The death benefit refers to the payment the annuity contract’s beneficiary or beneficiaries will receive when its owner or annuitant dies. Most annuities have a standard death benefit built into the contract and require the annuity purchaser to name a beneficiary.

Annuity death benefits address a few key issues related to estate planning. First, as long as the owner names a beneficiary other than their estate, the death benefit can pass to the beneficiary privately and without going through the lengthy and expensive probate process.

The death benefit also helps manage the risk of untimely death. A common apprehension towards annuities is that the person receiving the payments may die shortly after payments begin, which can result in most of the annuity’s value going back to the insurer.

A death benefit — especially a period certain benefit — mitigates this risk. By having a death benefit that goes to a named beneficiary, the annuity owner can ensure that their heir will receive what’s left of the annuity if they pass away before they can receive payments.

Annuities not only provide an additional source of lifetime income to owners and annuitants but also offer benefits to beneficiaries. It is important to evaluate and understand the death benefit options available within your contract.

Annuity Death Benefit Options

Annuity owners provide a sum to beneficiaries that is predetermined by the type of death benefit written into the annuity contract. Primary death benefit options include standard, return of premium and riders.

Standard Death Benefit

The standard death benefit has the least value, insurers usually offer it for no additional cost. The insurance company pays beneficiaries the value of a contract, less any fees and withdrawals. The contract value is determined on the day the insurance company receives proof of the annuitant’s death or when the beneficiary files a claim. For some variable annuities, this benefit can decrease in value. For example, a beneficiary might report the annuitant’s death on a date when stocks are underperforming.

Return of Premium

Return of premium has a higher value and may cost an additional 0.30% to 1.50% per year. With the return of premium benefit, either the market value of the contract or the sum of all contributions minus fees and withdrawals determines the inherited amount. The insurance company pays whichever is greater.

Stepped-Up Death Benefit Rider

A rider is a provision to a contract that can be added when the contract is created. With annuity death benefit riders, there can be an annual fee over the life of the policy. The riders can vary depending on the company that provided the annuity and the cost.

The specifics of the rider will be written in the annuity contract. The insurance company determines the value of a contract on each anniversary of the annuity’s purchase. A stepped-up death benefit rider pays the beneficiary the highest value amount recorded less any fees and withdrawals, instead of the value of the annuity when the insurance company learns of the annuitant’s death. Some insurance companies add a fee of 0.20% or more per year for this benefit.

Additional Riders

Variable annuity owners can opt for additional riders, such as guaranteed minimum withdrawal benefits (GMWB) and guaranteed minimum income benefits (GMIB). However, these riders typically only prove cost-effective in specific scenarios. The insurance company calculates benefits based on the highest monthly asset value, which fluctuates with the market.

While a period certain rider is not necessarily a death benefit rider, it is another way to ensure that your annuity’s value is passed on after your death. An annuity with a period certain payout rider is guaranteed to make payments for a specified time, typically 10 or 20 years. If you pass away before that period elapses, the remaining years of payments will go to your named beneficiary.

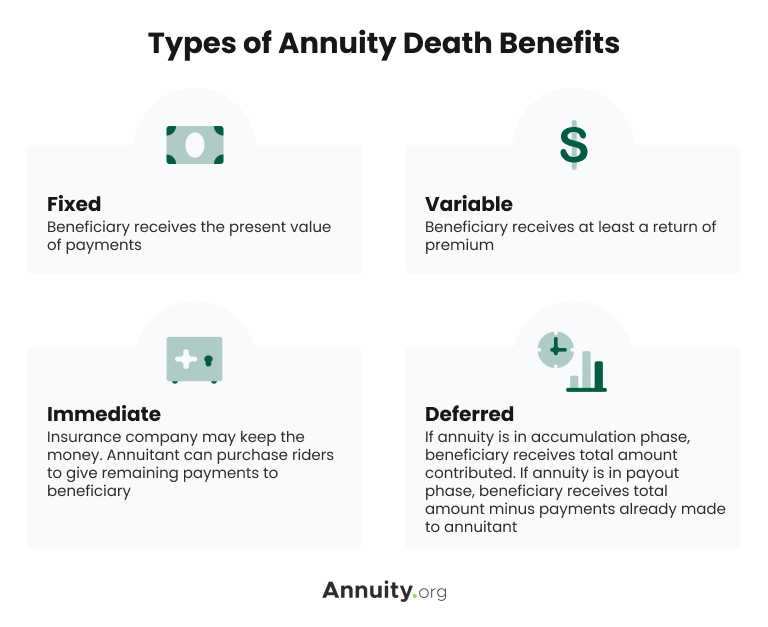

Death Benefits by Type of Annuity

Death benefits impact the total amount of money available for beneficiaries. The type of annuity — fixed, variable, immediate or deferred — determines how much the insurance company pays them.

General guidelines determine the death benefits of annuities. For fixed annuities, the beneficiary receives the present value of payments.

For some immediate annuities, such as a lifetime immediate income annuity without period certain, the insurance company keeps the money when the owner dies. In other cases, the immediate annuity might pay the remaining value of the annuity, which could vary depending on how long the annuity has been paying out. The annuity may have an optional provision that guarantees the beneficiary will continue receiving payments for a minimum period.

For deferred annuities, the amount paid depends on whether the payments are in the accumulation or payout phase. Annuities in the accumulation phase pay beneficiaries the total amount contributed to the account. Once the annuity is in the payout phase, the beneficiary subtracts payments already made to the annuitant.

With the array of annuity options available and the customizable nature of contracts, the size of an inheritance greatly varies. Annuity owners can prepare for the future of a spouse or other beneficiary by comparing their options with an annuity expert.

Frequently Asked Questions About Annuity Death Benefits

Whether the annuity is qualified or non-qualified, the death benefit that a beneficiary receives from the annuity will be treated as taxable income.

If an annuity contract has a named beneficiary other than the owner’s estate, the annuity death benefit does not have to go through probate.

An annuity may pay out as a lump sum or a stream of income payments depending on how the death benefit is structured.

Still have questions?

Get Guidance Before You Decide