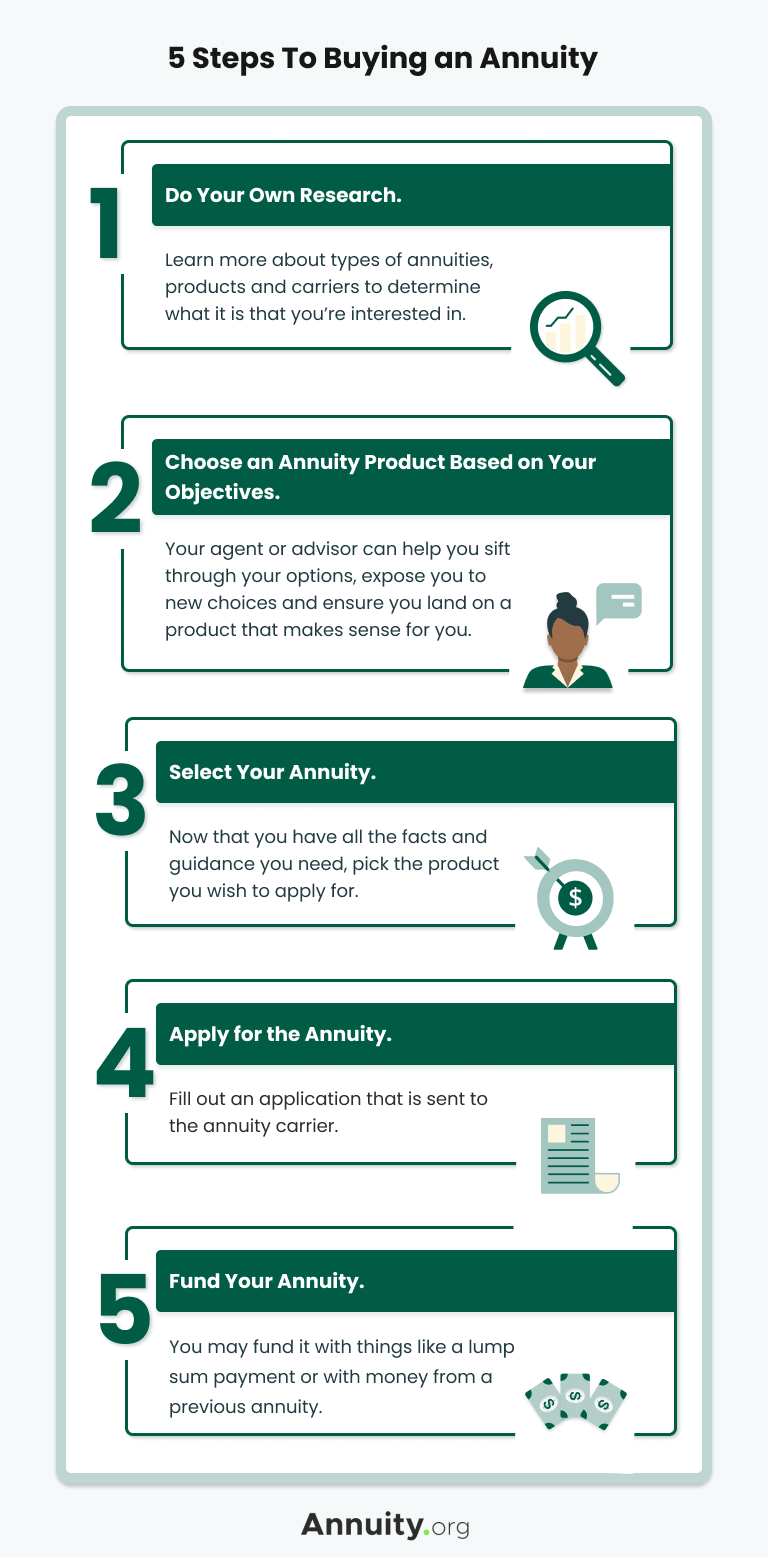

The 5 Steps to Buying an Annuity are:

- Do your own research h

- Choose an annuity product based on your objectives

- Select your annuity

- Apply for the annuity

- Fund your annuity

Conducting your own research beforehand is key, as it enables you to refine your preferences, explore available options and gain insight into what you seek in an annuity.

On that note, it’s essential not to become overly fixated on a single interest rate, product or company that may not ultimately be the most suitable choice for your needs.

Maintaining an open relationship with your agent or advisor can be highly beneficial. By sharing your financial goals and pertinent information, they can guide you toward the most suitable product.

This process doesn’t need to feel intimidating, as your advisor is available to provide assistance and guidance every step of the way.

“Consumers should feel comfortable with their financial advisor and they should not be afraid,” Garofoli said. “Much like when you go to a doctor, don’t be afraid to ask questions and not only share the details of your situation but ask about what the agent’s philosophy is.”

Your advisor can assist you in selecting a product, completing the application and facilitating the issuance of your new annuity.

Being prepared for what lies ahead in the process can make a significant difference.

Hannah Albersti Contributed to this article.