The accumulation period is when the value of your annuity grows from your contributions, investment returns and compounding interest. Annuities are designed for long-term income and savings, and insurance companies expect to hold the premiums for an extended period.

Not all annuity types have an accumulation period. While there are two main types of annuities, deferred and immediate, only deferred annuities have an accumulation period.

Immediate annuities, also known as single premium immediate annuities (SPIAs), do not have an accumulation period because they are converted to a stream of payments at the time the contract is purchased.

- Contributions

- Your contributions can be a single lump sum, flexible period payments or fixed scheduled payments. Contributing a series of payments can build your annuity’s worth over time to solidify your retirement plan.

- Investment Returns

- Your annuity can provide higher returns if you invest in a mutual fund or tie your returns to a specific market index. Different deferred annuity types yield varied results.

- Compounding of Interest

- Compounded interest is the interest you earn on your principal investment and previously earned interest.

How the Accumulation Period Increases Your Annuity’s Worth

During your accumulation period, your annuity may grow at a fixed rate, or it may be based on the performance of investments. Make sure you understand how growth is credited before purchasing one.

What Are the Features and Characteristics of an Accumulation Period?

One important feature of the accumulation period is its flexibility — you determine when your annuity shifts into the payout period.

“The cool thing is, you can make your accumulation period shorter or longer, depending on what you need,” Andrew Gosselin, CFP®, told Annuity.org.

“It’s pretty handy because, let’s face it, life changes, and so can your retirement plans and money situation. Let’s say you need to start getting some income earlier than you first thought. You can choose to cut that accumulation period short and start getting your money sooner. On the flip side, if you find you can keep on working past when you planned to retire or maybe you got some money from somewhere else, you can make the accumulation period longer.”

You also need to consider your withdrawals and contributions. During the accumulation period, your withdrawals are limited, but there are no restrictions on how much you can contribute.

“These contributions are not capped in most instances. You can invest as much as you’re comfortable with, depending on your future income needs. That said, there might be some restrictions depending on the specific annuity product.” Gosselin told Annuity.org.

You can withdraw funds during the accumulation period, but you may face tax penalties and surrender charges — typically a percentage of the withdrawn total.

These charges are incurred during the surrender period, which can last up to 10 years. The penalty is typically around 10% of the current value of the contract but usually declines as you advance throughout the accumulation period.

It is counterproductive to withdraw money from tax-deferred savings instruments before their value has matured. Tax-deferred compound interest adds up significantly over time. Similar to taking money out of a 401(k) prior to retirement, withdrawing funds from a deferred annuity during the accumulation period will have an adverse effect on your ability to grow your savings.

What Affects the Accumulation Period?

Gosselin offered Annuity.org advice on factors affecting the success of an annuity’s accumulation period. “The length and success of the accumulation period can be influenced by a variety of factors. Market performance is one key determinant — the better the market does, the more your annuity can grow.”

“Another important factor is the duration of the accumulation period itself. The longer you allow your money to grow, the more it will accumulate, thanks to the power of compounding. Lastly, the amount of your contributions can make a significant difference. Larger and more frequent contributions can lead to a more robust accumulation.”

It’s important to compare the advantages and disadvantages of the factors listed above. For example, a longer accumulation period gets you the most growth in the long run. However, not everyone has the ability to delay their payments. You need to carefully evaluate your finances and determine what accumulation period works for you.

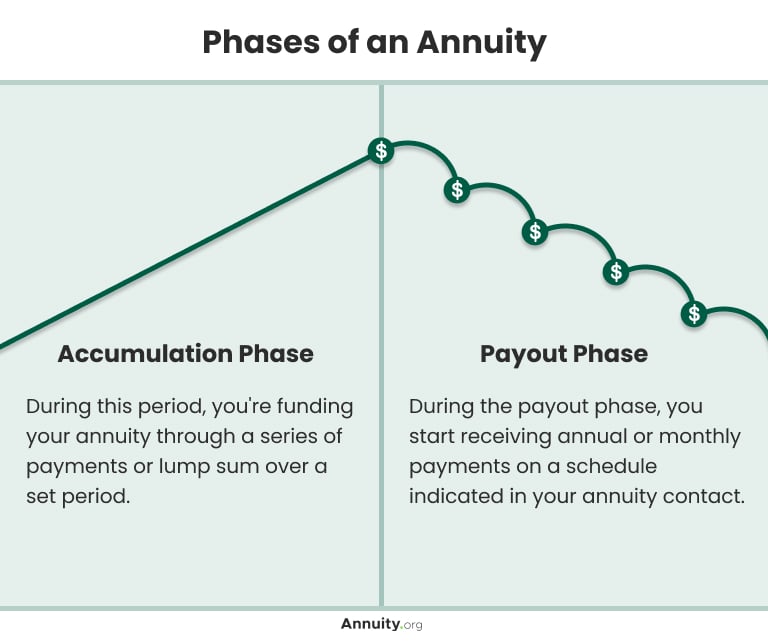

What Is the Difference Between the Accumulation Period and Payout Period?

It helps to think of the accumulation period as the buildup and the payout period as reaping the rewards.

The accumulation period is at the start of your annuity – when you’re bulking up your funds through contributions, investment returns and the compounding of interest. Your contributions are tax deferred during this period. So, the longer you stay in the accumulation period, the more you can earn.

Once you reach the payout period, also known as the annuitization phase, you receive your gains as either a lump sum or a stream of payments. Under most annuity contracts, you can choose your annuity payout period to last for a specific timeframe (such as 20 years) or for an indefinite period.

Get Guidance Before You Decide

What To Consider Before Buying an Annuity With an Accumulation Period

An annuity’s ability to earn interest and their taxed-deferred nature makes it a popular retirement income vehicle, according to the National Association of Insurance Commissioners. It is, however, important to consider several factors before committing to an annuity that has an accumulation period.

- Liquidity

- Do you have enough money to cover your near-term spending needs? Deferred annuities are not ideal for individuals with inadequate liquidity and erratic cash flows. In this case, having money tied up in an annuity can result in significant financial problems.

- Opportunity Cost

- While the annuity is in its accumulation period, you may not be able to pursue other investments — some of which may have higher return potential. Consider your needs and risk tolerance before allocating your assets to low-risk, low-return products. Consult a financial advisor to determine whether a deferred annuity makes sense for you.

- Financial Goals

- What are your current and future priorities and objectives? Perhaps you are planning for future retirement income, permitting ample time for growth. Your actions now will affect your payout later. Whether you are saving money now or actively contributing to an annuity, tax deferral and other tax strategies are important considerations.

Assess Your Immediate Needs and Long-Term Goals

Mapping out your savings timeline and understanding your investments’ accumulation periods can prepare you for retirement planning — and ultimately help you reach your financial objectives.

Frequently Asked Questions

Interest earned during the accumulation period is tax-deferred. However, it will be subject to taxes once you reach the payout period.

You can withdraw money during the accumulation period, but you could face penalties and surrender charges.

Yes. You can make additional contributions during your accumulation period. Your contributions are within your control and are not capped, in most instances.

Editor Lena Borrelli contributed to this article.