Retirement Anxiety Widespread

The NAPFA findings echo reports released over the last year by the Alliance for Lifetime Income, the U.S. Federal Reserve and the World Economic Forum. Last summer, the Alliance for Lifetime Income released a survey that found that 80 percent of workers had anxiety about whether their savings will provide them enough money to live on in retirement. The Alliance is a coalition of financial service providers who advocate for income annuities. Its online survey polled more than 3,000 people. It found several factors contributing to retirement-funding anxiety. The top four were:- Health care costs

- The risk of a financial surprise

- Health problems

- Not having enough lifetime income

Thinking About Buying an Annuity?

Reports: Average Americans Will Outlive Retirement Savings

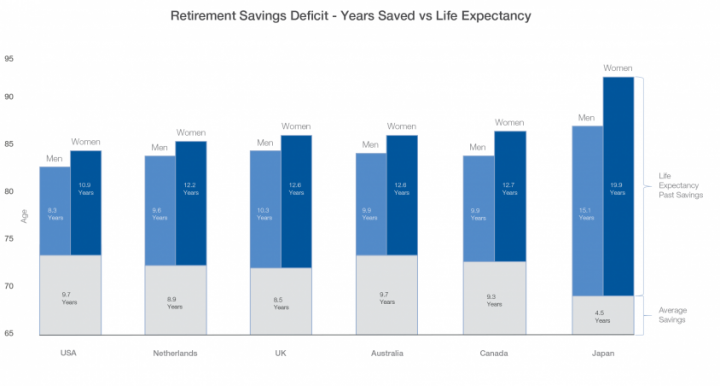

The apprehension is justifiable, according to a white paper by the World Economic Forum, which found that American men can expect to live an estimated 9.6 years longer than their retirement savings will last, while American women can expect a gap of 12.2 years. The report looked at six countries with major economies and found these gaps in all of them. The United States had the smallest gap. The worst was in Japan, where women can expect to outlive their savings by 19.9 years, and men have a gap of 15.1 years. In every country, the report concluded, women bear the biggest brunt of the shortfall, as they tend to outlive their savings by an average of two years longer than men.

Source: World Economic Forum

In addition, the report revealed that a quarter of non-retired U.S. adults have no pension or retirement savings, while just 36 percent consider their savings to be on track.Americans Struggle with Managing Money

The lack of retirement savings persists even among older workers. A 2019 report from the U.S. Federal Reserve found that 13 percent of workers over 60 have not saved for retirement and only 45 percent believe they are saving adequately. “Many adults are struggling to save for retirement,” the authors of the report said. “Even among those who have some savings, people commonly lack financial knowledge and are uncomfortable making investment decisions.” The Federal Reserve survey was conducted by Ipsos, a private research firm, and involved 11,440 participants.Tips for Preparing for Retirement

As overwhelming as retirement planning seems, following the advice of the experts can provide the foundation for a solid plan. NAPFA offers the following suggestions for ensuring a healthier savings upon retirement. Boost your savings- Put extra money, such as bonuses and tax refunds, into a retirement savings account.

- Millennials should do market research and negotiate their salaries.

- Members of Generation X should open high-yield savings accounts and initiate automatic deposits.

- Baby boomers should take advantage of provisions that allow them to increase their retirement savings through catch-up contributions. Those under 50 can deposit $19,500 in pre-tax money into 401(k) accounts. Those over 50 can deposit another $6,000 in pre-tax money, for a total of $25,500.