People buy annuities for several reasons, but most choose them because they offer a safe way to grow retirement savings and provide guaranteed lifetime income.

Annuities help address major retirement risks — such as outliving your savings, losing purchasing power to inflation, or struggling to afford long-term care — by offering income guarantees and optional protections.

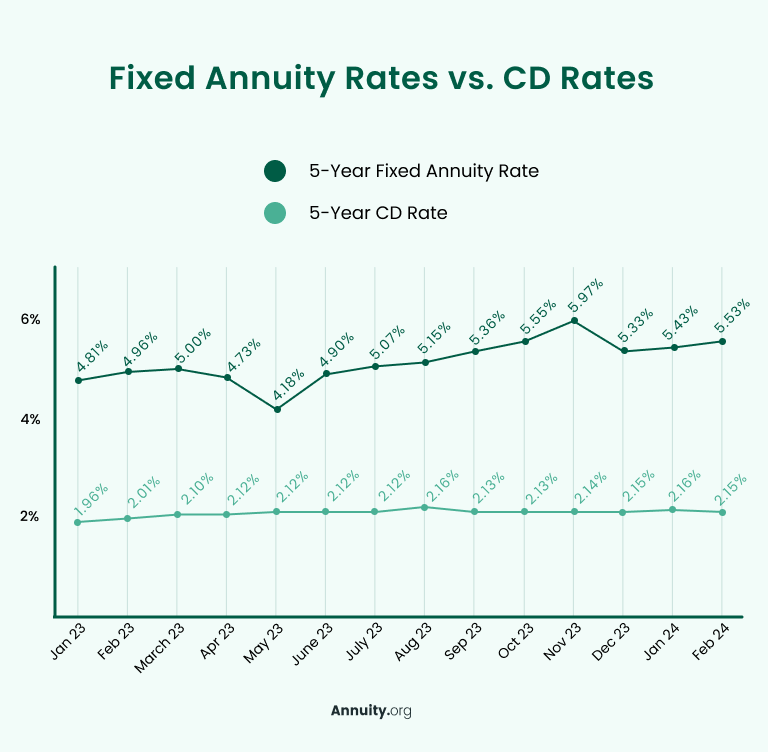

Besides helping address these retirement risks, annuities have other advantages. They allow your savings to grow tax-deferred, unlike certificates of deposit (CDs) or other savings products. Annuities might also offer more competitive rates.

Some people purchase annuities as part of their estate planning. Because annuity contracts have a named beneficiary, these products can be advantageous for leaving money to heirs.

Finally, some customers prefer annuities because of the ability to customize the contract. Adding riders or provisions can give your annuity a larger death benefit, increase your income payments to hedge against inflation, and even provide a guaranteed minimum accumulation or income benefit.

One of the primary reasons anyone should consider purchasing an annuity is for their contractual guarantees, not the hypothetical growth projections. I have had many people contact me seeking an indexed annuity to outperform the stock market or being pitched a higher hypothetical income potential instead of the highest guarantee possible. Purchase an annuity for what it will give you, not for a maybe.

Annuities Have Tax Benefits and Good Rates

Many investors buy annuities for their unique tax advantages. Annuities grow tax-deferred, meaning your dividends, interest and capital gains all remain untaxed while held in the annuity. Your funds will be taxed only when withdrawn. Moreover, if you drop to a lower tax bracket in your retirement years, you’ll be taxed less compared to what you’d be taxed today.

Michael M. purchased an annuity from Annuity.org because he found its tax benefits to be a standout feature.

“One thing about an annuity is that you don’t have to pay taxes until you actually get the interest dividend from the account. So, you can accumulate until you decide to withdraw, and then it will be taxed,” he said.

When asked if he feels he benefits from his annuity, Michael said, “Oh yeah, definitely. It fits what I was looking for with a good rate and tax benefits.”

Compared to other investments, annuities can offer higher rates. For example, at the time of his purchase, Michael found annuities to have better rates than other investments. “Compared to certificates of deposit, annuities get a better rate with protection,” he said.

This isn’t to say annuity rates always beat CD rates. It’s important to research current annuity rates and evaluate them, as well as their features, before making a purchase.

They’re a Safe Investment Option

Annuities are considered safe investments for several reasons. They are state-protected, endorsed by financial professionals and offer principal protection.

All 50 states, the District of Columbia and Puerto Rico have state guaranty associations that protect annuity owners if the issuing company goes bankrupt.

But this doesn’t mean you should purchase an annuity from any company. Research annuity companies with high ratings that have little to no risk of going bankrupt. Review our list of the best annuity companies to get a head start.

Insights From a Financial Expert

Wendy Swanson RICP®, CLTC®, NSSA®, a Retirement Income Certified Professional™ offered her thoughts on the security and principal protection of annuities.

