How Are Income Annuity Payouts Calculated?

Insurers calculate annuity payouts based on several factors. One of the largest factors is the annuitant’s life expectancy. In general, the longer the insurance company expects to have to pay you, the lower your payments will be.

The reason you enter your age and sex in the monthly annuity calculator is to determine your life expectancy. An older person will probably receive higher payouts than a younger person. And because women tend to have longer life expectancies than men, a woman might receive a lower monthly payout than a man of the same age.

Additionally, any guarantees to pay out for a certain number of years will lower your payment amount. If you select a life annuity with a 10-year period certain, the annuity calculator payout will be lower than if you selected a life only annuity. A period certain guarantee represents a greater risk to the insurer, so they balance that risk by lowering the monthly payment amount.

By understanding the annuitant’s life expectancy and any guarantees, the annuity issuer can determine the expected number of years of payments, which is one of the variables in the annuity formula.

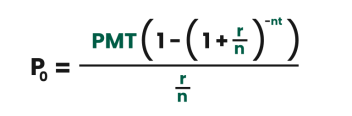

The annuity formula uses the following variables to calculate the present value of an annuity:

- P0 = Principal

- r = Annual interest rate

- n = Number of payments per year

- T = Number of years of payments

Interest rates will vary depending on the type of annuity and the provider. You can customize the number of payments per year in your contract, but most annuitants receive payouts once per month.

The formula for calculating an annuity payout looks something like this:

The type of annuity you have also plays a role in how payments are calculated. Income annuities are the simplest products to calculate because they do not have accumulation periods. The calculator above works for immediate income annuities (also known as SPIAs) and deferred income annuities.

Annuity Payout Options

You can choose from a few different options for how your annuity pays out. Payments can start as soon as 30 days after the contract is issued and must begin within the first contract year.

You can also choose how long the payments are guaranteed to last. These options vary by provider, but most companies offer payout guarantees including period certain, single life and joint life.

- Period Certain

- A period certain annuity, sometimes called a term certain annuity, guarantees payments for a set number of years, usually between 10 and 25.

- Single Life

- A single life annuity guarantees payments for the annuitant’s lifetime.

- Joint Life

- A joint life annuity, sometimes called a joint and survivor annuity, guarantees payments for two lifetimes, usually the annuitant and their spouse.

How Does Your Payout Option Affect Your Annuity Income?

When it comes to how long payments will last, the option you choose will affect how much each payment will be. The longer the insurance company expects to pay out your annuity, the lower payments will be.

The following table illustrates how the monthly payment of a $200,000 annuity can change based on the payout option selected. The estimated payments below were calculated assuming a 65-year-old female annuitant, and in the case of the joint life annuity, a 65-year-old female annuitant and a 65-year-old male annuitant.

| Payout Guarantee | Monthly Payment | Minimum Payout | Explanation |

| Life with 10-year period certain | $1,218 | $146,160 | The annuitant receives payments for their life, and if they pass away within the first 10 years, the contract’s beneficiary receives the remaining income payments until the guarantee period ends. |

| Single life | $1,234 | $0 | The annuitant receives payments for their lifetime. The contract beneficiaries do not receive any payments after the annuitant’s death. |

| Joint life | $1,112 | $0 | As long as either annuitant is still alive, they will continue to receive payments. Once both annuitants have died, no payments will be made to the contract’s beneficiaries. |

Other Annuity Factors To Consider

Annuities are highly customizable products, so there are a few additional factors that may influence your payment amount, such as their frequency

While monthly payments are the most common choice, providers may offer additional options, including quarterly, semi-annual or annual payments.

You can add riders to your annuity contract for an additional cost. Some of these riders may adjust your payment amount, such as a cost of living adjustment (COLA) rider. If you choose a COLA rider, your monthly payments will start out lower than they would without the rider, but they’ll increase by a small amount each year, usually 1% to 2%, to help offset the effects of inflation.