Why Should I Buy an Annuity?

Annuities turn accumulated savings into a reliable, lifelong income.

When you’ve spent years building your savings, the next challenge is protecting them and turning them into a dependable income you can count on. That’s where annuities come in. They offer predictability when the markets feel uncertain and help transform a portion of your nest egg into guaranteed payments for life.

Buying an annuity is often a timing decision. Many people choose to lock in today’s interest rates, secure lifetime income before retiring, or rebalance a portfolio that feels too exposed to risk. For others, it’s about replacing a paycheck, covering essential expenses, or ensuring a spouse’s financial security.

What are the Benefits of Annuities?

When structured thoughtfully, annuities can:

- Guarantee income you can’t outlive, no matter what happens in the market

- Grow tax-deferred, helping your balance compound efficiently over time

- Add flexibility through optional income or death benefit riders

- Preserve control and peace of mind, allowing you to focus on enjoying retirement, not managing risk

As financial analyst Thomas J. Brock, CFA, CPA, puts it, “Annuities are most effective when viewed as a complement to an existing portfolio — they turn volatility into predictability.”

How Can I Buy an Annuity?

If you’re interested in adding an annuity to your retirement portfolio, follow these four steps.

1. Align Your Purchase With Your Financial Goals

The right annuity depends on what you want your money to do for you.

Once you decide to buy an annuity, the next step is matching the product to your goals. Every annuity is designed to solve a different financial need, whether that’s replacing income, protecting principal, or leaving something for your family. The key is to identify which outcome matters most to you.

Most buyers fall into one of three categories:

Income Stability

You want a reliable monthly paycheck to cover essential expenses, so you don’t have to worry about market swings or timing withdrawals.

Tax Efficiency

You want to defer taxes on investment growth and optimize how your retirement income is distributed over time.

Legacy and Protection

You want to ensure a spouse or beneficiary continues receiving income, or that your assets pass efficiently to loved ones.

Annuities can be flexible, with options to adjust payout timing, add income or death benefit riders, and coordinate with your other accounts. Many people use them to complement Social Security, pensions, or investment portfolios, creating a balanced mix of growth potential and guaranteed income.

If you’re unsure which structure best suits your goals, that’s where professional guidance is essential. A licensed annuity specialist can compare top-rated providers and help you see which contracts align with your time horizon, income needs, and comfort with risk, so you can move forward with confidence.

2. Choose the Right Annuity Type for Your Strategy

Match your annuity to your income timeline, risk comfort, and long-term goals.

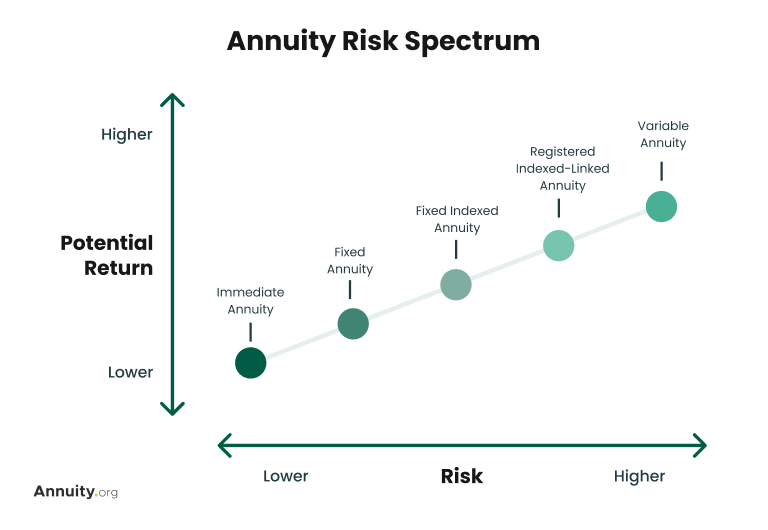

Once you know what you want your annuity to accomplish, the next step is choosing the right structure. The best annuity type for you depends on when you want income to begin, how much flexibility you want, and how comfortable you are with market exposure.

Here’s a simple way to think about it:

- Fixed Annuities, such as MYGAs and immediate annuities, offer guaranteed rates for a set period, often appealing to individuals comparing them to CDs or bonds.

- Fixed Index Annuities link growth to a market index but protect your principal from losses, balancing opportunity with security.

- Variable Annuities, as well as Registered Index-Linked Annuities (RILAs), offer more market exposure and upside potential, with optional riders for added protection or income guarantees.

The right choice ultimately comes down to your personal priorities: do you prioritize certainty, growth potential, or flexibility? Many retirees blend different annuities or pair one with other income sources to cover both their essential expenses and discretionary goals.

As with any financial product, it’s important to review the fees, rider costs, and surrender terms associated with each annuity so you fully understand how they fit into your overall plan.

3. Research Companies Before You Buy

The strength of your annuity depends on the strength of the company behind it.

An annuity is only as reliable as the insurer that backs it. That’s why comparing companies is just as important as comparing products. The right provider offers not only competitive rates, but also long-term financial strength and a proven reputation for customer care.

What to Look for in a Trusted Annuity Provider

- Financial strength ratings from agencies such as AM Best and Moody’s

- Customer satisfaction scores and complaint data from the NAIC

- Available riders and flexibility within each contract

- Company history and expertise in retirement income products

What Are the Best Annuity Companies?

Annuity.org evaluates annuity providers using the same criteria, focusing on transparency, financial stability, and user experience. Our independent specialists compare top-rated carriers including:

We aim to help you find the most competitive and reliable options available today.

Read More: 5 Best Annuity Companies of 2025

4. Complete Your Annuity Purchase

From quote to contract, your purchase should feel clear, guided, and pressure-free.

Buying an annuity is straightforward when you have the proper guidance. Once you’ve identified your goals and chosen a trusted provider, the final step is to complete your purchase and ensure that every detail aligns with your income plan.

Here’s what the process typically looks like:

- Consultation

- You’ll meet with a licensed annuity specialist to review your financial goals, time horizon, and risk comfort.

Comparison

Together, you’ll evaluate quotes from multiple A-rated insurers to see how each one fits your income or growth objectives.

Customization

You’ll decide on contract terms, income start date, and any optional riders that fit your needs — such as lifetime income or spousal benefits.

Application and Funding

Your specialist helps you complete the application, transfer or roll over funds, and finalize the policy directly with the insurer.

Most annuity buyers appreciate having a professional handle the details, from illustrating income scenarios to coordinating transfers, while ensuring the decision remains entirely in their control.

See How Much You Could Earn With Today’s Best Rates

Q&A With an Annuity Customer

Annuity.org spoke with annuity owner Ron Thompson about his annuity purchase experience.

- What financial circumstances led you to consider purchasing an annuity?

My wife and I had sold off some investment property as part of our financial strategy at that time. As we’re both nearing retirement, it was like, okay, so how should we invest this? What’s the next form of investment for that investment we just converted to cash? So that became the starting point for how we ended up approaching the topic of annuities.

- What was the most surprising part of the annuity purchasing process?

I think the biggest thing is just going from what you read about annuities to the offerings. You know, how they’re packaged by different providers and the options and riders and everything else that different providers will have in their packages. So regardless of how good they were and how well they explained things, the next big step is talking to providers and their complexities in their own products.

- How long did it take to purchase your annuity?

Wanting to make the optimal decision, we felt obliged to consider all the options. So that took a couple of months of just talking back and forth and exploring all these product offerings before we were comfortable with who, when and which of their products we’d be using.