Annuities are guaranteed. You have different backings that go through the financial institution, and there are state guaranties behind the annuities themselves. It is one of the safest places you can put your money.

What I love about an annuity is that I can put a portion of my money into a vehicle, and no matter what happens with the market, I’m going to know that it is safe. And, I’m at least going to get some minimal interest crediting, regardless of what’s occurring in the markets.

Some annuities can be riskier than others. If you do not want to bear any market risk, a fixed annuity is likely your best option. A fixed index annuity or a variable annuity have more upside potential, but will expose you to higher levels of risk.

Be sure to compare all types of annuities to find one that has an appropriate risk profile for your current needs and future goals.

Annuities Allow You To Leave a Legacy

If structured correctly, annuities can provide guaranteed lifetime income and legacy options.

You can make a lump-sum payment or multiple smaller payments to receive income distributions for life.

Annuities have been projected as the best hedge against longevity risk, according to T. Rowe Price. Longevity risk refers to the possibility of outliving your savings, which is a very real risk for many retirees, especially as life expectancies increase in America.

Marguerita Cheng, CEO of Blue Ocean Global Wealth, offered her insights on how annuities can mitigate this unique retirement risk.

It’s like my client said, “Longevity risk? Who ever thought that living too long was a risk?”… Annuities address outliving your savings because they provide an additional source of lifetime income.

As for legacy purposes, you can purchase an annuity for a child or plan to transfer your own annuity to a child. This could be for your own child or a grandchild.

Our editorial team interviewed two annuity owners, Syble Solomon and Ronnie Zelek, who discussed the lifetime income and legacy benefits of their annuities.

Lifetime Income & Legacy Highlights From Annuity Owners

Syble Solomon’s Backstory

Solomon was skeptical about the annuity buying process until she was promised her money would remain within her family and she’d be protected for life.

Her Take

Making a decision was difficult until I could see the options. I needed assurance that we weren’t going to be losing the money, that it wasn’t just going to go into the stratosphere or an insurance company and all that money we worked for would be gone from our family.

Knowing that we weren’t going to lose money and that I was protected for the rest of my life made it much easier.

Ronnie Zelek’s Backstory

Zelek’s mother purchased an annuity for him when he was young, and it has provided him with financial stability ever since.

His Take

It’s helped supplement a lot of things in my life. For example, my buying power of things was accelerated in some shape or form because I had this extra little pool of money coming to me monthly. So, that’s always been a little bit of help.

Not every annuity contract is the same. It’s important to meet with a financial advisor to determine what annuity type will offer you the best level of income protection and legacy options.

Get Guidance Before You Decide

They’re Highly Customizable

Annuities are customizable with options to include riders, negotiate contract details and select portfolio indexes. Annuity customization options vary depending on the annuity type and issuer.

Riders can be added to your annuity contract to achieve extra benefits. Some riders provide additional income in the event you become disabled or require long-term care coverage. Other riders protect against inflation via adjustable payments. Some companies offer riders for free, but most charge additional fees.

Michael M. found the rider customization benefits useful.

“I have a couple of riders on an annuity. I’m happy with my decision. There are specific benefits you can select. It might cost you more, but it’s worth it,” Michael M. told Annuity.org.

You can also determine how your annuity pays out and choose other important features of your contract details. For example, some annuities allow coverage for two people in a single contract. If one person dies, the second will continue to receive their payments.

The other way annuities are customizable relates to selecting indexes. This feature pertains only to index annuities, which provide payments that can increase, depending on the performance of a specified market index. Some companies offer a wide range of indexes to choose from, while others offer only a few options.

I have a couple of riders on an annuity. I’m happy with my decision. There are specific benefits you can select. It might cost you more, but it’s worth it.

Annuities Diversify Your Portfolio

Buying an annuity diversifies your portfolio, which usually reduces risk and leads to higher long-term returns.

Chris Magnussen, a licensed insurance agent, offered his take on the benefits of diversifying your portfolio with an annuity.

You may have heard the phrase “Don’t put all your eggs in one basket.” In this case, the basket is your portfolio, and an annuity is one of the eggs. You can have many different eggs, including money market accounts, certificates of deposit and stocks. However, to achieve the greatest diversification benefit, each egg in your portfolio should exhibit a unique risk profile.

Michael M. purchased his annuity partially for diversification reasons. “I did some research. I read about the pros and cons based on my needs. I made a decision that I want a portfolio of different things, so it’s not all in one basket.”

Remember, not everyone has the same diversification goals. Think about how much you need to save for your retirement, how much risk you are comfortable assuming and how many investments you can juggle simultaneously.

If any of the reasons to purchase an annuity resonate with you, reach out to a licensed financial advisor to determine whether an annuity could fit in your portfolio.

Find the Annuity That Fits Your Retirement Plan

Editor Hannah Alberstadt contributed to this article.